Little company AMMO Inc. (POWW) has sold a new issue of preferred stock which is trading now. Shares are now at $26.53–obviously some one is excited.

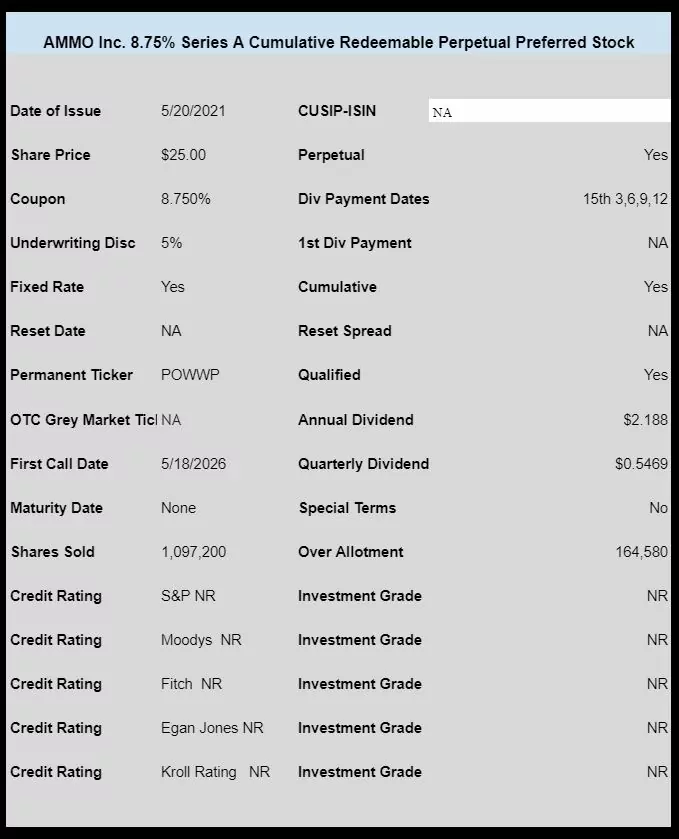

The coupon is 8.75%, and it is cumulative and qualified.

Some of you are already aware of this little company issue as it has been posted around in various areas.

The company is a newer company and they sell ammunition and related items to the consumer.

I have not had an opportunity to do any due diligence on AMMO (POWW) but highly recommend a deep dive if you have an interest in this new preferred.

Backlog on ammunition is two and a half years now according to some of the manufacturers.

Copper pricing is through the roof. It would take some doing to lose money in that industry right now.

Would have been nice to know about this one earlier.

Way too late to buy this one….the money has already been made.

I hold a position in AMMO / “POWW” common & have for some time.

Like the company given the massive growth in the premium ammunition sales market. They’ve also landed a number of large international ammo deals. Ammo continues to be in demand across the market, especially as more people buy guns.

AMMO recently purchased Gunbroker.com, which is a well known website for buying and selling guns, and else associated.

Experienced management team that has really expanded the business and improved sales. Management has increased revenue guidance consistently over the course of the past couple of quarters.

However, I’ve been disappointed in management’s use of the capital markets. AMMO did a follow-on offering of common shares back in March, which really irked me. AMMO raised $115 million at $5 share, when the stock was then trading well north of $6 / share. Deal was announced one day, and closed the next (go figure at that discount) and stock tanked, but ended well above follow-on offering price. Investment banks on the deal received a 7.5% underwriting fee – which is absurd for a follow-on offering.

I inquired of AMMO IR about the follow-on offering price and underwriting fee several times. I also questioned why a common offering when a convertible may have been a better option due to the volatility in the underlying stock and to avoid unnecessary dilution to existing shareholders.

Given growth, not surprised by the preferred issuance, but very disappointed company has not issued a PR.

Josh:

At some point, POWW has to start earning profits. None so far.

But I do believe the GunBroker website acquisition will help boost the bottom line, as POWW basically gets fee revenue for all products sold and receives $50 “Gold” Annual membership revenue on the website while offering no products for sale.

As long as the website stays popular, it should be a cash cow.

POWW is also constructing a new $12 million, 160K square foot ammo manufacturing plant in Wisconsin that will open next summer. The ammo business is very, very good right now.

This company had a 1 for 25 reverse split in 2017. Fidelity ranks their financial health at 5 out of 100. On the other hand, ammo is supposedly a hot business now.

Could really blow up your finances with this one I have quite a few 8% ish yielders none of which I would consider selling to buy POWWP.

Interesting contrast:

– POWWP 8.75% up 6.4% (relative to liq.pref)

– CXW 8.25% 2026 down 1.8% (relative to par)

Shootin’ ‘n’ jailin’…