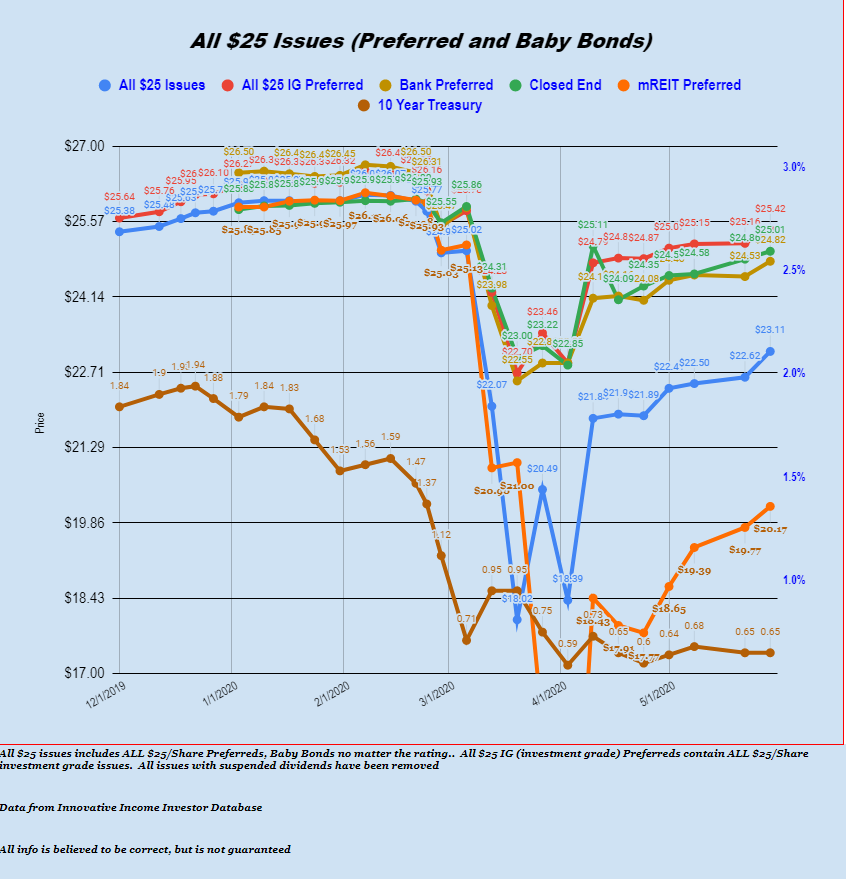

The S&P500 traded in a range of 2969 to 3068 before closing on Friday at 3044 which is around 3% higher than the previous Friday–party on.

The 10 year treasury moved in a range of .648% to .72% before closing at the low of .648%.

The Fed Balance Sheet moved higher by $58 billion which is only about 1/2 of the week before when we saw it grow by $103 billion.

The average $25/share preferred and baby bond moved almost 2% higher last week with shipping moving 3% higher, mREIT preferreds moving 2% higher. Lodging REITs were the biggest movers higher with a gain of around 20% (not on this chart). As quality issues (CEF, banks etc) slow in gains investors are rotating to low quality issues which have been laggards.

Last week we again had 3 new income issues ($25 issues) come to market.

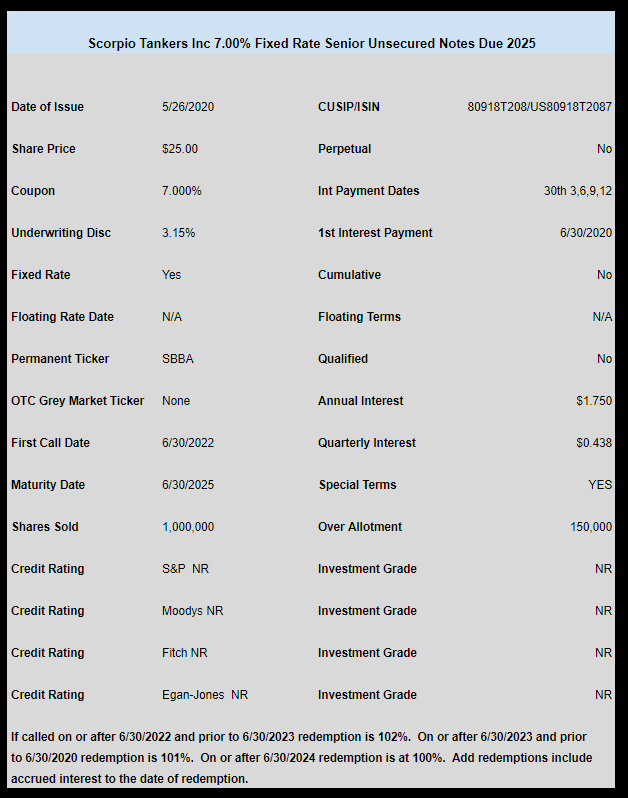

Scorpio Tankers (STNG) announced a small issue of 7% senior notes. I don’t find this trading yet but would expect it to trade this week.

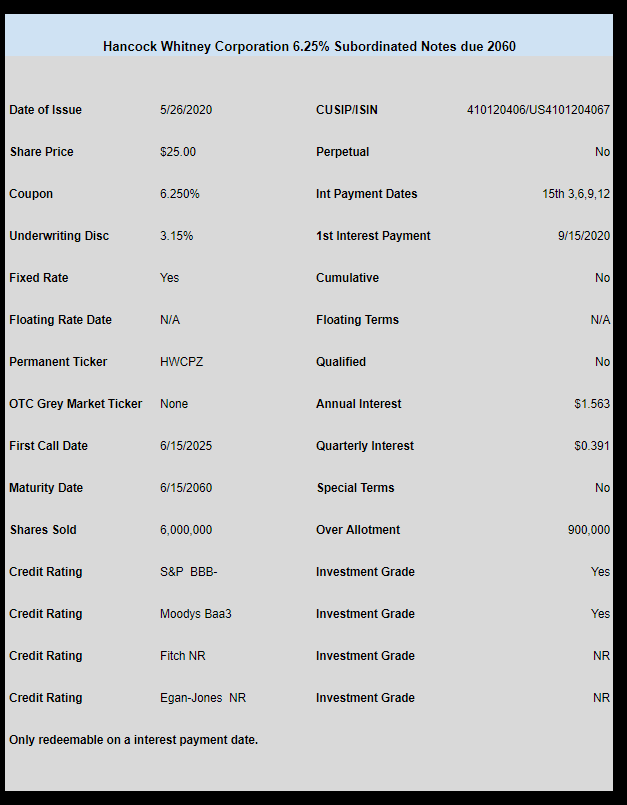

Southern Banker Hancock Whitney (HWC) sold a new issue of subordinated notes. I don’t find this trading yet but would expect it to trade this week.

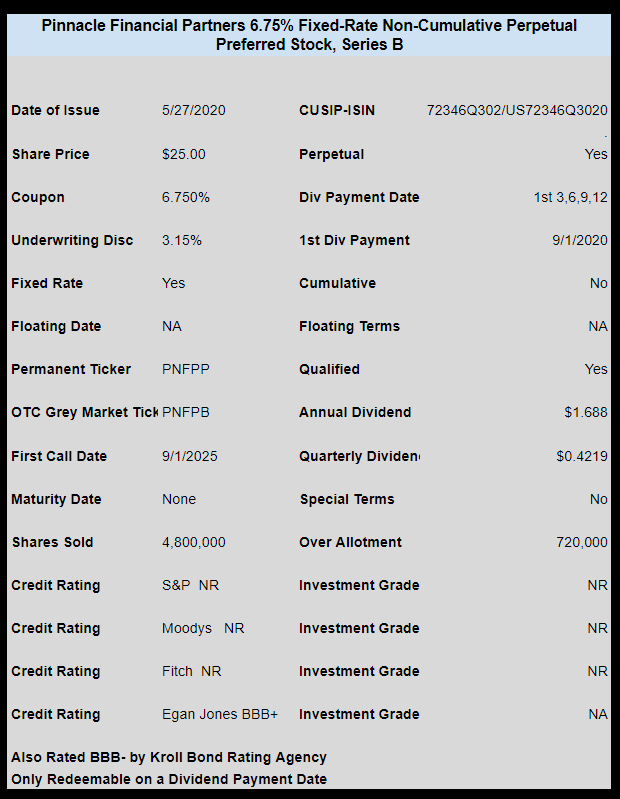

Lastly Tennessee banker Pinnacle Financial (PNFP) sold a 6.75% non cumulative preferred. Shares are trading on the OTC Grey market under ticker PNFPB and last traded at $25.60.

Disclosure–I did buy some shares of the Pinnacle offering–likely to hold until a 1-2% gain is realized.