I almost hate to see 2019 end–it was great for most everyone (unless you were a hedge fund)–almost everyone got to participate in one asset bubble or another.

For as long as there has been either financial TV–whether CNBC, Fox Business or previous to these FNN (Financial News Network) or the internet I would pop out of bed in the morning and check the equity futures markets to find out what has been happening in the world financial markets.

During the last 3 months (or maybe more) I seldom even check the markets until 8:30 a.m. central — the equity market opening time. I don’t remember a time when equity prices moved in only 1 direction for so long and even when prices move lower most certainly it is a prelude to a move much higher. Why even look–‘party on’—‘be happy’.

Now, for sure I am happy–double digit profits even when only 60-75% invested most of the time–what’s to be unhappy about?. Now these gains are tempered by the lousy 2018 many of us had–in my case I was down only 1-2% in 2018–which is lousy, but far from as terrible as many people performed. My devotion to higher levels of cash and ownership of almost exclusively short duration term preferreds and baby bonds served me well in 2018–but it is a 2 edged sword and devotion to these securities mean generally a lower coupon, thus providing less income.

In 2019 I swerved away from my devotion to the term preferreds and short duration baby bonds (although they still form the base positions for my investing) and have ‘tinkered’ through most of the year with ownership of some higher risk perpetual preferreds. For me to hold a small position in junky Tsakos Energy Navigation 8.875% perpetual preferred (TNP-C) through most of the year is a rare occurrence. Of course I try to minimize risk–in this case the TNP-C issue has a ‘failure to redeem’ penalty which kicks in on 10/30/2020 (so there are 4 dividend payments left at 55 cents each) and I fully expect a full redemption on 10/30.

I played a lot–at least for me–with dividend captures and flips. Virtually all of them worked providing 1 or 2 month returns of 1-4%. THIS JUST ISN’T RIGHT!!! I have never been able to be correct 90% of the time—it just isn’t possible–normally.

On the other hand I have never lived through a period in my 49 years of investing where the Fed almost instantly jumps to alleviate interest rate rises, or equity price softening–this is not fake news–but these markets are pretty ‘fake’.

$1 trillion deficits are forecast as far as the eye can see–no one really cares–just sell the bonds to the primary dealers who will then dish them off to the Fed–at some point we will have a big fire with all the paper and all will be right in the world–‘party on’!

Each day that goes by, each week, each month that goes by, brings us closer to a day of reckoning. The day when a ‘China deal’ no longer means anything (since even a true China deal is forecast to only boost GDP a few 1/10’s%) to markets, the day when the Fed gets the hell out of the way and lets interest rates rise and fall on supply and demand, the day when Deutsch Bank (or someone) fesses up that after ‘rolling’ derivatives for years they are bankrupt—and on and on.

Now as I write this I don’t really see that anything is changing–economic numbers are still OK–employment is great and no doubt the Fed is still there to make ‘everything alright’. But it is coming–the reckoning. WE JUST DON’T KNOW WHEN-next month or in 5 years. For now ‘party on‘!

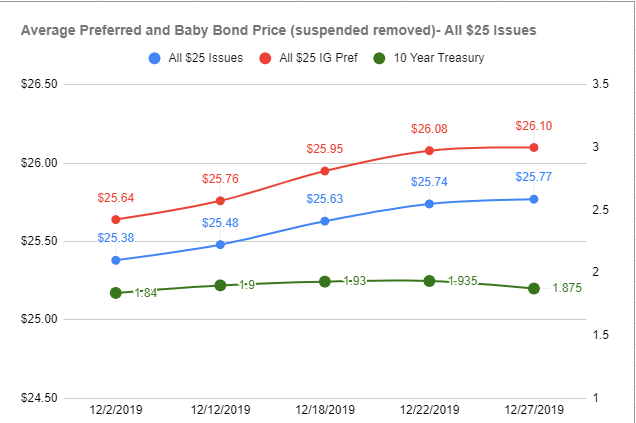

For 2020 my expectations are very modest–I have always tried to earn 7%–guess I am a 7% guy, but honestly for 2020 I will be happy with a 5%-6% return. I am going to scrutinize base positions more than ever. If we don’t get a setback in share prices of preferreds and baby bonds it is likely I will hold a fair amount of cash–I simply am not going to pay $27 for a 5.25% coupon (or some such silly number).

For now ‘party on’.