Well time to get back to more normal life as the holidays come to an end–at least for many of us. Hopefully everyone had time to get with family or folks they are close to and share a meal or to just visit. I had my time with 8 grandchildren and with a 1 and 2 year old part of the group I had my noise allowance fulfilled for a few months.

Last week we saw the S&P500 fairly quiet with the index gaining a modest .7%. Of course leading up to the holiday weekend one would expect markets to be quiet, but that markets continue to go higher and higher is quite amazing in itself. This morning we have equity futures up once again–but just by a tiny bit. I suspect it will be another ‘green’ week by a tiny amount–trading will be muted as folks vacation etc.

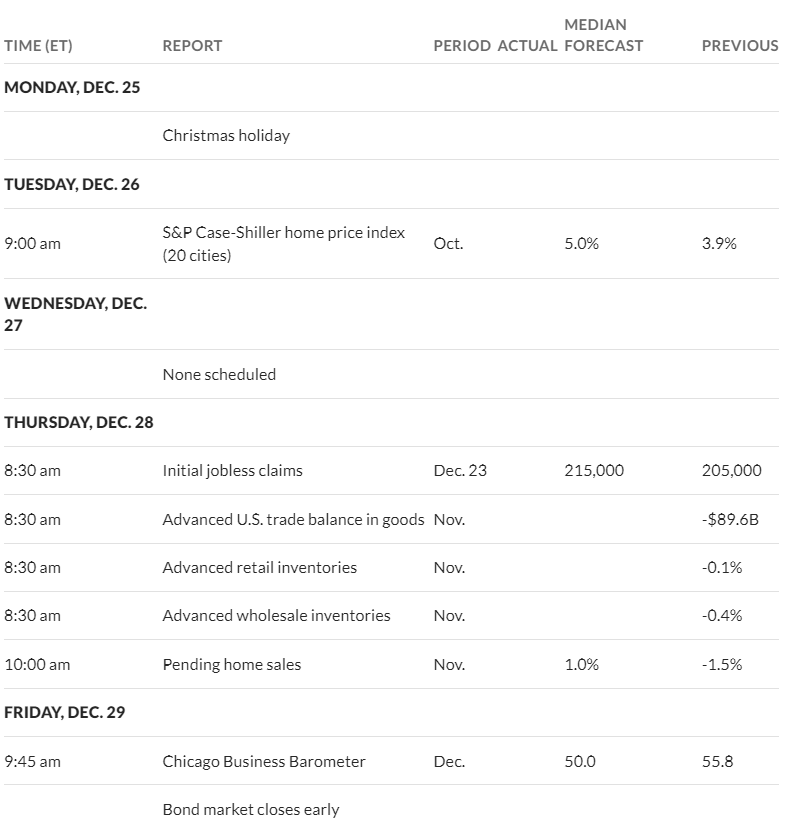

Interest rates continued to draft slowly lower as economic numbers, in particular inflation related indicators continue to remain tame. The 10 year treasury closed the week at 3.9% which was down 3 basis points from the previous Friday. This week the economic calendar is very lite so we shouldn’t expect to see any large interest rate moves (daily moves of 10 basis point etc).

Last week the Fed balance sheet fell by $14 billion after being flat the week before–now at $7.24 trillion.

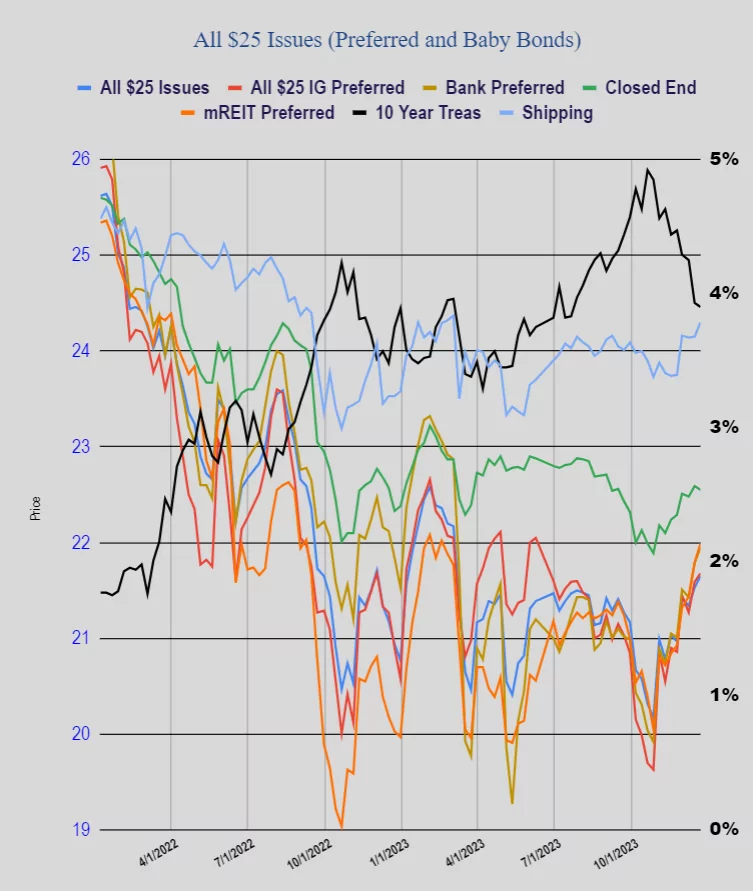

Last week the average $25/share preferred and baby bond moved higher by a modest 12 cents. The average investment grade issue was up 9 cents with banking preferreds up 16 cents, CEF preferreds down 4 cents, mREIT preferreds up 20 cents.

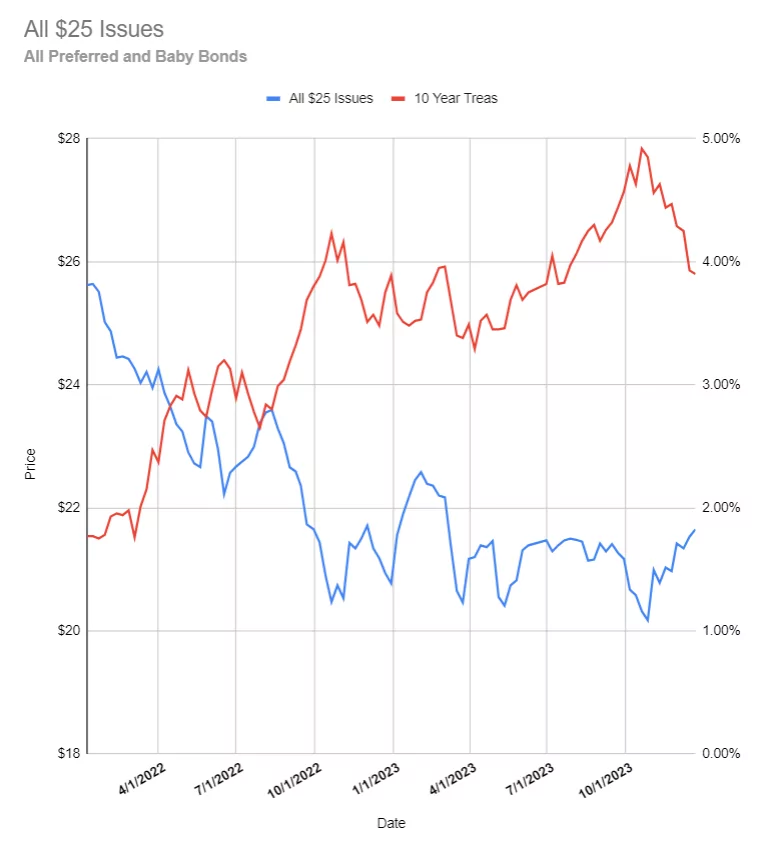

The chart below represents the average $25/share from 12/31/2021 to last Friday as compared to the 10 year treasury–I present it only because the chart above is getting very ‘busy’.

Last week we had no new income issues pricing.

Why is bfs-e trading at 23.75 and bfs-d (yields higher) trading at 22.9? Both ex on Friday

Irish, it’s tempting to sell these but I don’t think I will get the same opportunity as this year to flip. Buy 500 shares of E at 20.35 and 19.95 then sell at 21.45 then buy back as 18.70

Where would I find 8% in a safe return on a reit?

I just swapped out of my E into D, I just wondered why the discrepancy, and it’s persisted several days.

Irish, I have the D at 19.12 and 19.45 so again almost 8% , don’t think I will be selling for now.

If you like BFS, check out Lxp-c.

Maine I have that one too

Preferreds went up a lot in December. Glad I wasn’t heavy into fixed income. Not sure preferreds are a buy now after the rally I’m looking more toward reducing. Probably wait until after the year end volatility.

This is going to go down as one of the greatest opportunities to buy fixed income 8n the market…this whole year has been a gift, get your yields now….

Hope your right troy.

I’m used to better so I don’t consider 5% to be a good return. More of a holding place between trades, Biggest advantage is I don’t rush into things like when cash was earning nothing.