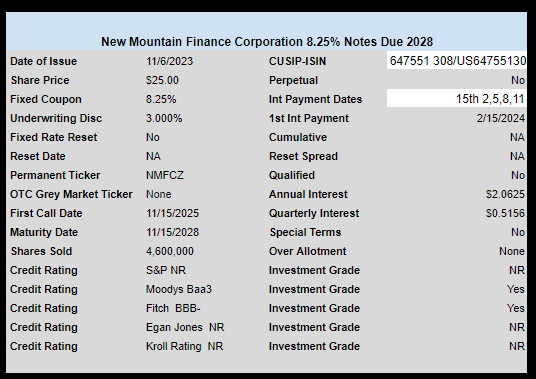

Business Development Company (BDC) New Mountain Finance (NMFC) has priced a new issue of baby bonds ($25/share).

The issue prices with a coupon of 8.25%. These baby bonds are investment grade per Moody’s (Baa3) and Fitch (BBB-).

When the shares trade (in the next 10 days likely) they will trade under the ticker NMFCZ on NASDAQ–there will be not be grey market trading.

The pricing term sheet is here.

Thanks to J for the alert on the Reader Alert Page

It was 24.9 by 25.10

Where did you see the quotes? The symbol is not yet valid at Yahoo, Schwab, or TDA.

I had to call ‘a desk’. That was a live quote.

Please list in NMFCZ in the new issues list when convenient. Thanks

Why buy this when you can get CSWCZ for slightly less yield but a much better run BDC?

Or MAIN bonds for 7.5% maturing in 2026.

2028 final…..I almost called to see where they were trading, but it was off my buy list!!

PIK income is over 8% of total income, and up almost 28% yoy for 3d qtr.

They have 10.5% in their red, orange, yellow categories on watch.

Not too enthused, although net assets and EPS are up nicely.

Just a basic question on the investment grade notion. If your business plan is to borrow money at 8.25% before underwriting discount, and then lend or invest in other companies at a profit, doesn’t that mean the companies you are investing in have an even higher cost of capital and therefore are a bit risky? That doesn’t immediately sound “investment grade” to me. Maybe part of the answer is diversification—you invest in 20 risky companies instead of 1. Maybe the equity cushion is good enough, because only a few risky companies fail. I’d like to learn more.

Don’t know anything about them. I do know the preferred IPO market has been sputtering lately. Wake me up when it’s worth it again.

Well looking at the max chart of their common stock they are definitely better managed then some other BDCs. They actually pay a nice pretty regular dividend and the stock price does not steadily decline. I might have to pick up 100-200 shares slowly over time. Just a bit. Plenty of time to read up on them and make a decision.