Well the stock markets continue higher as plenty of liquidity drives prices higher. The S&P500 moved higher by about 1.7% on the week–closing 1/10% under a record high trade. Strong cash balances (dry powder) remain available to ‘buy the dip’.

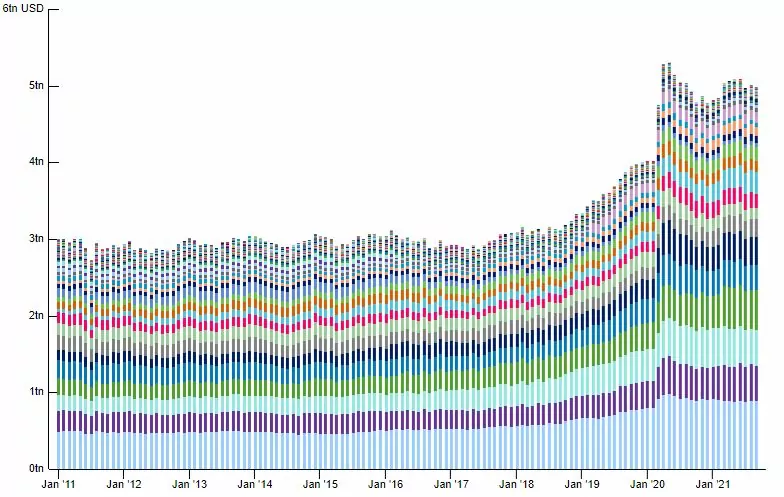

Below is a just released chart with money market funds for the period 9/30/2021. Balances remain in the $5 trillion dollar area–plenty of money to ‘buy the dip’.

Source:Office of Financial Research

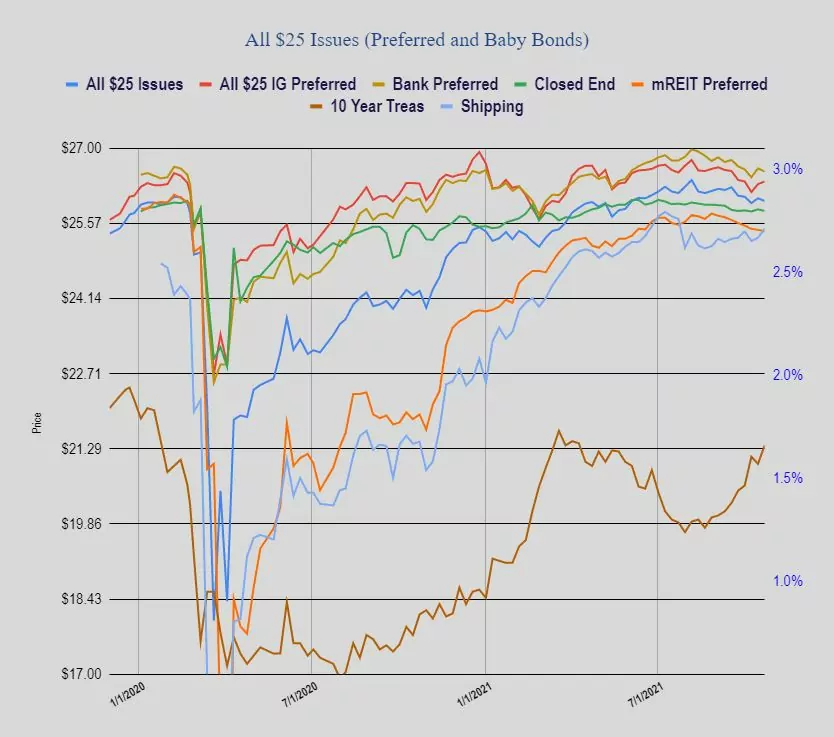

The 10 year treasury closed around 1.66% after knocking on the door of 1.70% on Friday–up about 8 basis points on the week. Rates are looking like they want to go above the 1.75% level from last April–as long as we don’t get major daily spikes of more than 10-12 basis points that will be ok–let’s do this a couple basis points at a time.

The Federal Reserve balance sheet took a giant leap higher last week–up $85 billion–easily a record high level. Up, up and away!!

It was a really quiet week in $25/share preferreds and baby bonds–on average. The average share fell by 5 cents, with investment grade gaining 3 cents, bank preferreds losing 6 cents, mREIT preferreds off 3 cents. The shippers popped up 17 cents

Last week we had 4 new income issues priced.

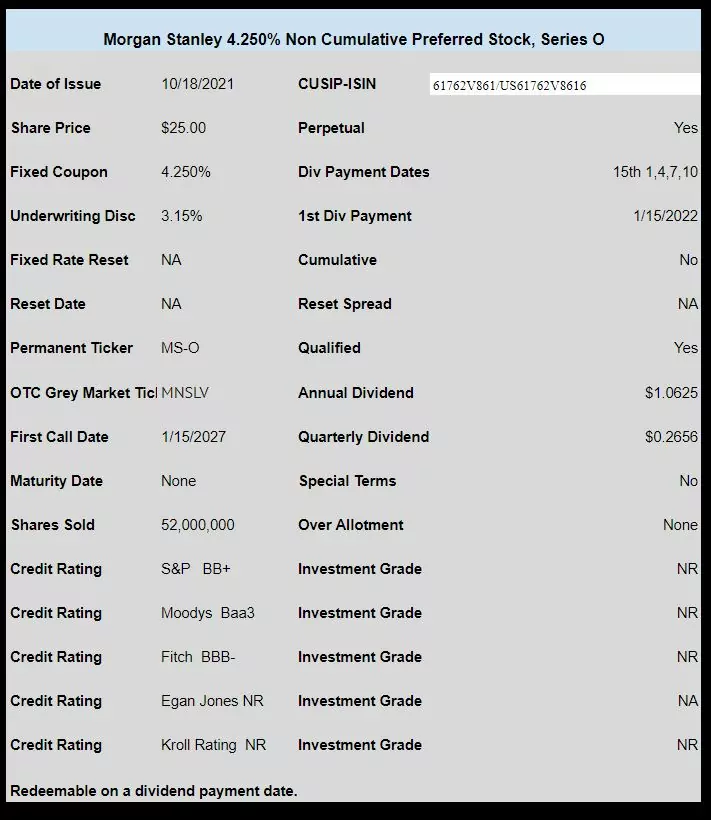

Morgan Stanley (MS) sold a new issue of non cumulative preferred stock with a 4.25% coupon. The issue is trading under OTC ticker MNSLL (ticker change) and closed on Friday at $25.00.

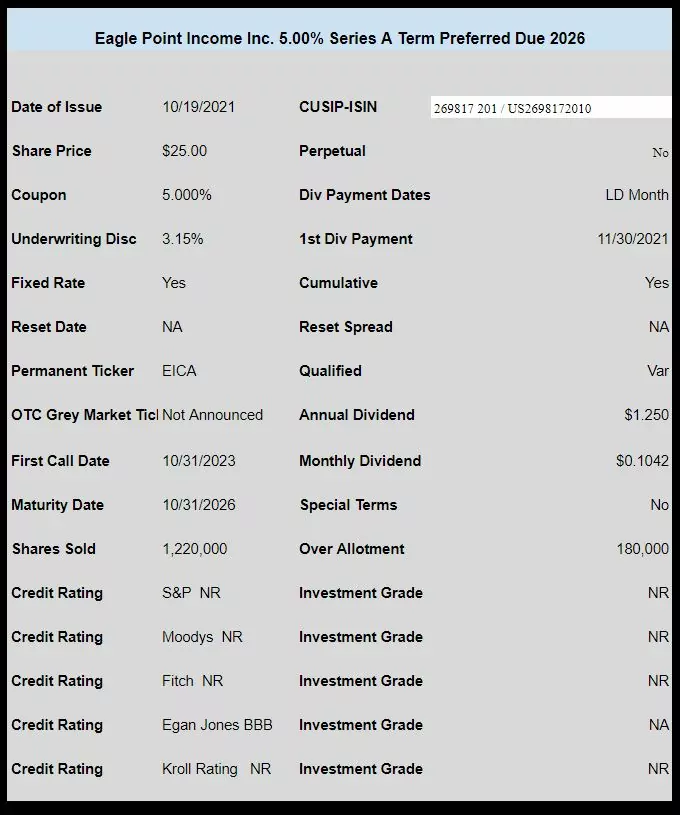

CLO owner Eagle Point Income (EIC) sold a new term preferred with a 5% coupon which is now trading under ticker EICPP and closed last Friday at $25.35.

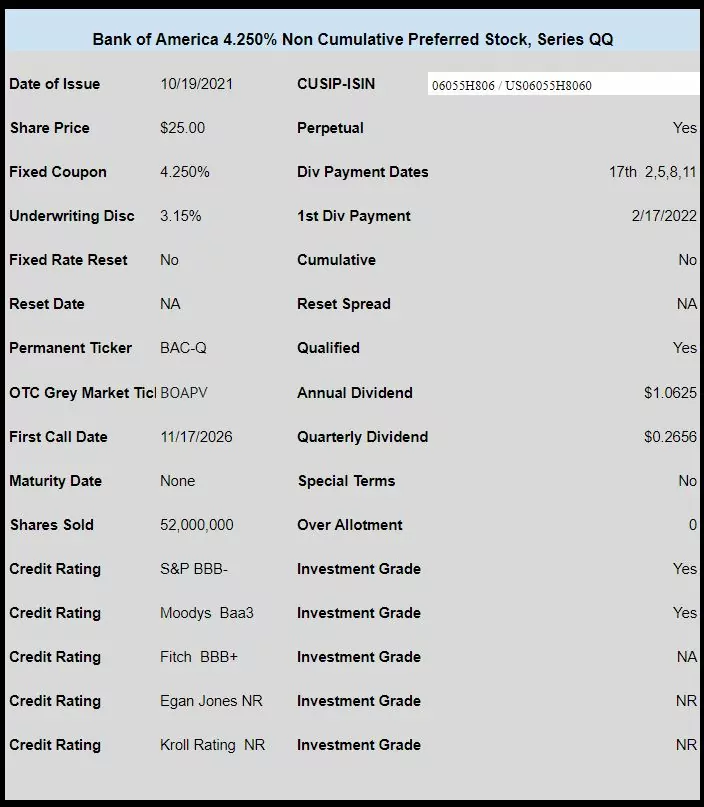

Bank of America (BAC) priced a new non cumulative preferred with a coupon of 4.25%. The issue is trading under ticker BOAPL (ticker change) and closed last Friday at $24.95.

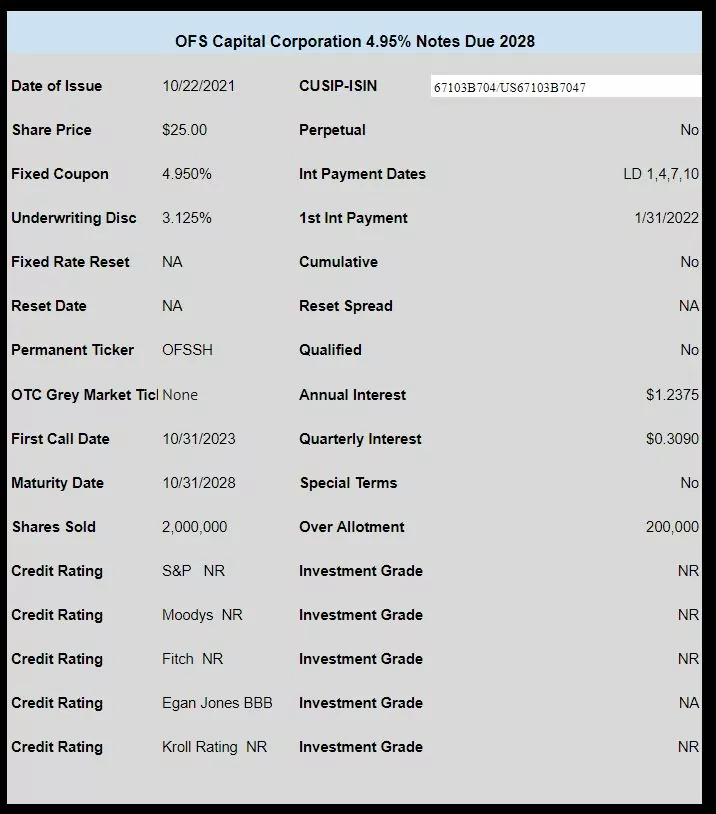

Lastly business development company OFS Capital Corporation (OFS) sold a new issue of baby bonds with a coupon of 4.95%. This issue is not trading but will be looking for trading to start in the coming week under permanent ticker OFSSH.

I think I must have missed the memo this morning… What’s behind the relatively large dip in US Treas rates today?

Front running of actual tapering IMHO. Tapering in the past has seen 10 year rates drop. We shall see if this time is different.

RE: the BoA recent issue. As I recall, back in Januaryish 2021, BoA had a preferred issue. It ended up being BAC-P I think but used the OTC ticker BOAPL. The recent issue of BoA started out as BOAPV but changed to BOAPL. Evidently, OTC tickers can be reused ? Can anyone confirm this ?

yes, all tickers can be re-used. OTC and NMS.

Good to know. Thanks.