Business development company OFS Capital Corporation (OFS) has priced the previously announced baby bonds.

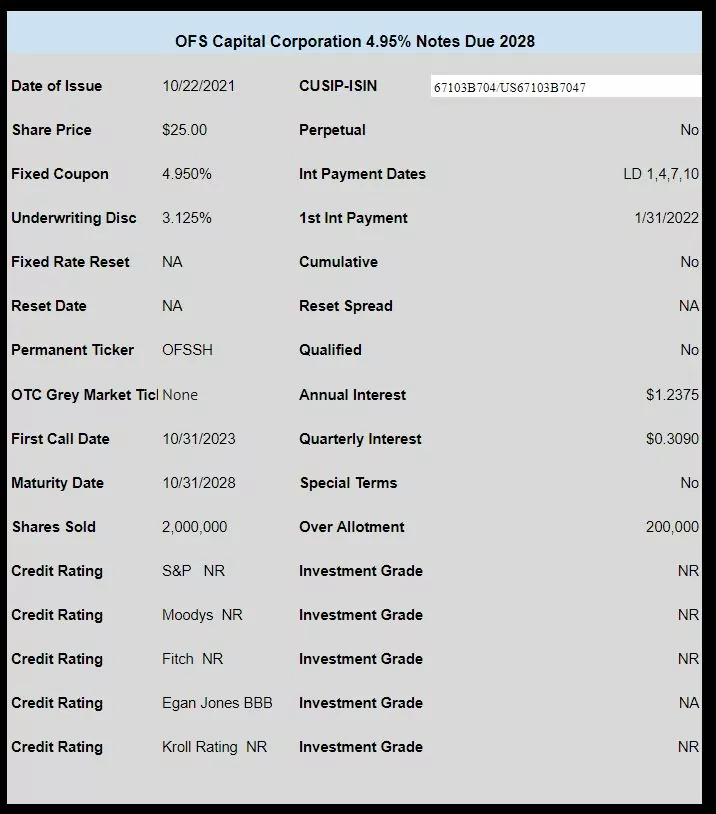

The notes price at a rock bottom coupon of 4.95% for 2 million shares (bonds) with another 200,000 available for over allotment.

The issue will trade under the ticker symbol OFSSH when it begins to trade in the next week or so.

The issue is rated BBB by Egan-Jones.

The pricing term sheet can be found here.

The fact that not a single BDC even approached distress in 2020, even the tiniest, hairiest one, has vastly lowered the risk profile for lenders. No BDC went bankrupt in 2008 and 2020 and literally ever. So rates are going down on these issuers.

Larry:

The BDCs didn’t get distressed in Spring of 2020 because the government gave massive handouts to many of the companies the BDCs lend to. That won’t be the case going forward if we have a recession or stagflation truly rears its ugly head. The loans these BDCs issue are to higher risk companies.

A sub 5% yield on a baby bond from a BDC is ridiculous, especially since the rate on the 10-year Treasury has increased 40 basis points since September 2nd.

Minimal margin of safety to anyone buying OFSHH. At least buyers can’t say they weren’t warned.