The S&P500 has taken a pretty fair ride today but in the end can’t decide which way it wants to go. Right now the index is up about 20 basis points.

The bond market is more guarded about inflation–the 10 year treasury yield is up 5 basis points at 3.75%—I tend to watch the bond market for direction–maybe I’m biased but bond traders seem to be more ‘level headed’.

Of course most of the inflation numbers (as measured by the CPI) were either on or very close to forecast this morning—and the talking heads are in plenty of disagreement as it relates to Fed policy. I think we have 50% of them that think the Fed needs to watch employment as the main driver of policy–while the other 50% believes that the slow 25 basis point hikes will bring economic activity down regardless of employment.

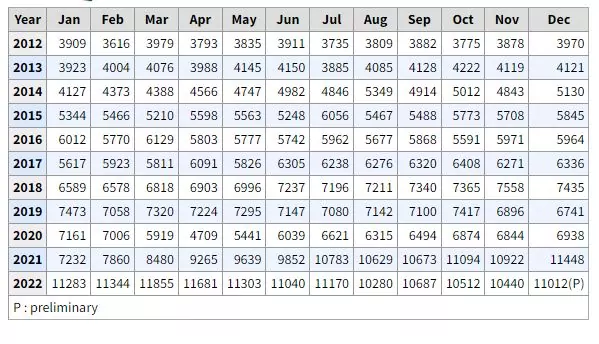

We see lots of layoff notices going out but the numbers in total are not huge–and the latest JOLTS (Job Openings and Labor Turnover) report for December shows a huge demand out there for workers. It’s hard to imagine the economy taking a huge hit with this many job openings (see below).

Income issues kind of look flattish today (just by eyeballing the spreadsheets)-my accounts are very slightly green—very slightly.

I did sell a chunk of my Liberty Broadband 7% cumulative redeemable preferred (LBRDP). I had been overweight this issue for quite some time so I had hung a Good til Cancelled order out there for some of it and I see that it executed.

I still have my LBRDP but it is a very small holding. Like you Tim I am ok holding a little.. overall- My pfd/bb’s positions have dwindled a lot. Keeping some in the mix to help the overall ‘cash’ return but small positions other than NSS which is my largest holding now in both taxable and Roth. Lots of 3/6m T’s now and SPAXX, rest is odd Bea stuff not III issues.