Another wild week is about to begin after the Presidents day holiday on Monday–and once again this will be a likely volatile week as news from Ukraine will drive equity values up and down.

The S&P500 fell 1.6% last week which means the index is now almost 10% off of record highs.

The 10 year treasury, which just had yields of up to 2.07% on Wednesday closed the week at 1.94% as money flowed to safety because of the Ukraine/Russia ordeal. This doesn’t change the likely continued move higher in interest rates–just gives us a pause.

The Fed balance sheet moved high by $33 billion to $8.9 trillion–of course a record high.

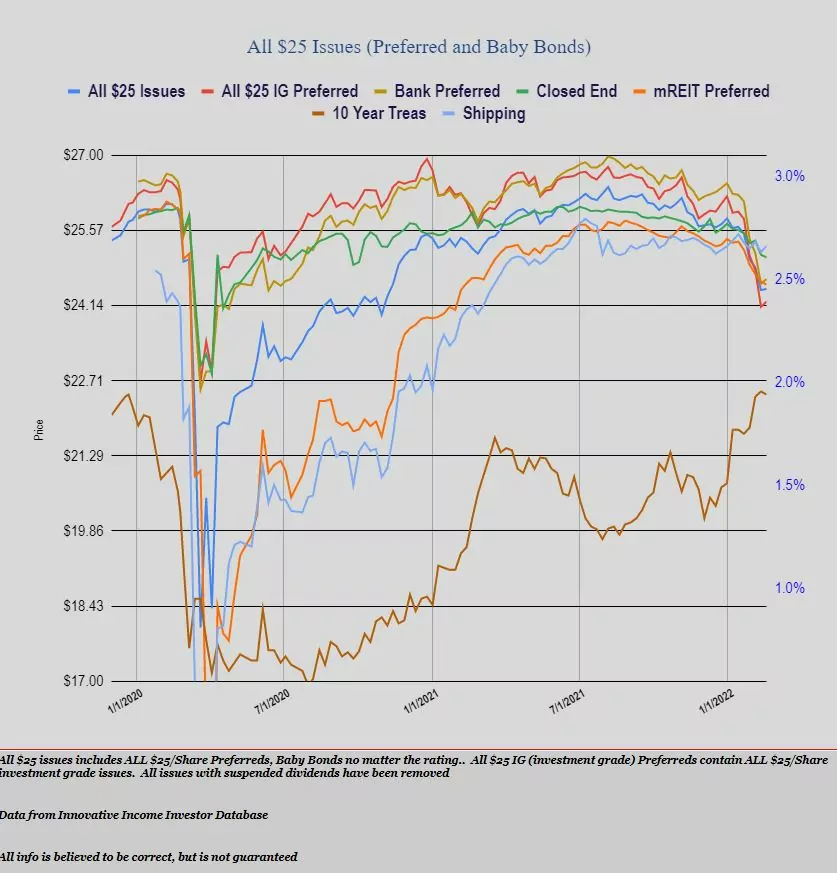

Last week the average $25/share preferred stock and baby bonds gained some stability after a number of weeks of being pounded lower (the average share is down over $1/share in the last month).

The average share was up by 2 cents with investment grade issues up a dime. Bank preferreds were up 9 cents, mREIT preferreds fell a nickel.

Once again we had no new income issues priced last week