As a bunch of treasuries and CDs mature on Friday one has to consider whether they should all be rolled over into new CDs. On the other hand I have little dry powder and want some available for ‘bargain hunting’. It seems to me that we could see some CDs near the 6% level in a couple months–that is a firm maybe of course.

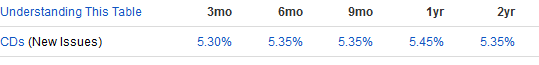

Today I see this on Fido for short term CDs. Of course various terms are available (callable versus non callable)

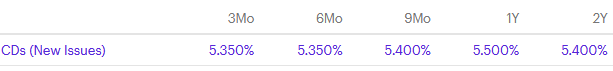

Over on eTrade I see this rates available. Of course various terms are available (callable versus non callable)

I am fairly certain I will take maybe 50% of my proceeds on Friday and go right back into new CDs–with the other 50% being held–at least for the time being, for potential preferreds or baby bond ‘bargains’.

Can the rates go higher–yes if the Fed follows through on their rate hike threats rates will go higher–6% certainly is in the realm of possibilities and decisions can be made later on on purchases at these levels as my ‘ladder’ of maturities will provide funds.

It aint no 5 year noncallable, but 6% is broached now for a 6 month CD….

Credit Union One of Oklahoma, an institution that serves the greater Oklahoma City area, is offering a 6-month share certificate with an interest rate of 6.167% APY (Annual Percentage Yield). A share certificate is what credit unions call a certificate of deposit, or CD. Credit Union One of Oklahoma has a $2,500 minimum requirement for opening this certificate.

We use to place a small percentage with credit unions. Back in the day a CU depositor was ncua insured when buying another CUs share certificates. Back then you had to be either a CU or a member of the CU to be federally insured.

I believe the gov relaxed rules centering on who can join CUs, opening it to nearly anyone. If one does invest there, just ask them first.

Can we get 6%? Well you already could if you had been willing to buy FRC’s at a discount, during the heat of their failure! The Q was, what would happen to the brokered Cds? Would JPM redeem them early. AND seeing they were sold discounted to face……there would have been an even higher pop if they were put back/cashed out early!!

In general when the FDIC does pay off brokered CD investors there is often a period when Principal stops accruing. A few days was the norm. Maybe over a week. The big ones WS securitized get some respect from FDIC/paid off quickly. When pressed for a worst case expectation I said a week or two. We calculated the difference between a couple weeks of interest and 6….and the 6 won out every way we calculated it. Plus going back to the discounted principal maturing even earlier? They were unique anyway. We had to ask also if an investor wanted to be associated with any failed bank much less one so much in the news!!

PS yesterday short terms new CDs were over 5.40

Speaking of the Titanic, which we weren’t, I once read that the chief technical guy of the shipyard that built it said that you can’t build an unsinkable ship; the best you can do is to build a ship that will sink slowly.

@Martin G ,

“People would avoid stocks and risky assets to buy CDs and such. Contributing to a market crash.”

Maybe there’s so much ‘excess’ cash sloshing around in the world, and people who feel like they have excess cash even if they don’t, that the big question is not whether there will be a big leak, or even when, but in what way.

A long, long time ago, in the world of computing, our big desideratum was only to be able to shut down in an orderly manner in case of disaster.

Maybe 6% CDs, or 8%, is shutting down in an orderly manner.

Anyone else old enough to remember CDs from respectable banks with a 12% coupon?

In the early 80s, I max limit borrowed student loans and put them in 12-15% CDs for 3 years. The interest accumulated in the CDs paid for my senior year in college. I remember getting a 2 year 8.1% CD around 1998 or so. And in 2006 I had a 6.2% from local bank. I personally would be thrilled for 6% and would move more money that way if it somehow did.

I love having interest rates working for me. I have a 0% car loan and a 2.75% mortgage note that will be pried from my cold dead hands. In retirement forums, you certainly dont read any “should I pay off my mortgage” threads anymore.

I’m pretty sure I paid 14% on my 5,000 student loan circa 1982. But it might have been 10….I’ll have to get my HP 10-C out and rerun the numbers!

But at the time, GB, people weren’t repaying those! The loan originator at my U was like a drug dealer giving away free stuff. “What do you mean you aren’t taking more..”

Yep, On my loan it was interest free until graduating.

My calculator is saying only 10 1/8. 5000 bucks cost me 67.71 a month for ten years for MBA. My check went in to bursae with a tear drop smudging the 4750 bill for first semester.

Funny thing, I went to some classes!!

Same here – I refi’ed my house with max cash out in early 2021 for 3.000% 30 year. I am retiring the end of this year but I am in no way paying one extra cent on that mortgage – if I don’t make it till age 93 when it is naturally paid off, my estate will take care of it! My mortgage payment is less than $1200/mo. so much less than I would be paying for rent.

I don’t have the 0% car loan(s) however – just paid cash for my used Civic and F-150. Sometimes I think the 0% loans come with a pricing premium to make up for the lack of interest charged. I do, however, use a 2% cash back credit card for everything I can to be able to get the 2%. PayPal recently offered 3% cash back on anything you use their card for though PayPal payments so, in essence, I get about 2.5-2.75% average cash back these days on stuff I have to buy anyway! Every year, the cash back roughly pays for my yearly electric bill. They are always trying to get me to switch to “points” instead of statement credit in cash but I ain’t biting. Sometimes I forget to thank the folks that have run up their installment debt to help me out! Fun stuff.

I had a $1000, one year CD for 15.05% back in 1981/82. Of course, I bought a townhouse in 1984 with an 11.25% one-year ARM too. So, it’s all relative!

I think the FED is less interested in being RIGHT than in proving they are TOUGH.

Prob a silly question, but when you buy a 3mo CD and it includes a rollover option, how do you know what it will roll into? Is it the same bank and whatever they are paying for the same 3mo time period? Seems like it’s better to look at other offering too, and skip rolling.

I have quite a few 3mo coming due in the next couple months, & I imagine you don’t add a rollover late in the game.

Just curious– thanks

I suspect your broker will notify you with the one scheduled to be purchased, and you will have time to call it off. That is how it works for me.

Did not set a rollover.

thx

What you are describing is a RO directly with a bank. Brokered CDs do not roll over. They mature and cash out.

In most cases be leery of auto rollover CDs. The intro rate may have been top market, the roll overs rarely are. And yes they will at least notify you in writing that the maturity and RO are about to occur. You most likely will not know the rate unless you call. Most CDs just RO until the rate is an insult.And most auto rolls used to have a feature where you can back out within a grace period. Most grace periods are non interest bearing. So not so graceful.

Brokered CDS 2 months out to 6 mo, yr end, are pushing 5.35. I saw 540 yesterday. If the difference is 50 bucks or more. Move.

Fidelity will roll-over brokered CD on maturity to a similar term and interest rate. You can opt out of this service when you purchase the brokered CD (check box). If roll-over is enabled, Fidelity does send a message that a roll-over is imminent and describes the new CD. You have time to cancel the RO. The new CD on a roll-over has similar terms as the initial CD but the bank can be different (typically is) as the initial bank may not be offering a brokered CD at roll-over time.

Tim, I’m holding I-bonds that were purchased in Q4 2021 and looking to sell them in the Aug-Sept time frame, as the current interest rate they’re paying is only 3.38%. That’s where my next tranche of dry powder is coming from…just in time for Q3 earnings season.

Citadel West – yes the air went out of those ibonds pretty quick. I never did get in on those.

6% CDs is not necessarily a good thing. People would avoid stocks and risky assets to buy CDs and such. Contributing to a market crash. Not to mention the problems with servicing the debt at high rates.

Martin G – yes the competition for moola would be awfully intense, but seemingly the world still is awash with liquidity available for all assets.

Looking for opportunities with safety now. Not enough cash so looking to sell some. I noticed my 6% GEO bond that was recommended several years ago, by a member no longer here, was up 21%. Sold that but still holding their 10% bond. I remember his advice: “If I didn’t own it would I buy it today?” Answered myself and said no, so took the nice capital gain. Getting some short term CDs now.

I will push the chips in bigly on the under 6% bet for a 5 year noncallable.

Grid–me to–but we don’t have to worry about that – don’t think we will ever see a 5 year non call issue (or course never say never).

Tim they were there for the taking in March. I bought several between 5%-5.15%. Should have bought more, but I like to trade too much and dont have an unlimited supply of money to buy daily “hand over fist” like apparently Moron and Jussi do, lol.

Grid- Don’t you mean Moron and Buffett? Because as the faithful Moron reader that I know you are, you know Buffett does whatever he does.. Just count the number of headlines that include the B name.

2WR, Sorry I forgot, how silly of me! They are tighter than Siamese twins. I bet Buffett gets all his investing ideas from Moron with the agreement that Moron gets to use his name in the title of the underresearched back up the truck, buying hand over fist article of the day!

Don’t get banned again Grid! You know they are watching.