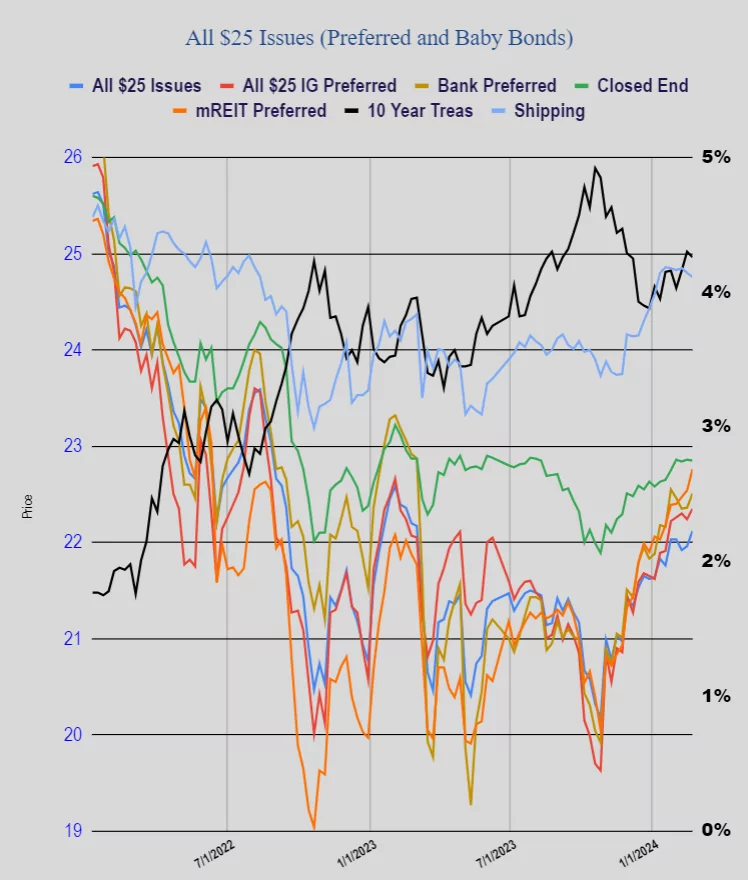

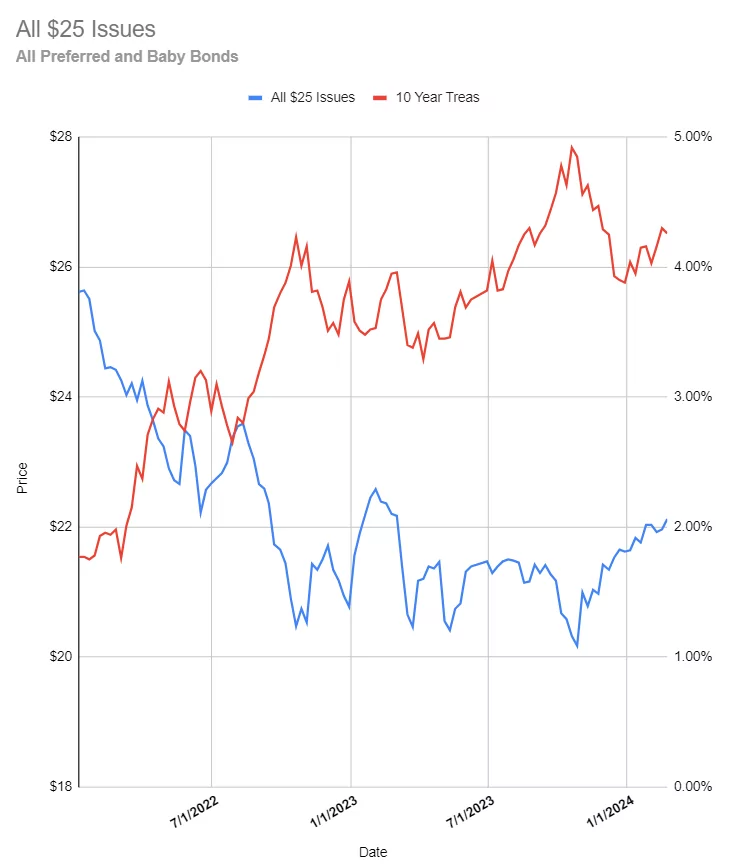

We continue with a market that has been moving favorably for income investors–in spite of interest rates trading in the 4.25% area. Income securities have for a the time being disconnected a bit from rates as the average $25/share issue hit the highest price level since 3/3/2023–just shy of a 52 week high.

Last week was another stellar week for the indexes with the S&P500 up almost 1.7%. This index is driven by tech and as everyone knows Nvidia moved sharply higher carrying other tech issues with it. Additionally with trillions of dollars available to move into equities in the future — when interest rates move lower (assuming they do) there is really ‘melt-up’ potential as money moves out of CDs and money markets–we’ll see.

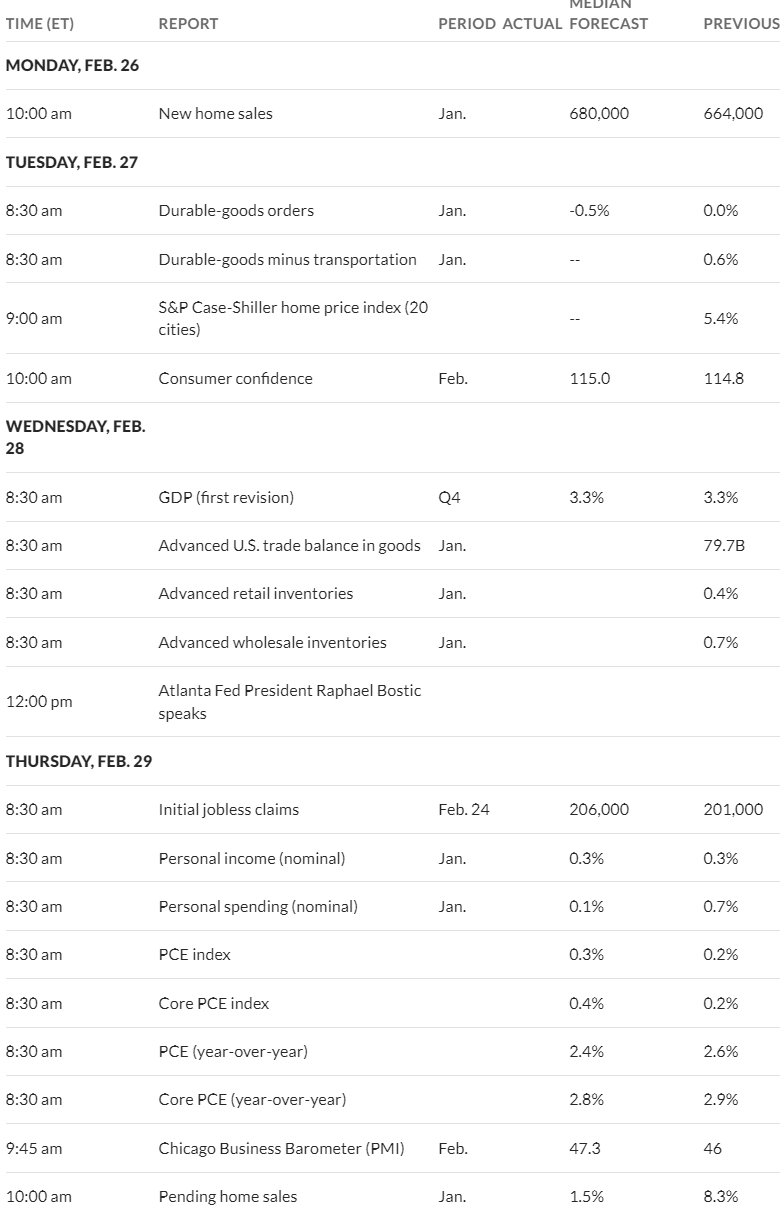

The 10 year treasury closed last week at 4.26%–the range for the week was tight at 4.24% to 4.35%–not too surprising given the lack of the most important economic news, This week we do have one of the most closely watched gauges of inflation in the PCE (personal consumption expenditures) on Thursday. Forecasts have the PCE moving lower–a lack of lower movement (flat or up) may kick interest rates up another rung.

The Federal Reserve balance sheet assets took a giant sized tumble–down $52 billion last week as the Fed continues at a $95 billion/month rate. As far as I know $95 billion per month runoff will continue for as long as the Fed can ‘get away’ with it.

Last week $25/share preferreds and baby bonds moved higher as I mentioned at the top of this note. The average $25/share issue moved 16 cents higher. Investment grade moved 11 cents higher, banks 15 cents higher, mREIT preferreds 22 cents higher with just shippers down–off 4 cents. NOTE that this push higher may be a timing event as 2/29 and 3/1 are pretty heavy ex-dividend dates meaning prices will be marked down on those days.

Last week we had no new income issues price.

Thanks for the response…whats alittle odd is that one or two could be called now but mgt has given no indication of that happening…

We continue to see large inflows into the $14+ Billion preferred ETF (PFF) every week in 2024. Nearly $200M in inflows just in February and $250M YTD.

As long as this continues, preferreds will hang in there and likely continue to trade even higher. Not sure who is doing all the buying of this ETF, but they obviously believe in several interest rate cuts later this year.

PFF has advanced 3.3% so far in 2024.

Not a lot of great buys atm. Would be very interested in another one of your great ”solid buys still available” or ”a few great buys” articles!

Mhug89,

One would need to know your goals for yield to be able to assist. An above average safe 5.5%? A reasonably safe 6-6.4%? A risker 7%? Etc…

It appears the reasonably safe 7% are gone. Only with us a brief moment in time last year.

Mhug89—if I see some compelling I will write about it for sure.

Thanks Tim….I have a question…if and when interest rates start coming down is it reasonable thinking that preferreds move up? for example I own chscl and currently it is $26.18 however a couple of yrs ago before the 11 rate increases it was trading in the $28 area and even closed above $30 ….do you think or is it reasonable to think chscl could move higer into the $28 area if maybe the fed reduces rates a few times…I realize this isn’t happening overnight but maybe a trend change coming for perferreds…thanks…craig

Craig, always keep in mind the call date of your preferred. This is general advice. If I held something that it’s first call isn’t until say 2028 I would be happy with the dividend and the price appreciation. But if it’s past call or coming up soon I would consider the difference between the call price and the next 1 or 2 dividends.

PFF mentioned here has been known to lose money before because they held over par on a preferred that was called.

Why folks here want to build their own portfolio instead of a fund so they have more control.

Several of us including Tim are holding CHSCM because it’s closer to it’s call value of 25.00 and less likely to be called .

Craig—when I talk interest rates one needs to differentiate between fed funds and then the 10 year treasury. The Fed could cut rates and the 10 year may remain where it is (or even higher–based on huge issuance from the treasury). With CHS I am going to be cautious—when all these preferreds were issued they had different management–I don’t know that the current management won’t start redeeming issues if rates come down some. The L issue isn’t callable until 1/2025 so as we get closer it may gravitate toward $25 if rates are lower and folks start to sniff out a call–we don’t know of course, but I will not buy here is the yield to 1st call is pretty meager.

Just to add to what Tim mentions–

As most preferreds are perpetuals, they care more about what longer-term rates are doing as opposed to Fed Funds rates.

You can see the results last quarter; from October 2023 to year end, the 10-year yield dropped from 4.9% to under 4.0% and it was party time for many preferreds.