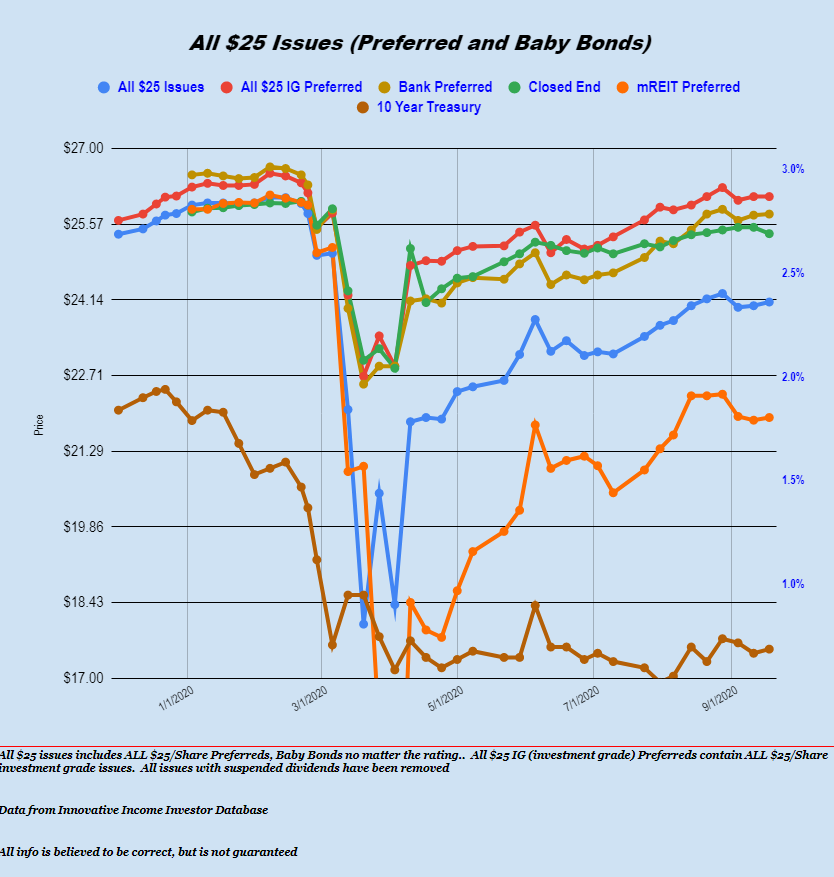

The S&P500 fell by 22 points last week–about .6%. The index traded in a range of 3292 to 3429 closing toward the bottom of that range at 3319.

As has become the norm the 10 year treasury traded in a range of .65% to .70% closing the week at .69% 2 basis points above the week before.

The Federal Reserve balance sheet grew by a stout $54 billion proving that quantitative easing is alive and well.

The average $25/share baby bond and preferred stock moved higher by a meager 7 cents. Investment grade was unchanged, utilities were 6 cents higher, CEF issues were down 12 cents (but 1/2 the issues were ex-dividend Friday). banks were 2 cents higher with shipper up 4 cents. Lodging REIT preferreds were the strongest–up by 45 cents.

Last week we had 6 new income issues sold.

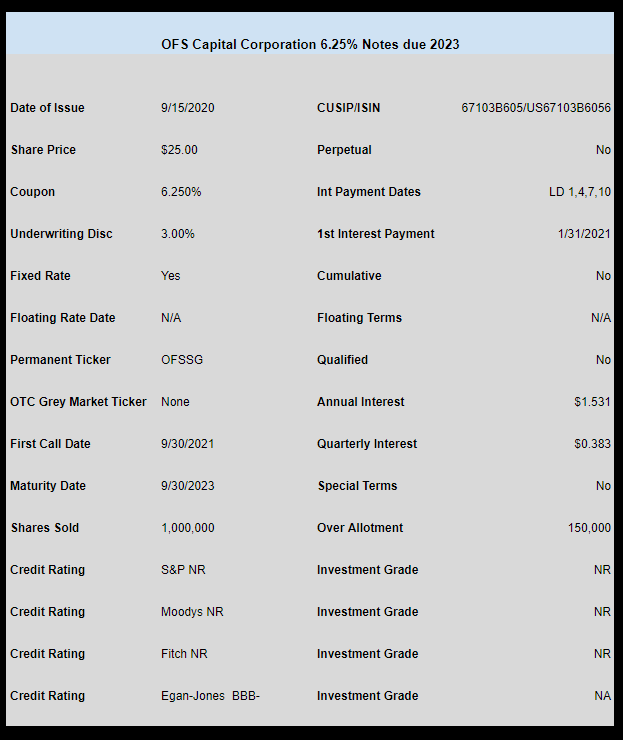

Business Development Company OFS Capital (OFS) sold a new baby bond.

The issue priced at 6.25% which at first glance seems low–but the issue is just a 3 year issue, maturing in 2023 and shorter dated maturities price lower.

There will not be OTC grey market trading. The issue should begin trading in the next week or so.

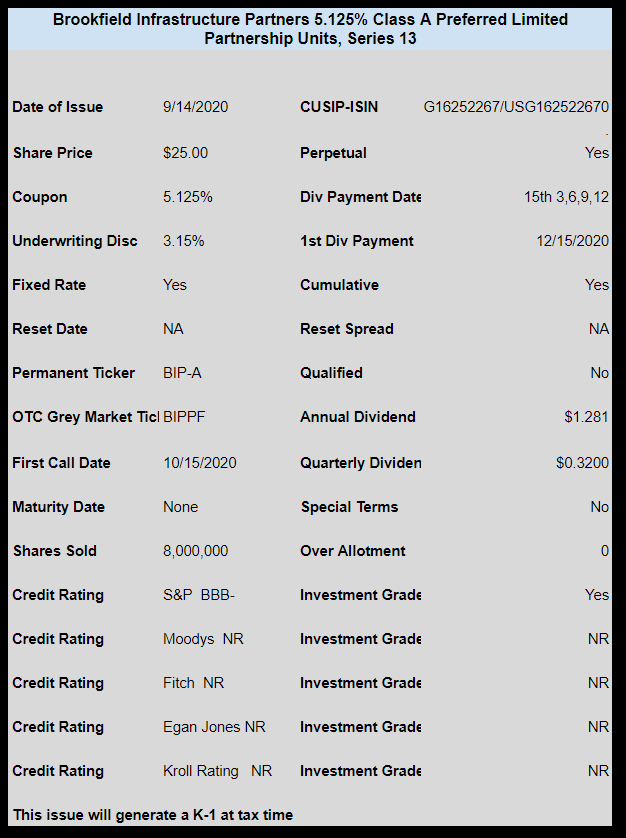

Brookfield Infrastructure Partners (BIP) sold a new issue of preferred stock units.

The issue priced at 5.125%.

The issue is investment grade–although low investment grade at BBB- from S&P.

This issue is trade on the OTC market closing at $25.16 on Friday.

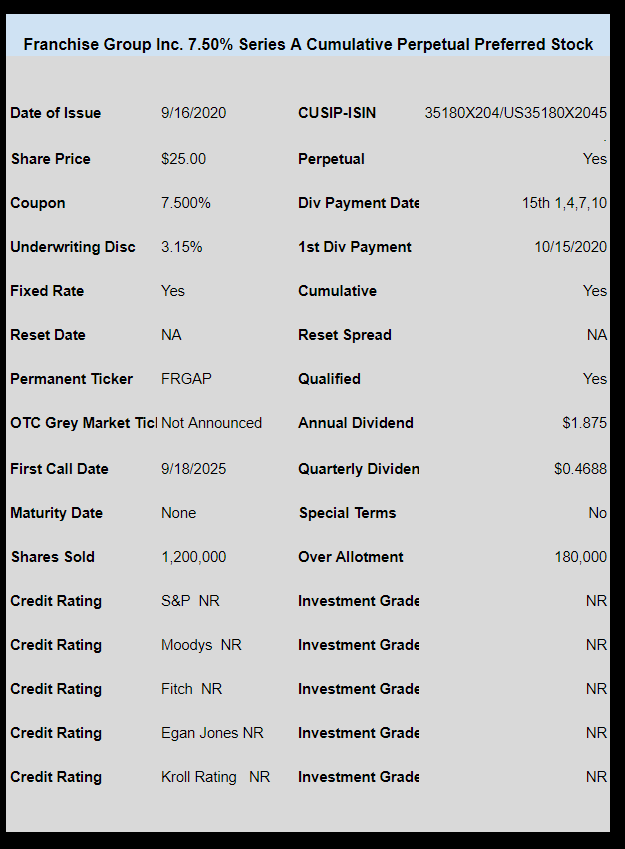

Franchise Group (FRG) priced a new issue of preferred stock.

The coupon is 7.50% and the issue will be cumulative and qualified.

There is no OTC ticker or trading, but it will trade today or tomorrow under the permanent ticker.

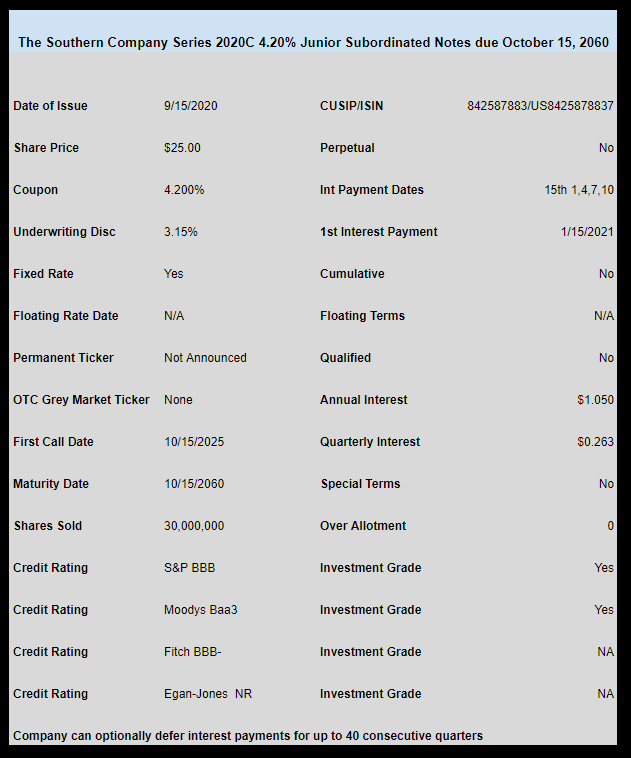

The Southern Company (SO) has sold a new issue of baby bonds. The coupon will be 4.20%–plenty low, but it will be strongly bought.

As announced the company will be calling all or a portion of the 6.25% Jr subordinated debentures (SOJA).

The issue is investment grade.

The issue is not yet trading.

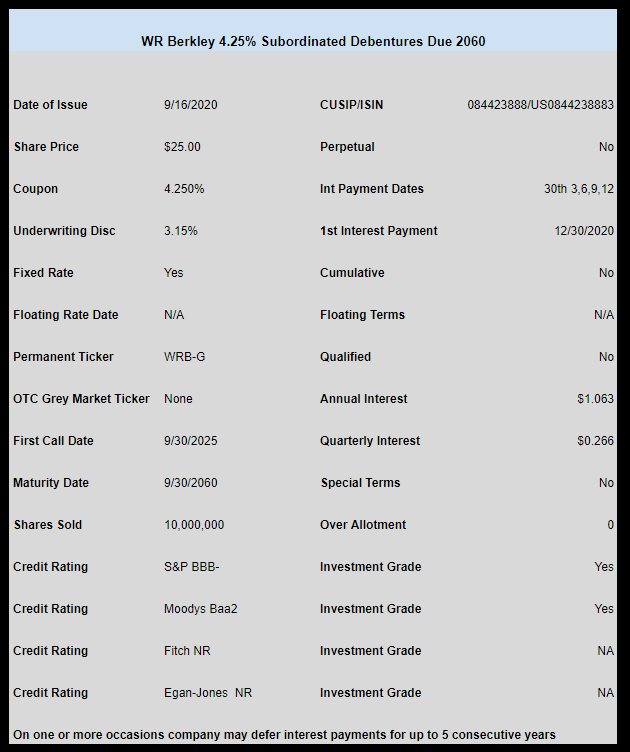

Insurer WR Berkley (WRB) has sold a new issuance of baby bonds.

The coupon is set at 4.25%. The bonds are investment grade.

The bond will mature in 2060 and will have an optional redemption starting in 2025. The company may defer interest payments for up to 5 years (multiple times) without being in default.

Proceeds from this issue will be used to call the balance of the WRB-B 5.625% baby bonds.

The issue is not yet trading.

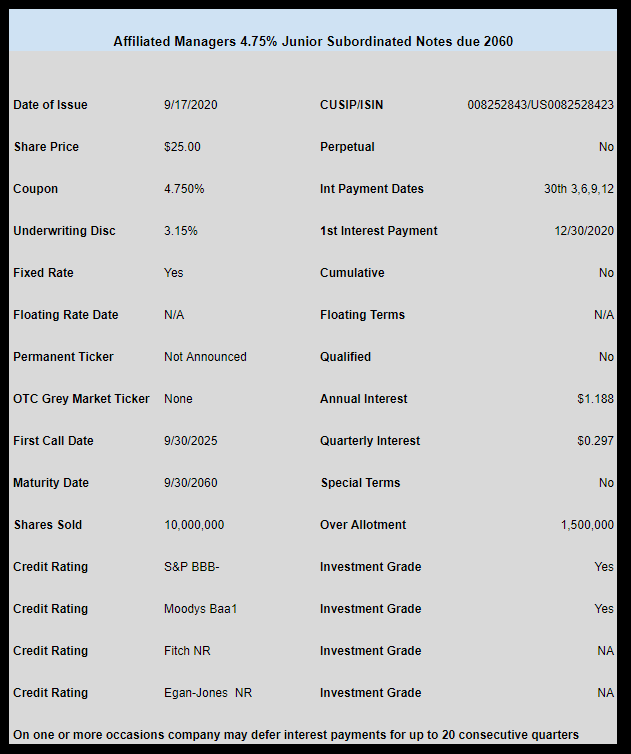

Affiliated Managers (AMG) sold a new baby bond.

The coupon will be 4.75%. The issue is investment grade being Baa1 by Moodys and BBB- by Standard and Poors.

The issue has a maturity date in 2060 and an optional redemption period starting in 2025.

The company can defer interest payments for 20 consecutive quarters without being in default.