Fortress Transportation and Infrastructure Investors LLC (FTAI) has priced their new issue of reset rate preferred.

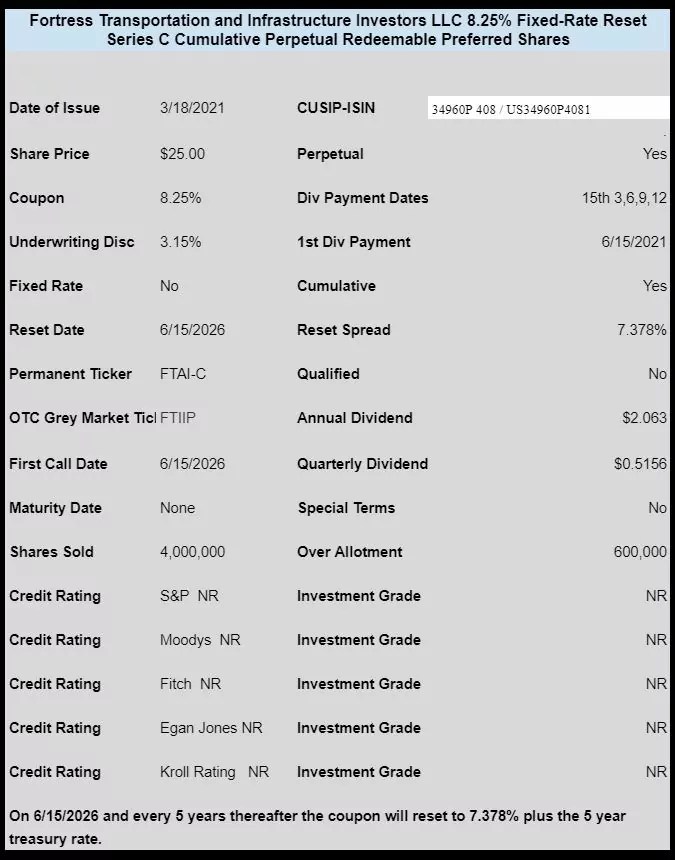

The new issue will have a fixed rate of 8.25% until 6/15/2026 after which point the coupon will reset at a spread of 7.378% plus the 5 year treasury rate. There after the coupon will reset every 5 years.

The issue becomes redeemable on 6/15/2026 for the normal $25/share plus accrued but unpaid dividends.

This issue will trade immediately under the OTC grey market ticker FTIIP.

The pricing term sheet can be read here.

I hope that we are talking about the same company. At the end of 2020, I see only about $ 1 B of equity (including about $150 M of goodwill) against $1.9 billion of debt. Same company? Also note how the relationship between debt and equity has gone upside down in the last three or four years.

I agree the pricing of the new FF is consistent with the other Fortress issues but overall seems over priced versus other lower junk preferreds like Global Partners, Tsakos and Teekay LNG.

8.25? Seems badly over priced in relation to Global Partners, Teekay LNG or Tsakos. Fortress’ operating income hasn’t covered interest expense for two or three years while capex has been two to three times depreciation over the same period. What upside did I miss?

Potter–not sure you missed anything. The financials of this company are pretty poor–but with the current economic situation they will be ok for now—if we hit a ‘real’ recession (one without continual government bailouts) it may be a different story.

FTAI is really two companies not one and it can help to think of them that way.

l. The first is an infrastructure project firm. They have three projects and all are close to completion. All have been eating up money. The good news is that they have started to be able to sell off parts to private equity investors who at this point will pay well for cash generating projects. My hope is that they will sell off all three. We will know much more by the end of the year.

2.The second firm is an aircraft leasing business which essentially specializes in leasing one style of aircraft engines. These engines are in short supply and they have recently concluded an agreement to be able to service these engines in ways that substantially reduces the cost and time needed for the servicing. In fact they can swap engines with the carrier so that planes have much less downtime. If they do not sell of the entire infrastructure firm- I expect the leasing company to be spun out. This is really the core of the business and has a lot of potential. It is a bit complex but the CC are fairly clear. Overall, I like the company and in a low interest environment, the new issue seems quite attractive as I expect the firm’s total capex to start to decline and get reduced by sale of ownership stakes in the infrastructure projects. sc

there certainly seems to be a lot more market interest in this issue, vs

the global partners preferred.

I think you have to consider the $2.5B of common stock equity that protects a fairly small amount of preferreds.

LL, common equity rarely protects any preferred value. Common equity protects debt.

Common equity protects every layer above it in the capital stack including preferreds. So long as the common equity has value, the liquidation value of the preferreds remains $25. A great example of how this works in practice can be seen with mREITs. Some like IVR and MITT lost 80% of their common value, however, the preferred value remained protected and today those preferreds trade at 24-25.

The trouble is Landlord from my observations is its mostly illusional. When things blow up, the preferreds blow up too. Look at WPG and their preferreds as an example. Then you can get things like Maiden where company is now turning a profit and yet divis are still suspended on preferreds. Or low take out prices, and or reorganizations that stiff the preferreds.

HOVNP is another example trading at $18.50 and hasnt paid a divi in years, yet the freaking common is trading at $107. Its all about what is above it. Like bond covenants restricting payment.

Grid, if secular trends turn the assets protecting your preferreds into worthless junk, then they don’t protect anyone in the cap stack. Enclosed malls turned out to be worthless junk. It’s possible that aviation assets also turn out to be worthless junk (maybe Virtual Reality replaces the need for flying) but I don’t think it’s likely.

Maiden was a case of fraud and then management acted in bad faith. While HOVNP is not exactly fraud, the preferreds have weak covenants that management is taking advantage of to act in bad faith. Another case is Equity Inns where it was taken private and they stopped paying the preferreds even though they had plenty of FFO. None of these are cases where there are insufficient funds to pay preferred divs but preferreds are dependent on management acting in good faith, so you have to look at management quality and track record as well.

As for bond covenants, yes they can restrict div payments. That’s what happened with many mREITs. However, so long as there is common equity remaining (and management acts in good faith), preferred holders are made whole.

That’ not to say that the volatility you have to endure is worth the reward in those cases. I’m just pointing out how common equity protects preferreds and why it is one of the most important factors which the original comment was not considering. Many people put great weight on the income statement which I find mostly useless. The income statement is backward looking while the common stock represents the forward value of cash flows.

Yes, but these trends can literally crash over night by focusing on the common. And any preferred owner should know they are the “bastards” when push comes to shove. Management will throw them to curb any chance they can get if trouble happens as preferreds generally arent aligned with managements, common shareholder or creditors interests.

Why has there not been a preferred issued in most likely 50 years that have preferreds take majority ownership of the board on a 4 quarter suspension that used to be common practice? Because they figured out they can get away with it and still issue them. The protections of a preferred are veneer at best, so Im watching what has the power to screw me from above the stack, not below….Unless they want to issue more equity to pay me, and that rarely happens. So I am never owning anything I would need help from below.

Im not suggesting you are wrong and I am right. Equity does have value, but my eyes are above the line not below and that has kept me out of any of those disasters, or take unders, or screw overs.

…. That is not to say that the volatility you have to endure is worth the reward in those cases. …Your quote above is really what my overall concern is as I view that more important for me. I dont mind occasionally buying one of those after the carnage if I trust a recovery can occur. But I dont want one that takes me down there and I hope it recovers.

WPG didn’t crash over night. It was on a long and steady downtrend from the moment it was spun off from SPG. There was also very high short interest which indicates that professionals didn’t think the common stock accurately reflected the forward earnings of the company. Focusing on the common is exactly what would have kept you out of WPG prefs. Focusing on backward looking earnings would have been totally misleading.

No, Me knowing malls earning were and will be in the pits kept me out. WPG spiked from a few bucks to $14 in February. That certainly didnt benefit the preferreds or prove preferreds were safer. It just showed market volatiity from other factors.

Yes, nothing is so simple. Temporary short squeeze spikes can happen in stocks that are heavily shorted. When a stock goes from 120 to $3 and then spikes to $14, it’s just a dead cat bounce.

I personally only worry about what is all above it, coverage ratios, and current earning capacity. I dont know if I have ever given any concern to common equity. Other than watching for price movements that may (or may not) be signaling something to be aware of.

Earning capacity can be very misleading as it is backward looking and there are many ways of calculating earnings (GAAP, FFO, FAD, adjusted, pro-forma, etc.). Common equity is the market value of forward (true) cash flows and that’s what matters.

Now, the market is sometimes wrong about common equity value. I was initially very skeptical of QRTEP because it had such low common stock coverage despite having high (backward looking) FCF. However, it turned out the market was wrong and re-valued the common stock much higher. In that scenario, in which the market is wrong about the common stock value, you should just buy the common stock and not the preferreds. The trick is, of course, knowing when the market is wrong.

Landlord, I dont agree with that. My purchase was not an either or. I was either going to buy the preferred or not, never the common as that wasnt what I was looking for. The genesis of the preferred came from the cash flows that were gushing from stay at home. That was pretty obvious and the preferred was a freebee reward not an underwritten issue.

In fact I view the common as the enemy to my preferred as it is giving management the reason to pass out special $1.50 cash special dividends instead of shoring things up above me. That is what got the price of common to start jumping. People tend to want to buy things that distribute big chunks of cash out a few times in very short order.

Actually if you compare it to Fortress’s other two issues – which are fairly recent, the pricing is consistent with those. Actually this issue may be better than their other two based on the floating rate calculation when it reaches that point

Yes, I’m not saying it’s some amazing value. I would have never bought their other issues due to the low Libor spreads but I agree pricing of the new issue is more or less in line with those. The original comment asked what was missing from their review of the financials and all I was saying is the common stock equity value is what was missing from that analysis.