Last week the S&P500 closed at 4105 which was just barely off from the previous Friday close of 4109–off course the week was a short week with the Good Friday holiday.

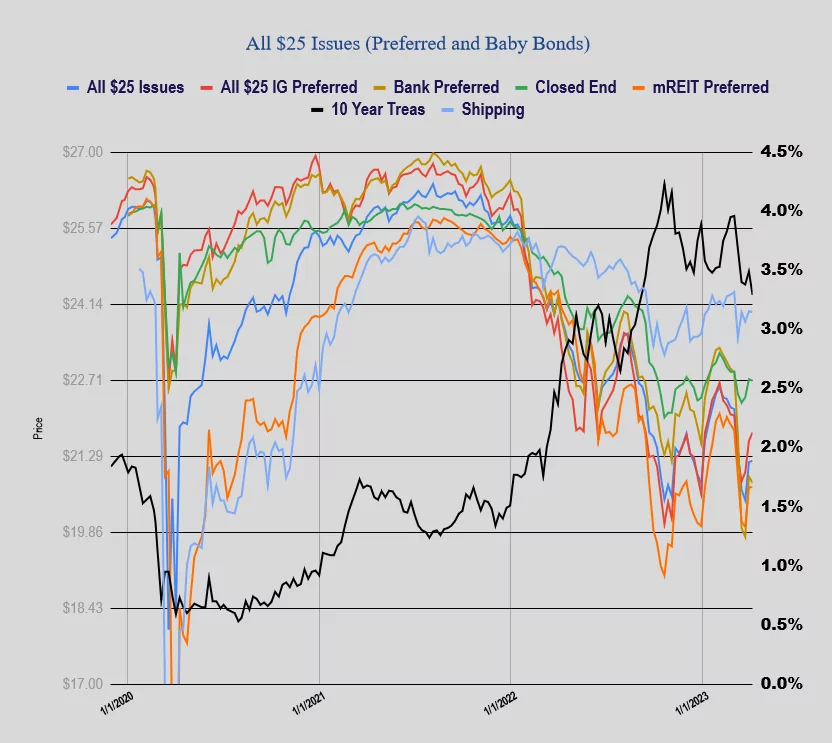

The 10 year treasury closed the week at 3.29% which was a full 20 basis points lower than the previous week, The employment report which was one of the important economic data points on the week was a mixed bag–softer than forecast new jobs created, but a lower unemployment rate.

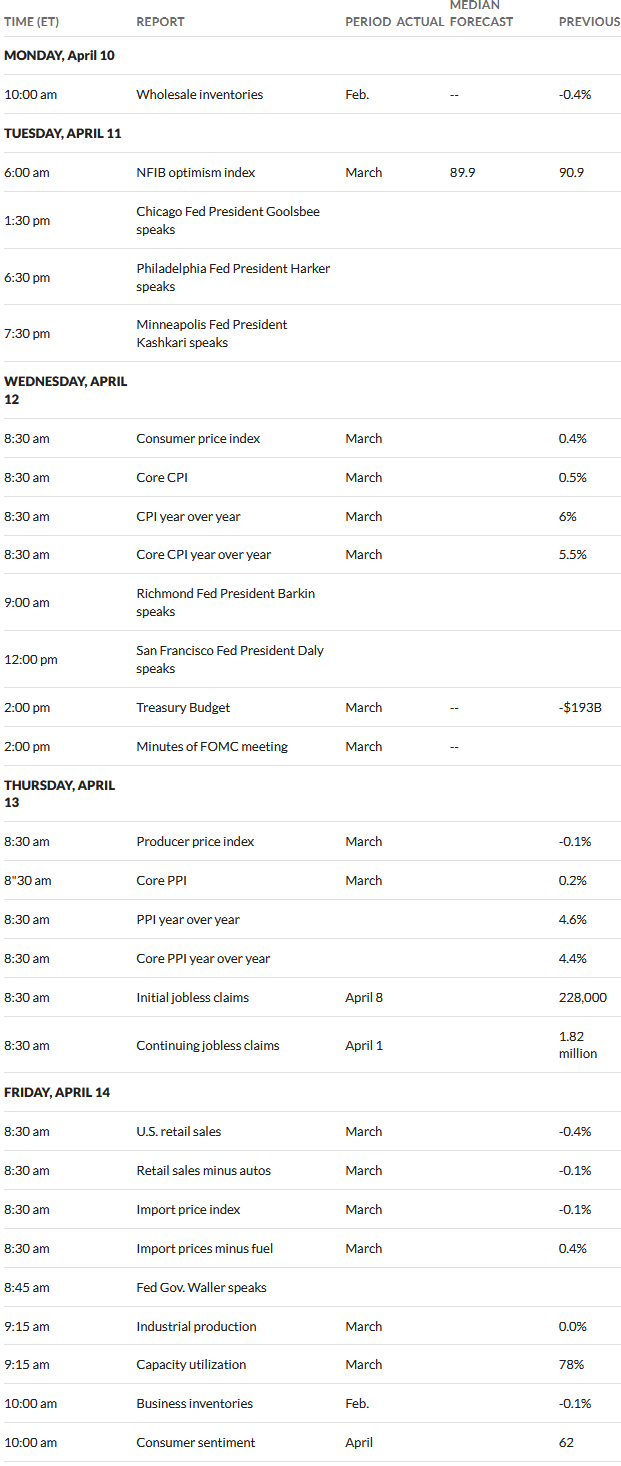

This week we have a number of important economic report–in particular the consumer price index (CPI) release on Wednesday. In addition to the actual data releases we have Fed Presidents talking almost daily–I think they will begin setting the path for a 1/4 point rate hike in May after the FOMC meeting.

After a giant $400 billion move higher in response to the banking crisis the Fed’s balance sheet fell for the second week in a row – down $74 billion on the week. The balance sheet is off $100 billion in 2 weeks.

Last week surprisingly the average $25/share preferred and baby bond was virtually flat – plus 3 cents. Investment grade issues were up 16 cents, banks down 12 cents, mREITS dead flat and shipping issues down 2 cents.

Last week we had no new issues priced.