What a crazy week last week was–apparently peak inflation has been here and now is behind us–at least this is how markets traded last week. Common stocks as well preferred’s and baby bonds all exploded higher. Well I suppose everything will need to come back to reality this week.

The S&P500 rose by 257 points to close at 4158–almost a 7% rise on the week. Will it be maintained or is it just a bear market bounce? Whether common stocks go up or down I prefer movement at a slow pace.

Th 10 year treasury closed last week at 2.74% after trading as high as 2.87%. The close was 4 basis points below the previous Friday’s close. We had new home sales implode with 591,000 units being sold versus a forecast of 750,000 and pending home sales fell by 3.9%. Inflation was reported about as expected. This week we will have jobs data on Thursday (ADP) and the official jobs numbers on Friday—this could be a market mover. The 10 year treasury is up 8 basis points this morning (at 530 am central).

The Fed balance sheet fell by about $30 billion last week. QT (quantitative tightening) starts this week and it will be very interesting to see how this plays out relative to the movement in interest rates.

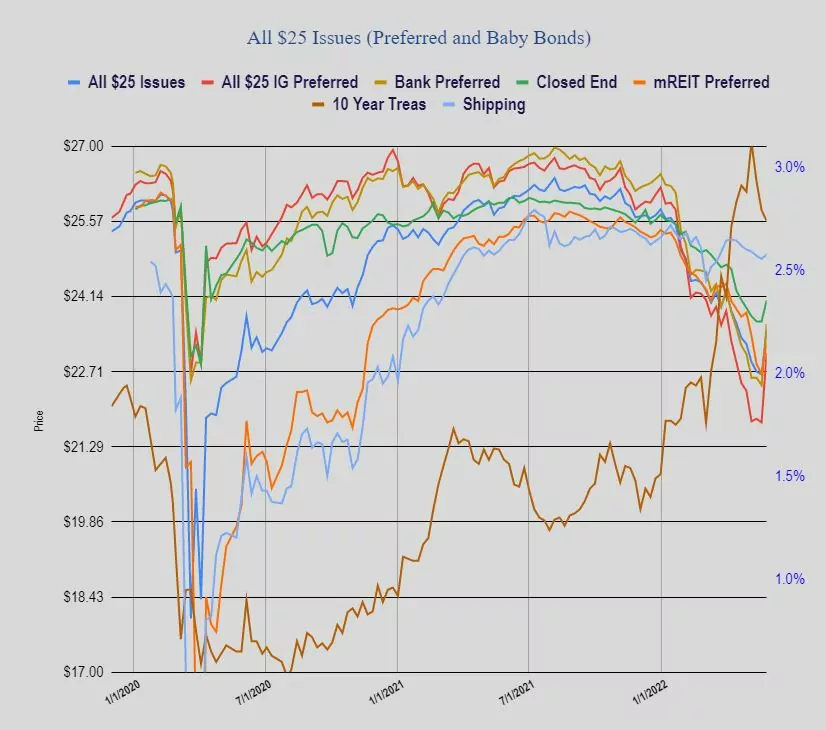

Last week the average $25/share preferred stock and baby bond moved sharply higher – up 3.3%. Investment grade issues moved even more sharply higher as they shot up 6%. This is a case of those shares which had taken the biggest poundings (high quality, low coupon) rose the most–I guess a bit of a panic to lock in high current yields in quality. Bank issues were up 5% and mREIT issues just over 2% and shippers 1/2%.

No income issues priced last week.

“Depending on the data” .Jaw boning is 90% what the Fed does, LOL!

Fed is already walking back their pause comments. Preferred market hasn’t reacted to it yet.

I saw that.

This makes the Fed look like a mad house. We could be in for some trouble here.

Thanks Tim. Could you please add NRZ-D to the master list when you get time?