Time get back to work after the 3 day weekend. Equity markets are up this morning—a reaction from what is being perceived as a dovish personal consumption expenditures (PCE) number on Friday. I took the number as a neutral number, but it doesn’t matter what I think.

The S&P500 moved higher last week by a small amount—just .38%, but after the large gain the previous week a little digestion is to be expected.

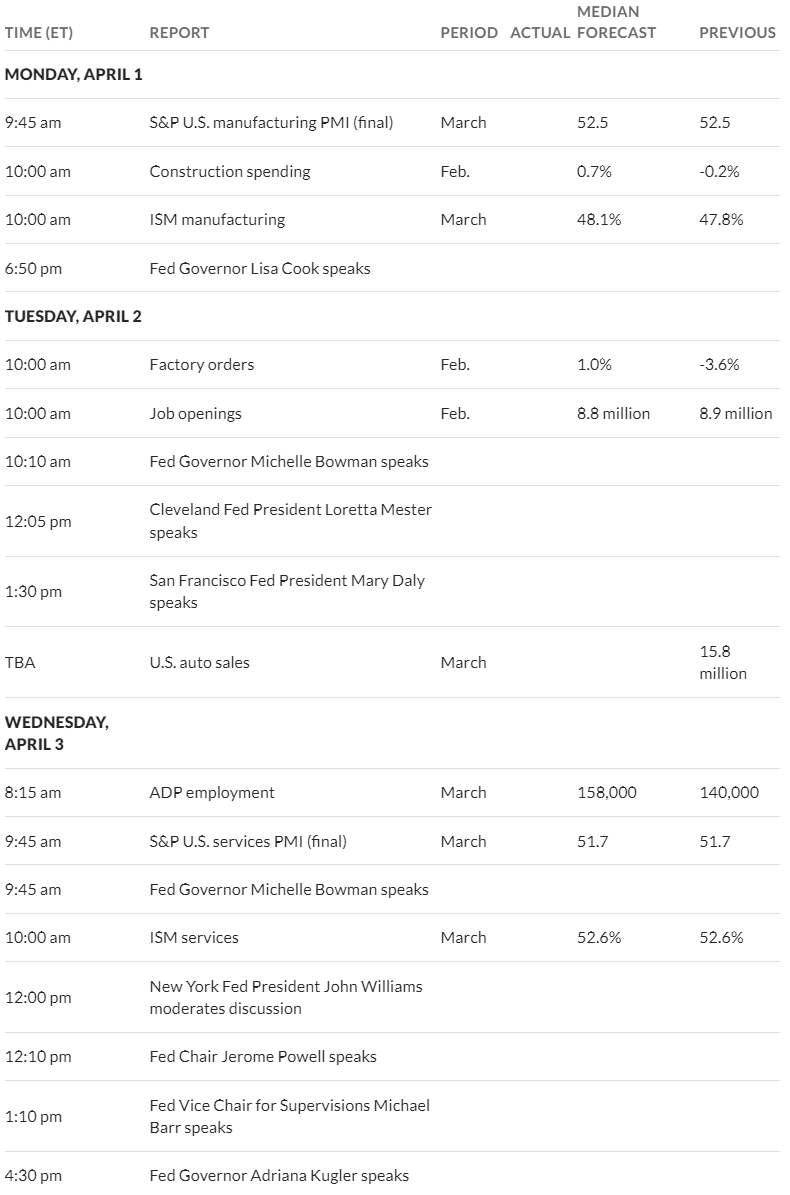

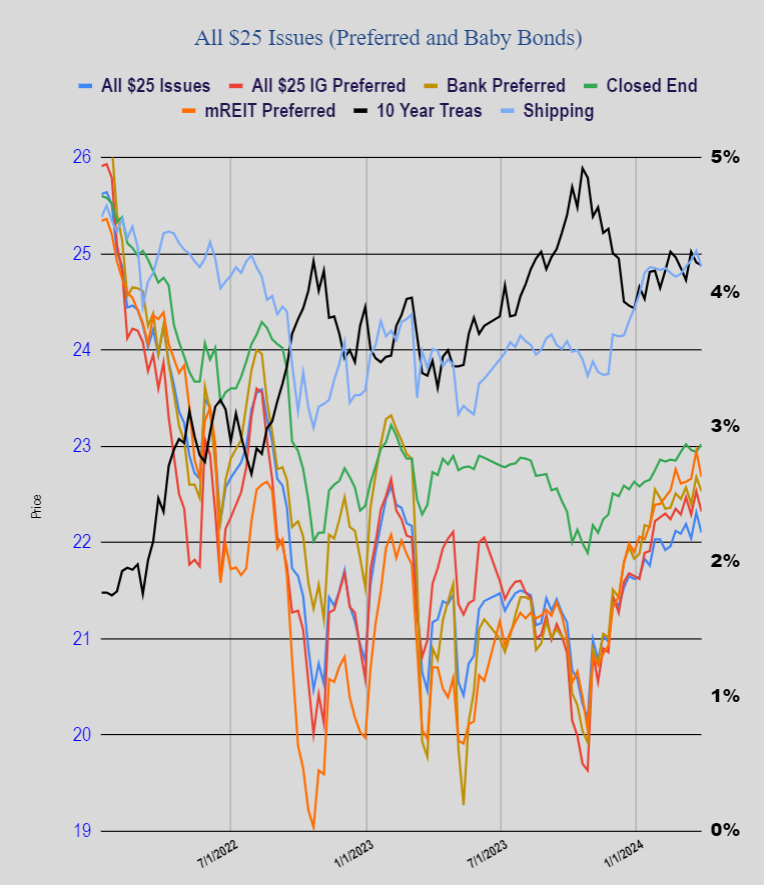

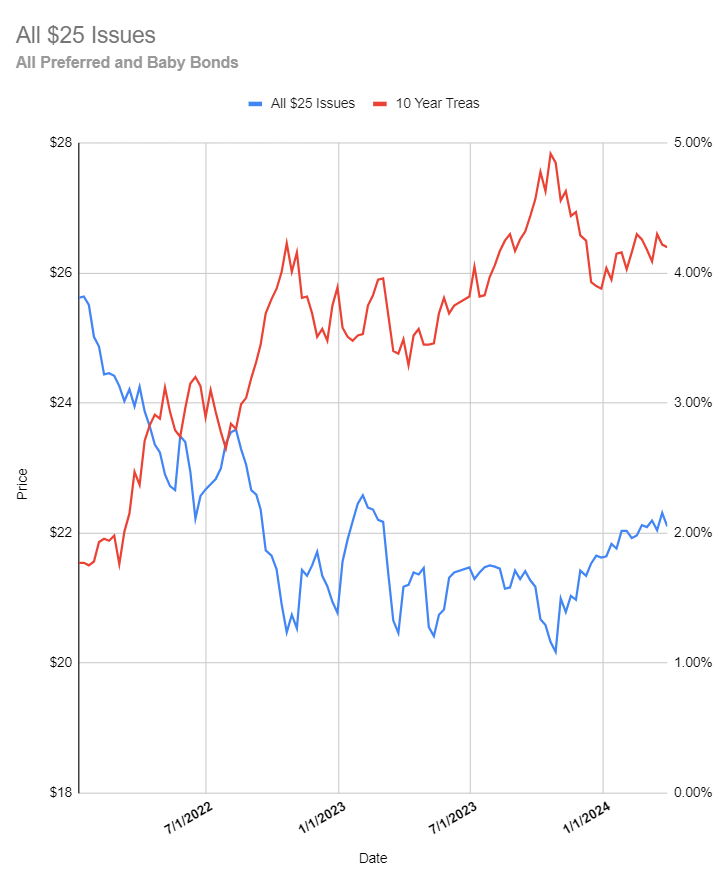

The 10 year treasury didn’t do much of anything–closing down just 1 basis point from the previous Friday at 4.21%. Right now the 10 year is at a yield of 4.21%–very, very quiet. With the supposedly dovish PCE number on Friday I thought we would see rates down some this morning. This week we have the biggest economic number being released on Friday with the employment number for March on Friday. For the coming week we also have bunches and bunches of Fed yakkers–not that they should move far away from the chairs ‘line’ which is inflation is too high and we need to see more progress toward the 2% goal.

The Fed balance sheet fell by $30 billion last week–now at $7.84 trillion.

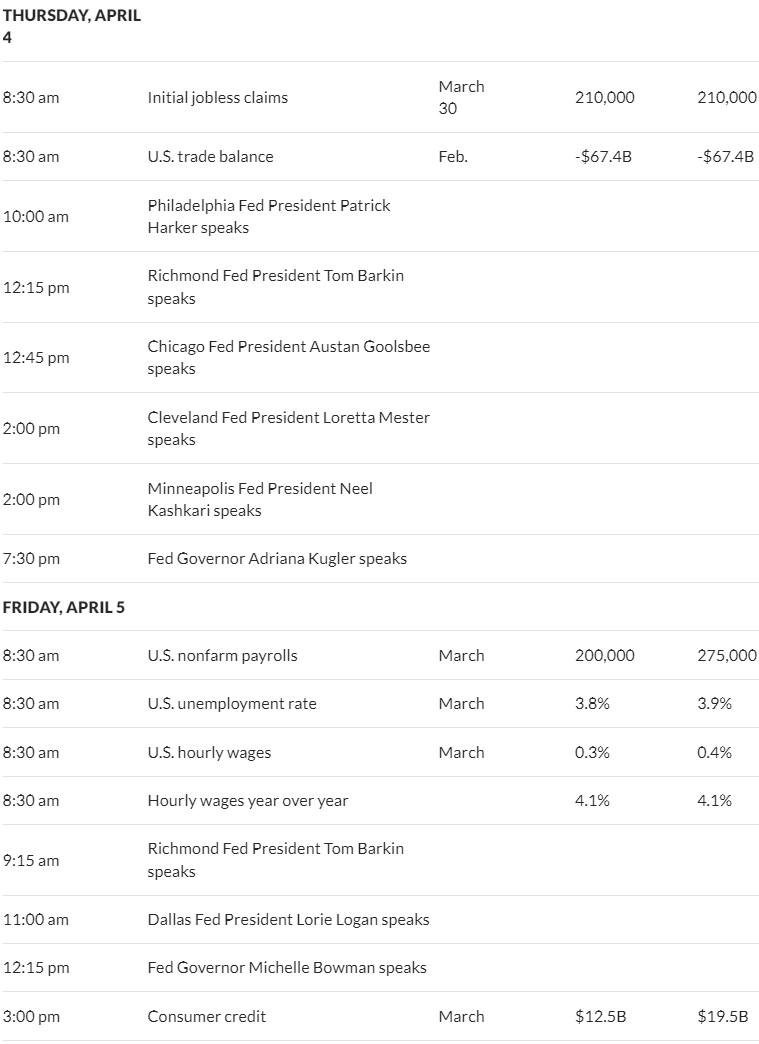

Last week in spite of little movement in the 10 year treasury we saw losses in $25/share preferreds and baby bonds with the average share price moving lower by 21 cents – closing at $22.10. Investment grade issues moved 21 cents lower, bankers down by 15 cents, mREIT issues were 27 cents lower and shipping issues were down 17 cents.

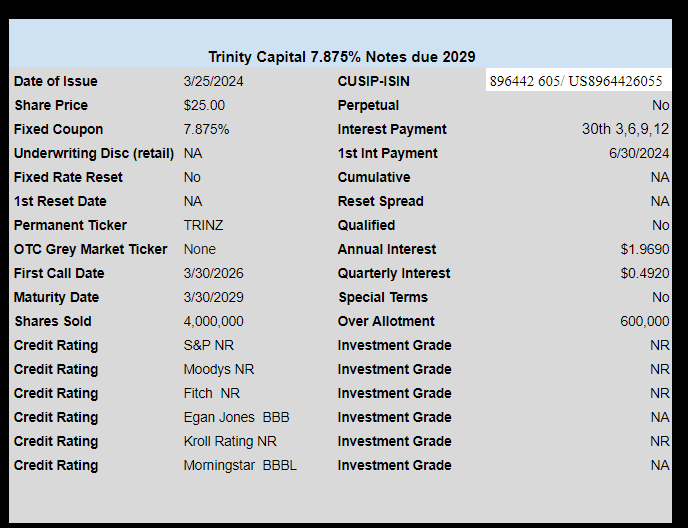

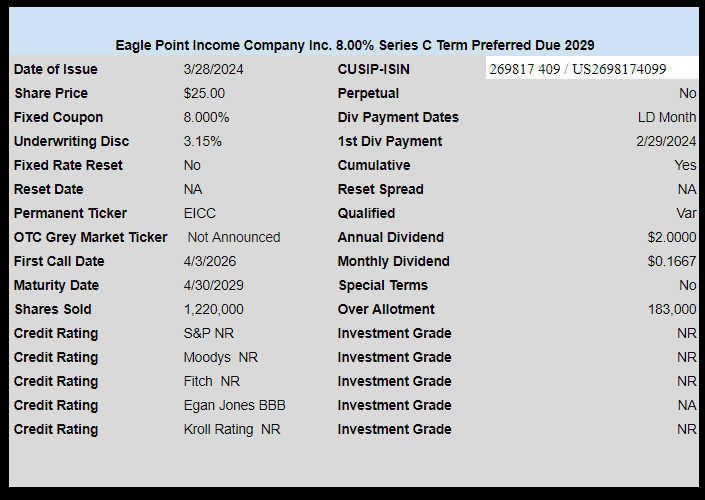

Last week we had 2 new issues priced. CLO owner Eagle Point Income (EIC) priced a nice 8% monthly pay term preferred issue, while BDC Trinity Capital (TRIN) priced a new baby bond with a coupon of 7.865%. High yield issues keep coming and most of the recent issues are trading solidly. These issues are not trading as of yet.

I just noticed that on march 29 CHS filed an 8K…..indicating exploring the possibility of a merger with Growmark concluded and both companies will operate independently…..eom

I’ve just bought SYF PRB at $24.85

TRINZ now trading at Fidelity. $25.20

10yr T – jumping today, up 11bp to 4.31% ~ will it test 4.4%?

GOLD has been on quite the run this year. A reaction to granny’s money printing bonanza, me thinks. Too bad it does not generate any income.

I miss Newmont’s old preferred that used to pay a dividend based on the price of gold. That was a long time ago. Maybe they’ll bring it back!

One could sell calls against a position and make a few bucks. For example, SGOL is trading at $21.42 and its April $22 calls are selling at .10. Roughly 5.5% (buy 1000 shares, sell 10 calls to get $100, repeat monthly).

I like the miners, and one can get paid some. I don’t hold a bunch, but they are source of great entertainment for me.

Doug, flip and trade IAUX

Thanks. I am more of a holder than a trader these days, but I see those occilations. I will check out further.