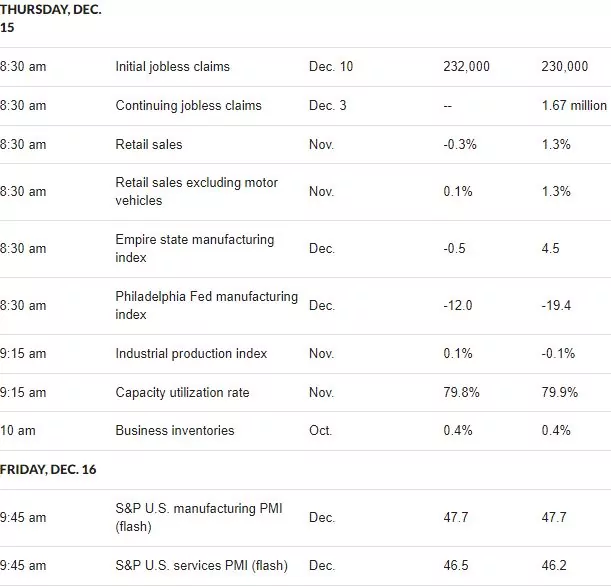

Well we had the main shows for the week yesterday and Tuesday with the CPI and the FOMC rate hike. Today we have a gaggle of minor reports which shouldn’t move markets much, but one never knows anymore.

Right now equity futures are down over 1% and interest rates have ticked down by a few basis points to 3.45%–it will be interesting watching how interest rates react to having no super major news for a few weeks–maybe we will just drift for weeks–that would be welcome.

I continue my streak of doing nothing (as far as selling or buying)–I did open my accounts to see that they were a bit ‘green’ yesterday–a tiny bit. December is a big month for my accounts for dividends and interest so I have that to look forward to for the end of the month. I doubt I will do anything to speak of as far as selling and buying for the balance of the month–it seems odd to be fully invested without reason to buy or sell.

Well let’s get this day going and see where we end up.

Is inflation really fading out? This morning Europe doesn’t think so, at least for them. Both the British and European feds were much less optimistic about the timeline required to manage their inflation.

The buzz term of the week: transitory deflation. Has inflation been declining in the US recently because of transitory deflation due say to China’s slow down? Oil is up almost 10% this week, government entitlements are going to be adjusted in January and Goldman Sachs is predicting a surge in metals and energy in the second quarter due to under investment.

I am still buying F/F’s and floaters.

What did he mean yesterday by an increased inflation target is a “long term project”?

We are in 31 trillion in debt, spending money like water, and the population is more takers than makers?

Over the past few years, there has been debate among economists about whether the 2% inflation target is set as the correct level. The 2% target was picked rather arbitrarily, without any detailed data to show that 2% inflation is better than 1.5% or 2.5% or 3%. One way to deal with failing to meet the 2% target is to change the target to 3%. The reporter who asked Powell about the 2% target was alluding to that controversy. In response, Powell was as adamant as he could be that the Fed will not deal with current inflation problems by changing the target. He wanted to be clear that he intends to get to 2%. That debate, he argues, is legitimate, but needs to be addressed after we reach 2%.

Regardless of whether 2% is the correct target (and I believe that is a legitimate issue for research and debate), I think Powell gave the right answer. Any hint that he would be OK with 3% inflation would send the wrong message to the markets.

Powell once again made the bulls look stupid. He’s not letting up.

He’s out to crush us. Cash is still king as long as he’s in charge.

Mister Z – he is doing what I expected – continued decent employment numbers and silly giant equity rally’s don’t make him happy.