Here we go on another big week—seems like pretty much every week is a big week in some respect and this week it is the employment report which is the big news.

Last week the S&P500 was up about 3.4% – a very solid week with markets wrapping up Friday with nice gains on the back of a somewhat softer personal consumption expenditures (PCE) being released on Friday. Never mind the banking crisis as it appears that investors have put this in the rear view mirror–of course at their own peril–but for now it is ‘party on’.

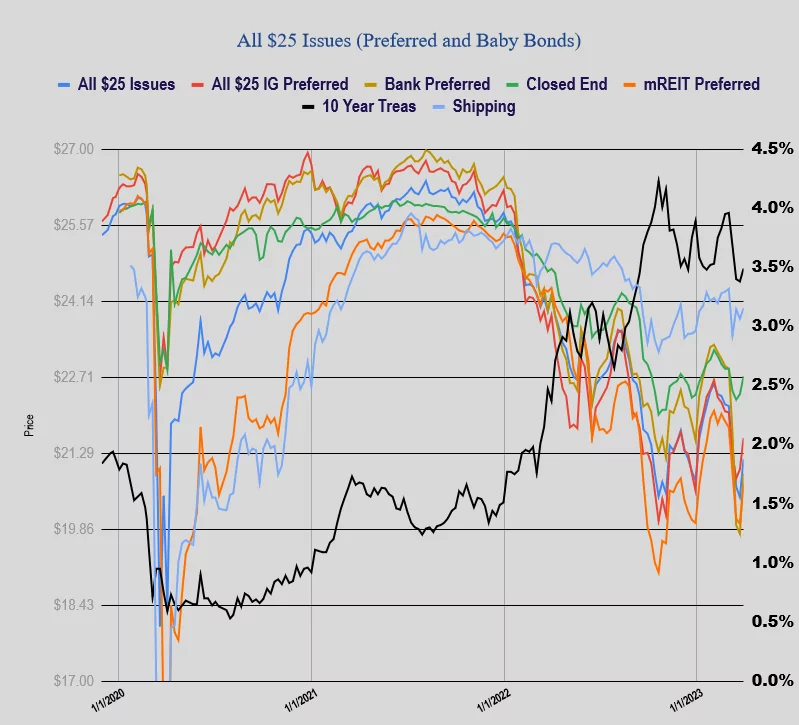

The 10 year treasury yield ended the week at 3.49% which was up 11 basis points on the week. The 2 year treasury yield ended last week at 4.07% which is up about 30 basis points on the week.

Last week the Fed balance sheet fell by $28 billion after rising the 2 previous week by near $400 billion in response to the banking crisis. It will be interesting to see the movement in the next few weeks.

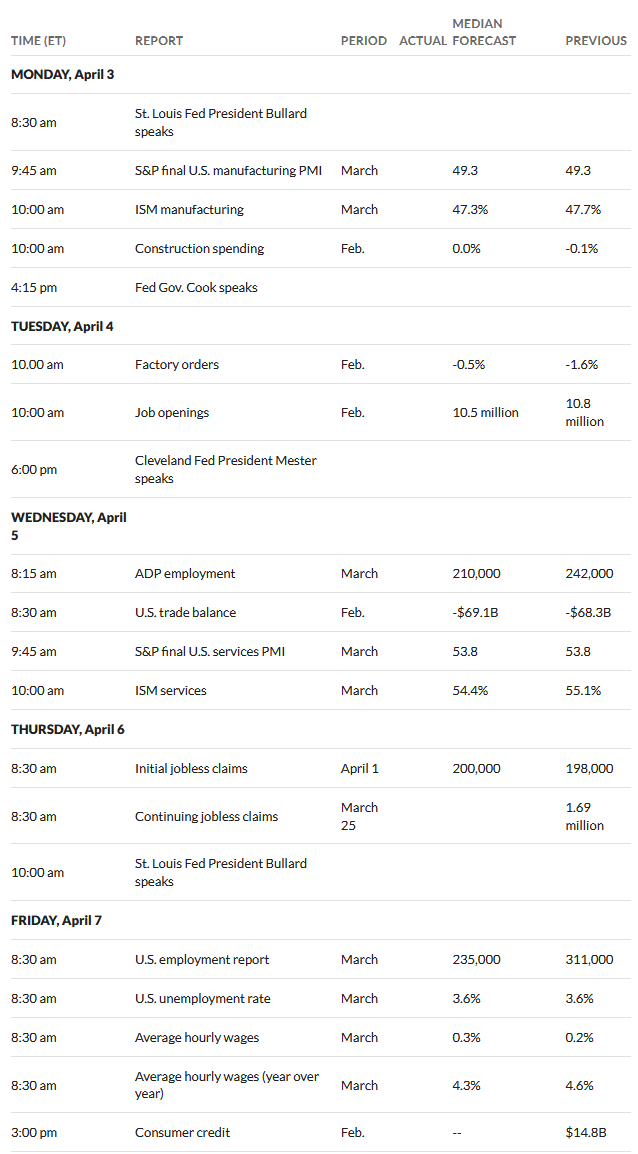

The key economic news item this week is the employment report on Friday with 235,000 new jobs forecast–versus 311,000 the month before. The unemployment rate is forecast flat at 3.6%. As always something a bit softer than expectations would be welcome – help provide cover for Powell at the next FOMC meeting to either hold rates steady or raise by a minimal amount.

I see that Fed official Bullard and Mester are both speaking this week–normally expected to move markets, but with the banking situation it is likely their comments will be tempered.

Last week we had a relatively strong rally in $25/share preferreds and baby bonds as the banking issues were pushed into the back of investors minds. The average share rose by 71 cents. Investment grade issues rose by 59 cents, banks by $1.13, with mREITs up 73 cents and shippers by 20 cents.

Last week we had no new income issues priced.