Another exciting week is upon us–we have CPI (consumer price index) numbers ahead of us on Thursday at 8:30 a.m. (central). I see expectations of 7.9% versus 8.2% year over year–so obviously we have room for a surprise in this number. This may be the lone piece of economic data that will send markets into either a tailspin or for a ride on a rocket ship

The S&P500 dropped last week by 3.3% from the previous Friday. Right at this moment the S&P500 futures are up 21 points–around .6%. This gain can evaporate quickly, but there is not specific economic news today which will derail the rally.

At this moment the 10 year treasury yield is at 4.14% which is down a few basis points from the close last Friday. My guess is that the yield will drift in the 4.05% to 4.15% area until Thursdays CPI release – then it is anyone’s guess. A hot surprise sends the yield to 4.30% which will crater equities.

The Federal Reserve balance sheet assets fell by a hefty $47 billion last week to now stand at $8.68 trillion.

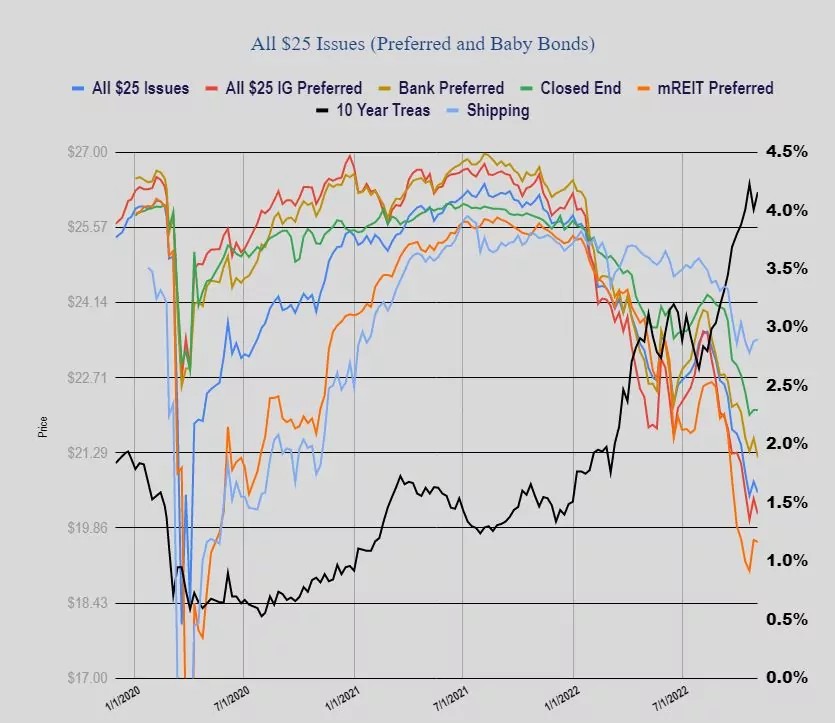

The average preferred stock and/baby bond fell last week 21 cents—about 1%. Investment grade issues 30 cents, banking issues by 36 cents. Junkier issues fell less–mREIT issues fell 4 cents and shippers rose 3 cents. BDC issues fell 7 cents with insurance issues falling by 42 cents.

Last week we had no new income issues priced.

QRTEP: ok, so I have hung onto a few shares, and recent earnings were dismal, but any opinions on whether the parent company is in immediate risk of ceasing payment?

Immediate risk of not paying? It really depends on the CEO. They can pay it if they want for now. They have a few options like selling some property and doing lease backs but they are very reserved with releasing that info. They can hit up their revolver which they have a lot available on. They even actually bought back a tiny bit of debt last quarter. With that said they are burning cash and need some positive cash flow. This Christmas will be pretty big for them as well as their turn around plan called Project Athens (fancy right?). I think the insurance claim they have also needs to pay out some more. For business interruption.

“And these actions taken up until June strengthen the balance sheet capacity and resulted in more than $2.5 billion liquidity between our cash and borrowing capacity on the revolver. It also gave us close to $1.5 billion of restricted payments capacity to support parent level needs, including debt and the preferred.” So that was June.. and the revolver was paid down even more the last 3 months which was 2.7 billion for the revolver alone.

The shortest term maturities will get taken out using the revolver most likely. So once again.. they need positive cash flow. Start selling the crap out of stuff. We will prob get a year of payments still but without pos cash.. the preferred will be the first to stop paying. I too also own a bit of this turd and won’t sell it unless it stops payment. The selling stage seems to have already passed me by to get out somewhat cleanly. I have 130 shares. I will ride this and see if they can turn things around to at least keep their head above water. I should have sold it.. but alas…

This is my simple view of things.

I believe the preferred dividends are considered restricted payments under the credit facility. If true, QVC must maintain 4.5 net leverage.

I dumped my QRTEP shares when it hit $40, taking a big loss and moved on. Should’ve had a stop loss set long ago but didn’t so now I pay the price, but I’ll at least get some tax benefit. I already used some of the proceeds to buy ABR-E, CUBB, and ARCC. I think these are all safe for now and will eventually move up to better prices, and in the meantime, I’ll sleep better. I listened to their conference call and the decline in new customers was troublesome to me, and they seem to be getting hit from many different directions which made me ask myself: “would I buy QRTEP at $40? NO. Then why hold it and keep hoping for a turnaround?” Lots of better opportunities in terms of risk and reward.

For what it is worth, recent comments from one of the investment newsletters I subscribe to (my guess is that liquidity in the Treasury market has the potential to break unfavorably):

“U.S. government spending is running out of control. The National Debt is now up to $31.25 trillion, having just surpassed the $31 trillion threshold in the first week of October. In just the past month, that debt has jumped by over $325 billion and by $660 billion over the past three months. Due to higher interest rates, the interest bill alone on the National Debt next year will likely be north of $1 trillion.

The growth rate of U.S. Government receipts is declining sharply as the economy slows and capital gains receipts (from the once-strong stock market) recede. Once the recession hits in full force next year (U.S. GDP is still growing slightly), safety net outlays and other entitlements will soar. It’s an ugly economic picture and without the huge gap in interest rates between the U.S. and other countries (who were slower to react with their rate hikes, but are starting to catch up), the U.S. dollar strength is unsustainable.”

With the Fed implementing QT at $95 billion per month ($60 billion in Treasury securities – $720 billion per year), plus the likely near-$2+ trillion deficits that will need to be funded, the question is – who will be the buyers of all that debt when the biggest buyers in recent years (the Fed, Chinese and Japanese) are now all sellers?

It’ll have to be mostly up to the U.S. public, whose personal debts are high as well. Demand at last month’s Treasury auctions was poor, with dealers stuck with excess supply. By all accounts, liquidity in the Treasuries market is deteriorating. It’s only going to get more difficult to fund this U.S. government’s spending.”

Sounds like a recipe for much higher interest rates or a “technical” default.

There could very well be a technical default if the debt ceiling is not raised in a couple of months. It’s a game of chicken and if both sides think they’ll get the upper hand by not backing down and blaming a technical default on the other side, it can definitely happen.

Hi Rob.

Well put!

Jeff Stein, Washington Post, 10/30, “Tremors in Treasury Bonds worry

Wall Street and Washington.”

I agree with all that has been said above. But isn’t this really all of the Fed’s doing in the first place. In theory they could stop QT at any point?

They seem to be well in control and continue to say more pain is coming so.

The core problem is us.. for allowing the federal government to spend huge sums of money and run up such mind boggling debt. The average citizen just does not care or maybe cannot comprehend the problem. We cannot even seem to agree on a freeze of fed spending for 5 years just to see how we can squeeze out savings from each dept. Ridiculous. Hard to fix a problem when the core issue cannot even be discussed because it is political suicide. Same goes for quite a few states. Same mentality.

Yes I am venting. Sorry. I am not expecting a reply.

Why did we cut the tax rate on wealthy individuals and corporations having tax loop holes already that they pay minimum taxes saying it would benefit everyone with a trickle down affect. But it gives the government less income to pay the debt. Remember the government’s own budget office did a report at the time these cuts passed that this would only increase the debt? Why as an individual I can only write off $3,000 in losses a year and businesses can write off good will which is hard to even define. Google it.

Why is it we don’t pursue more of the underground economy? I hired a guy who used to work for my company to watch my sheep while I am gone. He wants cash, 25.00 an hour. Lives in low income housing and plans on getting a tax refund for low income, married and one child and using it for a deposit on a used truck. I said this before, why are we talking about cutting SS when we quit collecting SS taxes from income above 160,200 for 2023 ?

I could go on, but the pork barrel politics of both parties is crazy.

PS, I hope this passes Tim’s no politics as I am laying blame on both parties and giving examples of bad policy for both sides of the aisle. I hope I am also not offending anyone.

On a related note, see the discussion in the sandbox about FHLB auction of notes. All these different government agencies chasing after money and investors. Here is another one.

Is it because it difficult to get investors that these short term rates are higher and the minimum required to buy has been lowered ? Joel A mentioned he thought it has been 50 to 100 lots and 2WR mentioned Fidelity is accepting orders for 10k

Now what could go wrong?