The S&P500 traded in a range of 4218 to 4325 closing the week at 4228 which is a drop of about 1.2% from the previous Friday–in the big scheme of things not much of a move.

The 10 year treasury rose to close at 2.99% which was a rise of about 15 basis points over the previous weeks close. The market place has now turned their focus from inflationary fears to the Fed driving interest rates higher based on a doubling of quantitative tightening to begin in September. This is a bit scary–while the Fed may slow their pace of interest rate hikes based on a slightly softening economic picture, the doubling (to the $95 billion area) of the runoff and sales of the Fed balance sheet is likely to bring some unwanted results (higher interest rates and lower stock prices). It is likely we will see mortgage rates shoot higher yet with the Fed letting $35 billion/month of mortgage backed securities run off the balance sheet. We’ll see what this grand experiment brings us.

The Federal reserve balance sheet fell by $30 billion last week bringing the balance sheet to $8.85 trillion–of course even with the ramping up of reductions next month the odds that we see even $8 trillion before the Fed is forced to suspend because of weak economic conditions–or a recession of some magnitude.

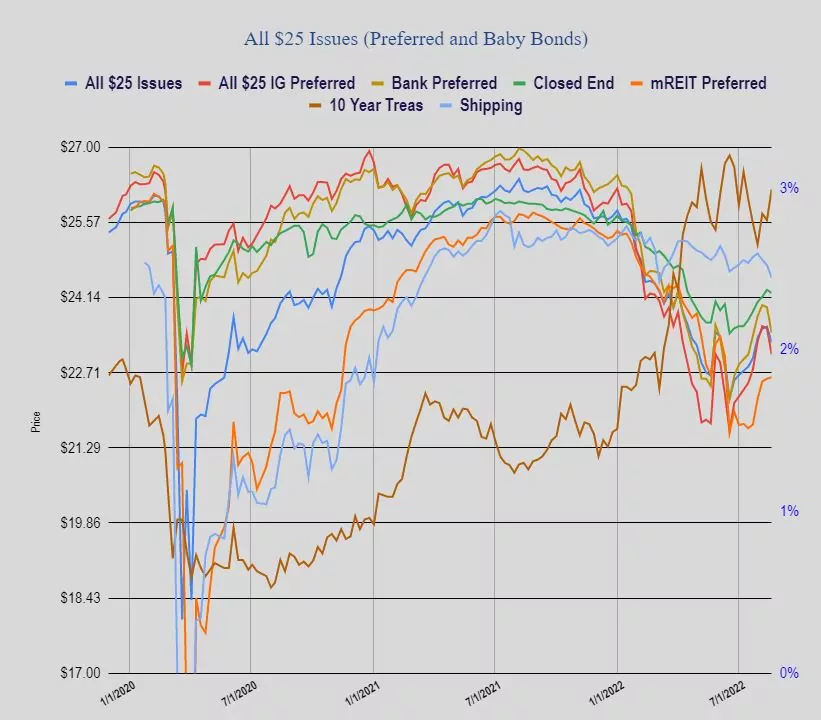

Last week was a tough week for $25/share preferreds and baby bonds as the average issue fell by 30 cents. Of course there had been significant gains in the last few months so a bit of a set back is to be expected. Investment grade issues fell by about 50 cents, banking issues by 49 cents while mREIT preferreds rose 3 cents and CEF issues were off 6 cents.

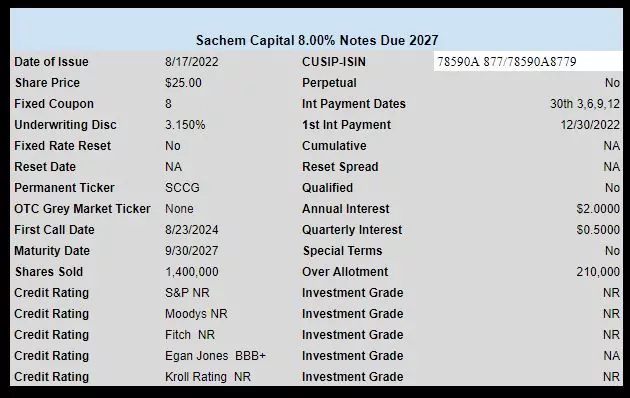

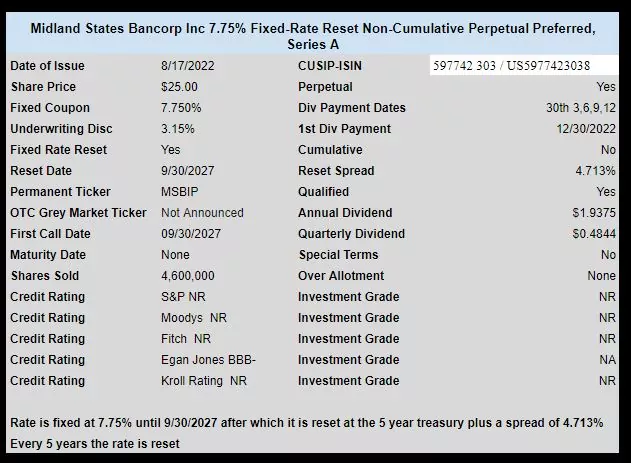

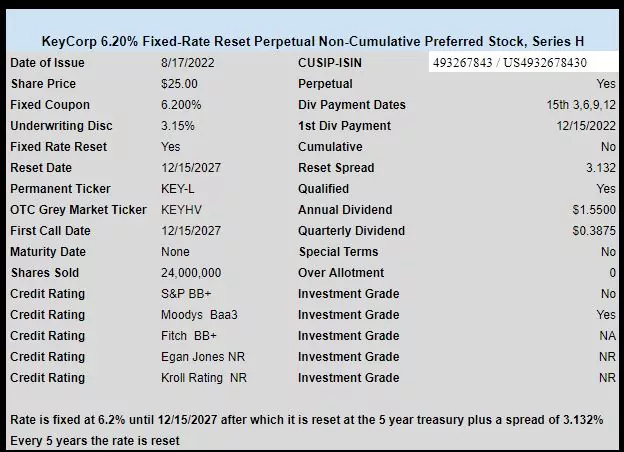

Last week we had 3 new income issues priced.

mREIT Sachem Capital (SACH) sold a new $25 baby bond with a high coupon of 8%.

Illinois banker Midland States Bancorp (MSBI) sold a new issue of fixed rate reset preferred with an initial coupon of 7.75%. The issue is trading on the OTC under ticker MSBSL and closed last Friday at $25.20.

Keycorp (KEY) sold a new issue of fixed rate reset preferred stock with a decent initial coupon of 6.2% The issue is now trading OTC under temp ticker KEYHL and closed Friday at $25.21.

There was also a new PNC $1000 Reset issue last week, 6.20% coupon. The prospectus refers to a “public offering price” but it doesn’t appear to be tradeable. Am I missing something here?

CUSIP 693475BF1

https://sec.report/Document/0001193125-22-223038/

The Preferred Stock will not be listed on any securities exchange.

Fidelity does show trades today on this one on their bond platform…. They’ve got the description screwed up as a perpetual with a maturity of 12/15/2049 (not your 3999 identifier, Grid)….. Most trades have been at a slight discount to par such as 99.85 with the occasional trade shown to retail guys who obviously still have brokers on commission at prices anywhere from 101 to 102 1/8.

Might take a bit for it to show up on FINRA. Typically they trade on bond market. PNC is no stranger to $1000 preferreds. They already have six of them on the market. The “3999 maturity date” is the flag that shows you they are preferreds.

https://finra-markets.morningstar.com/BondCenter/Results.jsp

Link didnt take so I will try this..

Issuer Name

Symbol

Callable

Sub-Product Type

Coupon

Maturity

Moody’s®

S&P

Price

Yield

PNC FINL SVCS GROUP INC

PNC5255632

Yes

Corporate Bond

3.400

12/31/3999

BBB-

83.582

PNC FINL SVCS GROUP INC

PNC3925909

Corporate Bond

2.854

11/09/2022

A3

A-

99.648

4.490

PNC FINL SVCS GROUP INC

PNC5402215

Yes

Corporate Bond

6.000

12/31/3999

BBB-

98.625

PNC FINL SVCS GROUP INC

PNC5423630

Yes

Corporate Bond

4.626

06/06/2033

A3

BBB+

96.549

PNC FINL SVCS GROUP INC

PNC5463651

Yes

Corporate Bond

6.200

12/31/3999

101.745

PNC FINL SVCS GROUP INC

PNC.KR

Corporate Bond

6.460

12/31/3999

BBB-

99.540

6.490

PNC FINL SVCS GROUP INC

PNC4119535

Yes

Corporate Bond

3.900

04/29/2024

A3

BBB+

100.291

3.710

PNC FINL SVCS GROUP INC

PNC4420925

Yes

Corporate Bond

5.000

12/31/3999

BBB-

92.125

5.427

PNC FINL SVCS GROUP INC

PNC4135545

Yes

Corporate Bond

4.850

12/31/3999

BBB-

93.920

5.163

PNC FINL SVCS GROUP INC

PNC4497661

Yes

Corporate Bond

3.150

05/19/2027

A3

A-

96.794

3.897