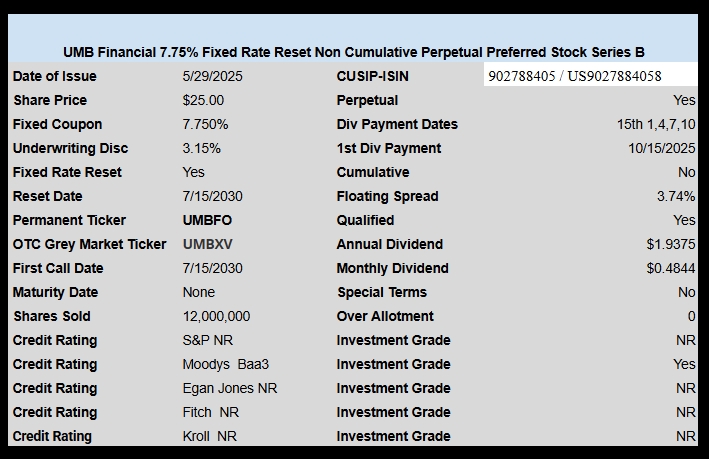

Banker UMB Financial (UMBF) has filed to sell a new fixed-to-floating rate preferred stock issue.

Of course it is non cumulative and pays the normal quarterly dividend.

The company has a fixed to floating preferred issue (UMBFP) outstanding which is redeemable on 7/15/2025–this issue has a giant sized spread of 6.675% (to be added to 3 month SOFR) and the banker no doubt wants to get rid of this potential 10-11% coupon so I would expect a call for 7/15/2025–here is their ‘use of proceeds’ statement–

We expect to receive net proceeds from this offering, after deducting underwriting discounts and estimated offering expenses payable by us, of approximately $ (or approximately $ if the underwriters exercise in full their option to purchase additional depositary shares). We expect to use the net proceeds from the sale of the depositary shares for general corporate purposes, which may include the redemption of all outstanding shares of the Series A Preferred Stock and the repurchase, redemption, or retirement of a portion of the 2030 Notes.

The preliminary prospectus can be read here.

Thanks to 2whiteroses for catching this one and to jerrymac for chiming in yield talk in the 7.875% area.