Brookfield Infrastructure Finance, a division of Brookfield Infrastructure Partners LP (BIP), has priced the previously announced new subordinated notes.

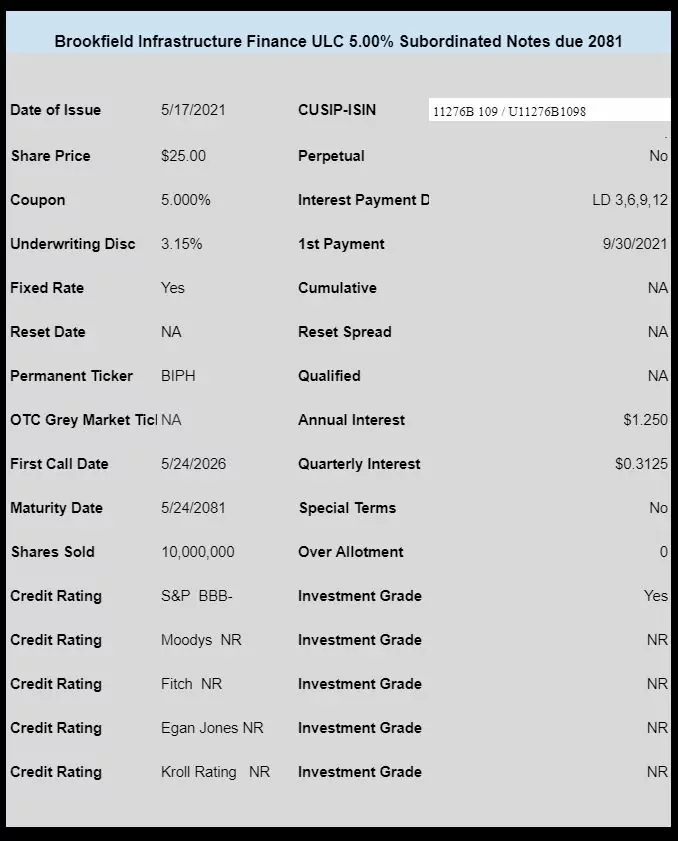

The issue prices at 5.00%. 10 million share (bonds) are being sold and they are fully and unconditionally guaranteed by Brookfield Infrastructure Partners LP. The issue is rated BBB- by S&P.

Brookfield will have the right to defer interest payments one or more times for a period of up to 5 years without causing a default. No deferral of interest may extend past the maturity date.

Being debt there is no OTC grey market trading. If investors want shares prior to trading on the NYSE they will need to contact their brokerage bond desk with the CUSIP shown below.

The issue will trade under the permanent ticker BIPH.

The pricing term sheet can be read here.

Tim.. are they part of,, Brookfield property,, with K-1

Georges…apparently no K-1 because this is Debt. At least that’s my understanding, but please feel free to correct if this is flawed info.

Which is also the reason I think this might move differently to BIP-B

Any company that issues a K-1 for its common will always issue a K-1 for preferred. Debt (if it’s true debt) never gets a K-1.

I think this one will rise out of the gates. New inv grade at 5% increasingly hard to find. So went ahead and grabbed a few hundred at 24.99 this am thru Schwab bond desk..$25 commission unfortunately. Didn’t get hit with that by the Vanguard desk a couple of weeks ago on a similar pre market trade

It’s regular preferred BIP-B with 5% coupon and callable Feb 2026 traded below $25 most of past month with $24.52 low 12-May!

So why should this BIPH trade much above par?