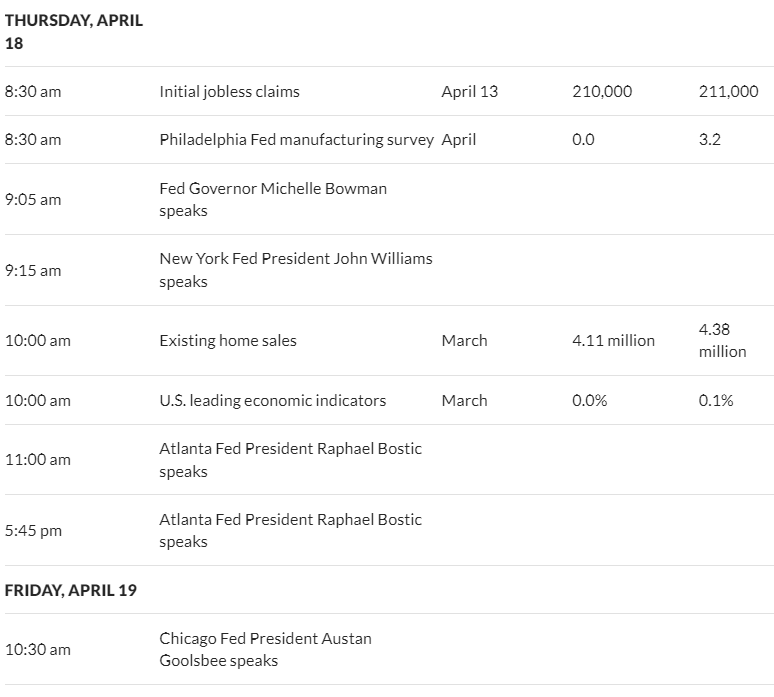

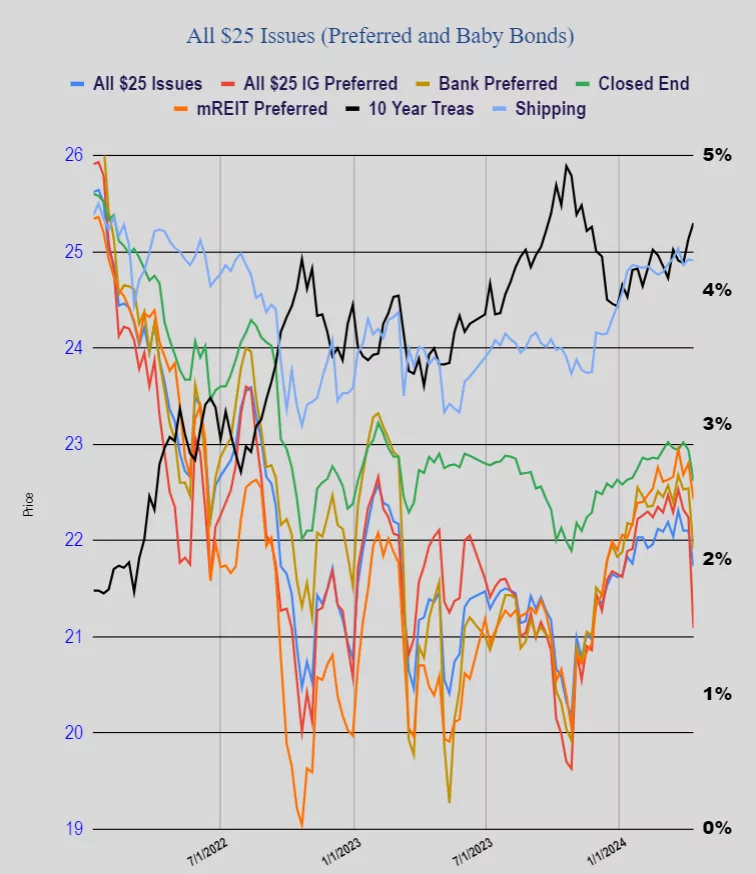

Last week was a relatively exciting week–not necessarily in a good way, but lots of movement in stocks and bonds. Personally I had some damage done to portfolios, but not severe and will hopefully start to get some of the losses back starting this week. As it turns out most of the damage in income issues was done to the high quality (low coupon issues)—not a huge surprise as historically when interest rates move higher the high yield, mid level quality issues hold up best.

The S&P500 fell by almost 2% lost week, although the index had been down somewhat more on Friday. While the index fell on Wednesday as the CPI was announced at a somewhat hotter level than forecast it bounced back Thursday as PPI was tame, but once again tumbling on Friday.

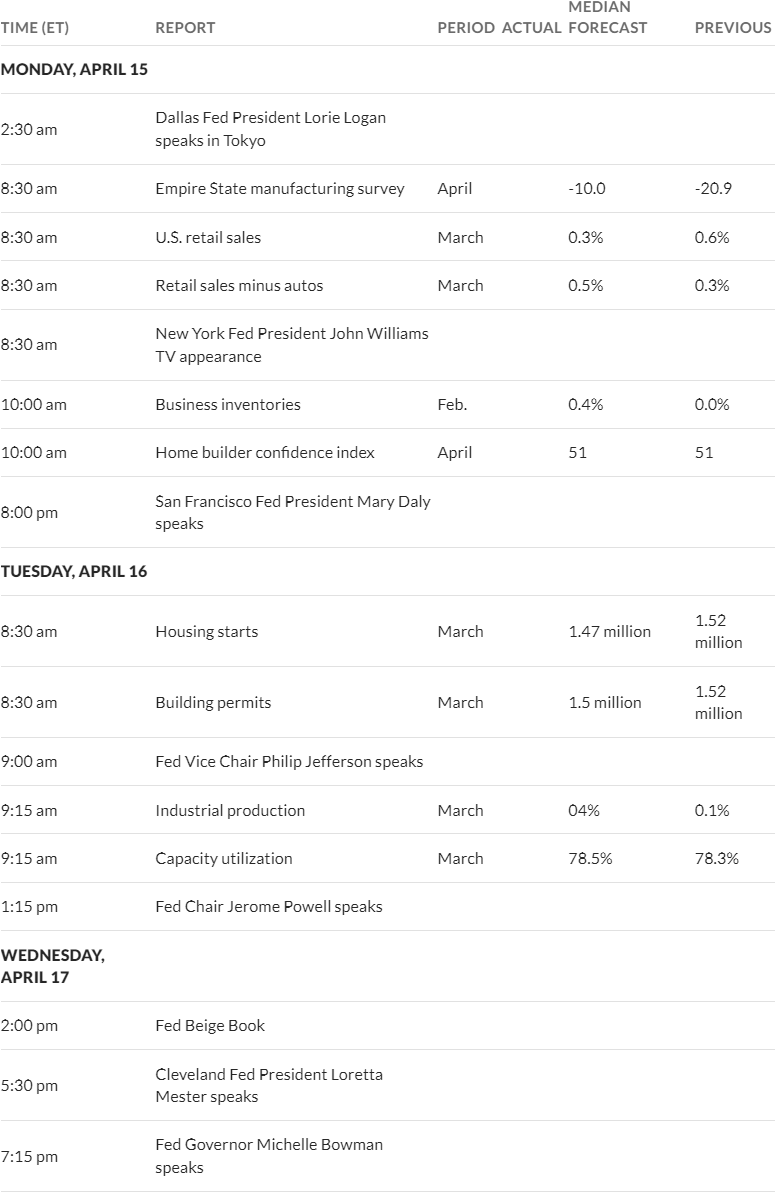

The 10 year treasury closed the week at 4.50% which was up about 12 basis points on the week. The yield had been as high as 4.59% on Thursday. The close of 4.50% was the highest yield we have seen since last November (on a weekly closing basis). This week we see leading economic indicators on Thursday and sprinkled throughout the we see housing numbers–home builder confidence, building permits, existing home sales and housing starts. We also see the ‘beige book’ for a rundown of what each Federal Reserve district is seeing in their area. And of course we will have the war situation in the middle east hanging over the markets.

The Fed balance sheet fell by $1 billion. Right now we can count on the assets to fall by the planned $90-95 billion each month–although the runoff will be somewhat lumpy. There is talk of reducing the runoff in the next couple of months.

Last week the average $25/share preferred and baby bond fell by 1.7% (37 cents), which puts the average share at $21.73/share. Investment grade issues were beaten badly – down about a dollar, banks down by 63 cents, mREITs down 37 cents and shippers fell by just 1 cent.

Last week we had 1 new income issue price with a new baby bond from Great Elm Capital (GECC). The issue priced at 8.50%.

Looks like GLP-A was just redeemed. Bummer will miss the 12% yield.