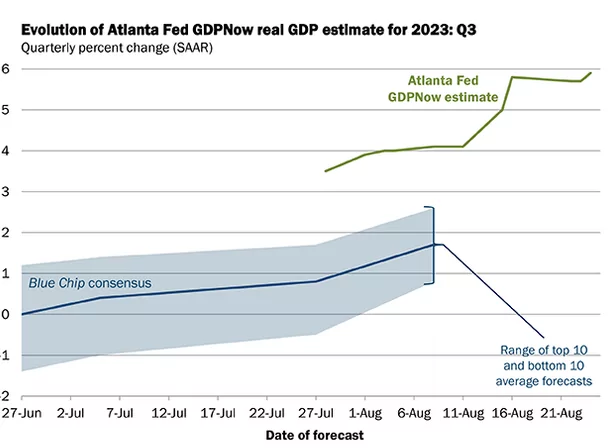

Have you noticed? I suspect most our readers are well aware that the Atlanta Fed model for GDP on 8/24/2023 shows growth predicted at 5.9% annually. If this is anywhere close we are going to have a lot of trouble getting interest rates much (if any) lower. Personally I think this is balony (I didn’t try to scrutinize the underlying data).

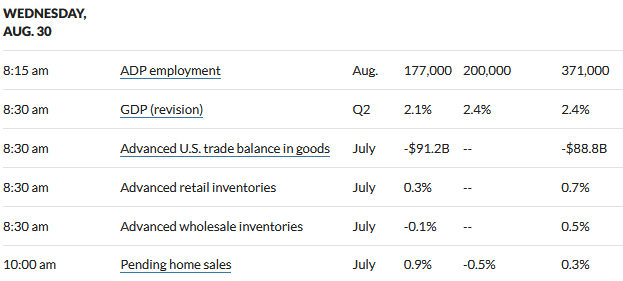

This morning we had the 2nd reading of GDP for the 2nd quarter and it was lowered. Something is wrong somewhere here – somebody’s model is broken I think.

Interest rates are dead flat this morning while equities are trying to decide where to go next – 1st way up and then a tumble, now the S&P500 is up 1/4%–of course where we end up nobody knows.

I have a ‘friend’ who does industrial/heavy duty contractual jobs. He says he’s busier than he’s ever been in over 20 years. On the flip side, on the flip side is the doom and gloom marching thru our offices. No ‘long only’ manager is promoting any growth idea/fund. Bond fund/duration only.

SO I keep asking…if they couldn’t guess market direction right, why should we listen to their interest rate prediction??

Yet, markets just keep marching steadily higher. I am wondering if they think markets will just be higher but worth less in real money due to inflation? LOL. For instance, we could have a 100K Dow but it worth only the same if calculated in today’s dollars. Nuts.

That’s exactly what’s happening. Uncle sugar, borrows and spends, that money eventually ends up in stocks, real estate, and speculative junk.

There’s also always been the theory that the easiest way for a debtor nation to get out from under its debt is to years later pay it back in inflated dollars…. Was that Keynes?

2wr – EXACTLY!!! I know many here might not subscribe to this, but this is part of the reason I took a max cash-out mortgage on my house that was almost paid off back in 2021. I got a 3.000% loan for 30 years when, at the time I was 61 yo. A lot of my friends and family thought I was nuts. LOL.

But, think in terms of cash flow and business – it made all the sense in the world. I live a a rural area on the Eastern Shore of MD in a 3000 sq ft house in a golf course community. Back in 2021, my house was appraised at $350K so I took a $280K loan for 3% fixed for 30 years with mortgage payment – $1180 – less than I can rent a house of less desirable location (I could rent it out now for about twice that).

I am not a genius but it made sense to me to lock in long term funds for 3% and invest them at 7% or more. Now, the “luck” part of it hit when inflation started spiking and the house value started upwards. Today, it’s now worth about $440K and I still only pay a mortgage of $1180/month! My house has risen more than 25% and First Federal bank is hold a 3% loan that is worth much, much less than par to them these days – it’s probably why they have not sold it to someone else! LOL.

My parents, in their 80s (Dad will be 90 next year), think I’m crazy to have taken on a 30-year mortgage and that I should pay it off before I retire in 4 months. I told them the bank will have to pry this mortgage from my cold, clenched fists before I would pay 3 extra cents on the principle in any given month! It’s worth its weight in gold today where mortgage rates are 7-8%. If I ever get to the point I need to downsize, I’ll just rent this place out. Mortgage plus taxes come to just under $1500/mo and I can rent it for $2250+ and – since it’s in a golf course community – I can carefully vet potential renters to only those with ability to pay and keep up the premises. For what renters there are in this neighborhood, they usually are doctors in the local hospital, or other higher level professionals in the local university or industry.

LOL – inflation does indeed “work” if we all know how to work it…

I tried to convince my wife to let me take out a modest $1M mortgage on our house back in 2020, but wouldn’t go for it.

We haven’t had a mortgage for about 10 years, and she said she likes it that way.

I tried to explain that I could put the money in something pretty safe and make money every month. She said something about how much more she could make from collecting my life insurance, so I let it drop.

2wr,

I hear this theory regularly, but one thing that is missing is that it only works if a nation actually quits adding to the debt.

If you are adding $100 to your debt by spending inflated dollars and paying it down by $90 with inflated dollars, you are not accomplishing anything.

The inflated dollars theory works with a home mortgage because the homeowner is not constantly adding to the loan with inflated dollars.

When as a nation are we going to quit spending more than we take in so we can pay off debt with inflated dollars?

I’m 54…..I don’t see that happening in my lifetime.

I don’t disagree NTT, but the powers that be just don’t ever seem to get it, do they……….

2wr, Debasement of currency of every sort has been going on from the top down for oh so very long and documented by Classical and Neo-Economics (circa 1970 – present).

It seems to be part of human nature (neurotic (I did NOT say psychotic) justification) to try to live in the dream and believe their krewe and themselves are special, then just be a regular Joe Smith who observe, admit and voluntarily succumb to the idea that they live in a marvelous social system of support and can be fulfilled by living in that larger world of smiles, connection and then… simple expiry. There are no Smartest Guys in The Room, in black suits or commanding some army.

It was called Morals and Ethics at some distant point in the past! How passe!

Joel, hard to keep your values or ethics when you’re exposed to group with a differing outlook on life.

My house is paid for and I don’t want get on the merry-go-round again. Never know what could change. In my life time in sales I have seen customers who thought they hadn’t over extended and took out loans confident they could expand the business and had the resources to pay them back. Timing or something beyond their control shattered that reality. My age it could be a health event. Seen people walking away from their homes and letting the bank take it as it was worth less than they owed or in one case taking a motorcycle ride to the country and not coming back. Yes the wife collected the insurance but it wasn’t enough

Is the revision also from Atlanta Fed?

Gary—no–the GDPNow model is strictly an in house – supposedly more up to date forecast.