It was kind of a ‘wild’ week last week–so are we going to have more of the same this week? Actually this week could be a bit quiet with the Christmas holiday dead in the middle of the week on Wednesday–actually equity markets will close early on Tuesday at 1 p.m. (eastern time). Just remember that when volumes are thin movements could be exacerbated–but I am not expecting giant moves.

Last week we saw the S&P500 lose right at 2% on the week–but at the low the index was off by 3.75%. Of course we saw the big plunge on Wednesday as stocks fell all afternoon as Jay Powell gave what was perceived as a hawkish press conference. I personally didn’t see it as hawkish, but I didn’t have my rose colored glasses on–obviously I was in a minority. The index remains just 2.8% off of the all time high–it will be interesting to see if this index can set new highs–we may well see some folks locking down some profits in early January as we get closer to the new administration coming to power and bringing with it all sorts of uncertainty.

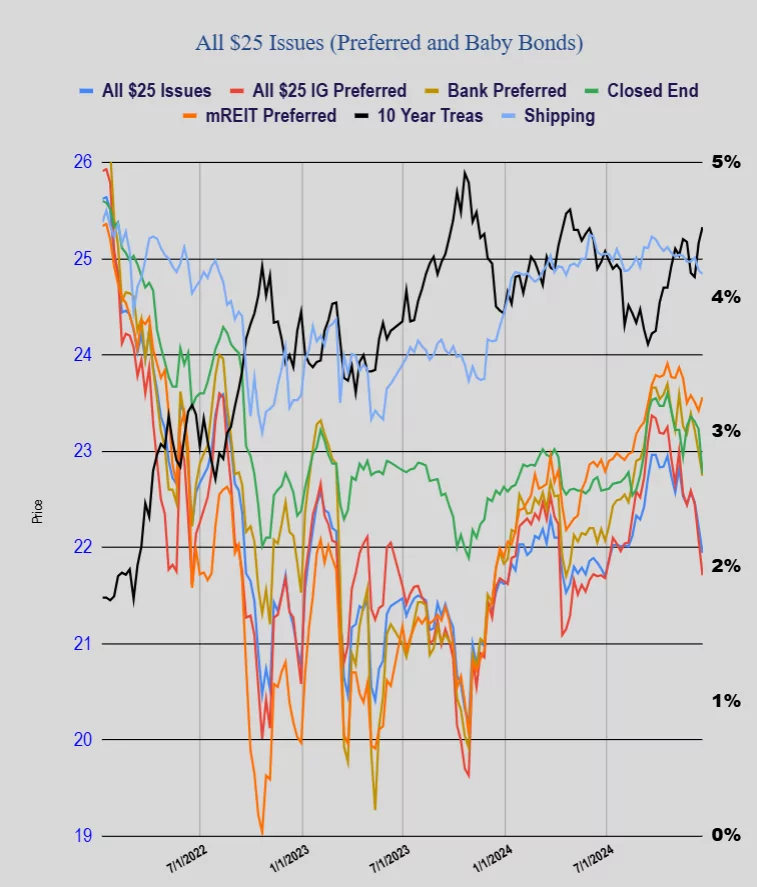

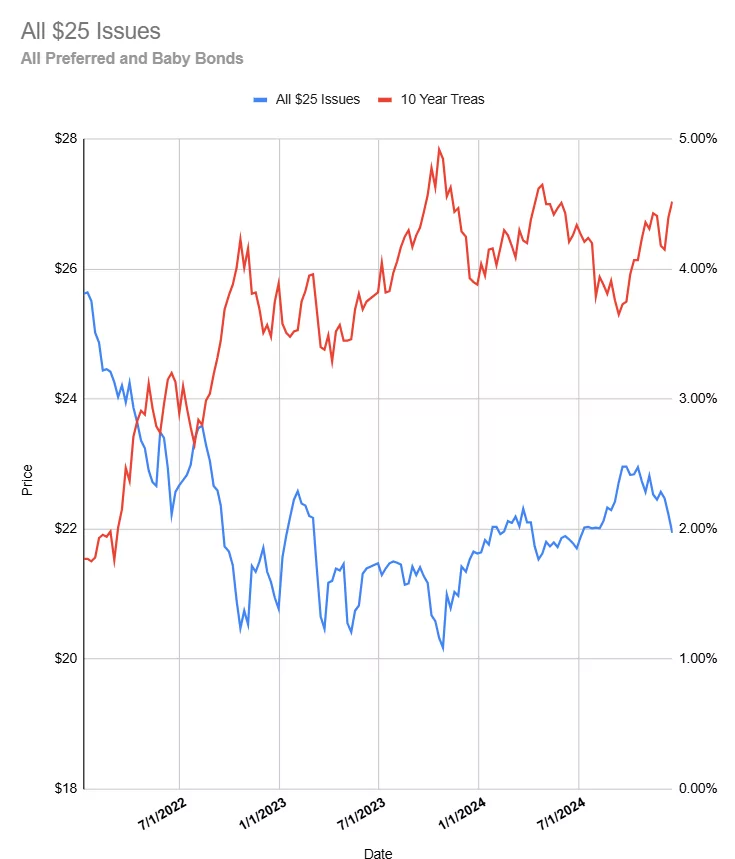

While equities were taking a tumble the 10 year Treasury yield was jumping–as high as 4.59% before settling down and closing the week at 4.52% which was 12 basis points higher than the close the previous Friday. Of course interest rates reacted to Jay Powell–investors had their expectations ‘reset’. The personal consumption expenditures (PCE) were released on Friday and were fairly tame which kept the situation from growing worse.

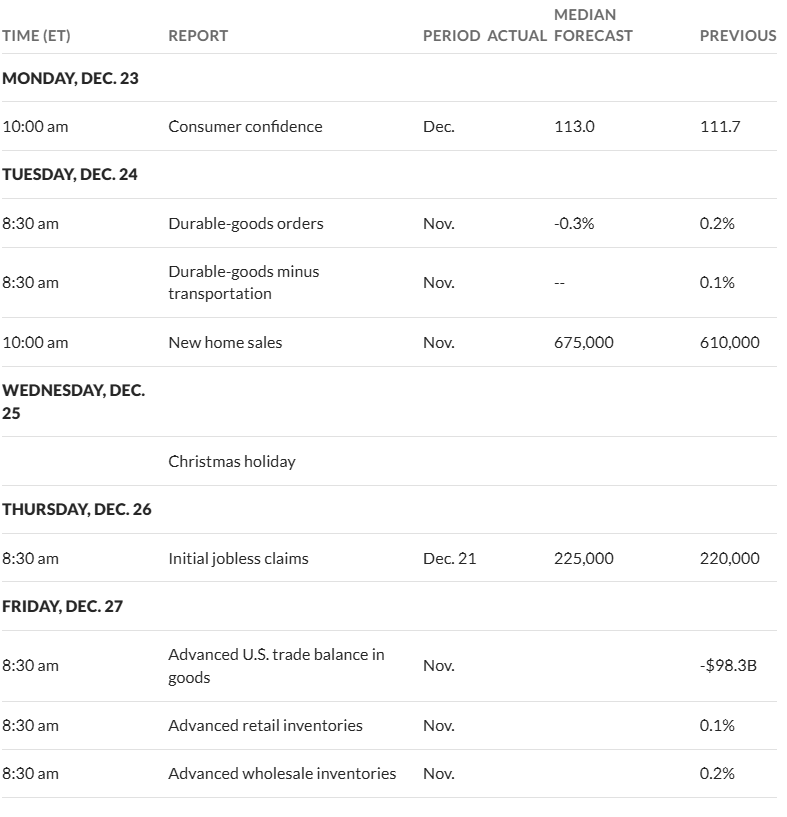

This week most of the economic data to be released,while important, is not likely to move markets much–if any. More likely is that the lack of faith in our Congress could set off selling–the CR passed late Friday doesn’t inspire great faith in the ability of politicians to begin to cut spending.

The Federal Reserve balance sheet fell by $8 billion last week at $6.89 trillion.

Last week, as one might expect, the average $25/share preferred and baby bond fell in price–by 28 cents. Investment grade issues fell by 37 cents, banks by 24, CEF preferreds by 46 cents, mREIT issues rose by 14 cents and shippers fell by 4 cents.

I shudder to think of 2024 as a good year. We had three presidential candidates who made the American people hold their noses and vote for whom they disliked the least. About the only thing you can say about 2024 is that the Baby Boomers (including me) got richer (at least for now?) We (both parties) avoided any important questions and just borrowed and spent more money (which is now beginning to show in real interest rates). The American economy only looks good because most other economies look even worse. Other than avoiding the outcome of a contested election outcome, I blow a raspberry for 2024.

Good year for the markets even if for the wrong reasons. Many of my uderpriced preferreds went up to or near par.

Martin, Mine went up and now they are falling. Most are still in positive territory ( not all) nothing has defaulted or suspended payment. Not the time to sell, maybe the time to buy more or sit and wait for them to fall more before buying. As r2s posted, charts are showing a downtrend. Most of what I bought recently is down. Losing Trader posted something similar in the bond discussion. Is the market retrenching for a move up or down?

Tech stocks have always had high P/E multiples but retail like COST at 52? and another retail WMT at 37? look at what happened to TGT reports 1 bad quarter and its back to a 15 P/E

Segway here, a friend and I were joking that all we see offered on Amazon is stuff from China.

Common sense tells me America ceded basic production jobs and industry for IT and services jobs and business starting 50 yrs ago Compare to late 1800’s moving from a agrarian economy to an industrial one. Are tariffs going to bring back industry if ever overnight? Maybe a ghost long term, but first prices, inflation and shortages could happen affecting retail business and jobs.

Let’s see how 2025 plays out. If real borrowing rates are lower then inflation and costs can be lived with.

Can America do like Japan, China and the EU and set lower rates ( I want to say artificially) and keep a strong dollar? will people keep believing in the all powerful and mighty Oz in the Emerald Kingdom?

People don’t like uncertainty. The fight over the budget and kicking the can down the road for a short 3 months was much ado about nothing. No one wanted to be the Grinch that stole Christmas with a threat of a government shutdown after the holidays. Revisiting the issue in the coming months is going to add to the uncertainty and people’s angst with all the other issues going on.

I heard on the radio that a poll said people are more positive about things being better in 2025 than when the same poll was done in 2023 and people were asked what they thought 2024 was going to be. I believe history will find people will look back and say 2024 wasn’t all that bad after all.

2024 was just fine for me financially. I could stand a repeat for 2025 myself.

DJ, Same here 2024 was a good year financially but the inflation was a killer.

Call me cynical but more and more I really feel news and the internet are just 60 sec news bytes that create an echo chamber. The algorithms just reinforce whatever you are looking at or reading by displaying more of the same. If you think something is bad and hit the click bait then the logo’s just keep feeding more of the same to you.

Note I said financially. Outside of that 2024 was just full of things we don’t discuss here much for very good reason. We are too polarized to have intelligent civil discussions any more and frankly I am tired of it all. I need to restock the popcorn etc. after last week’s fun watching Congress……… Yes inflation was tough, but my investment income went up largely because I had bought a number of floaters previously. My crystal ball, when I can make out anything through all the clouds, tells me that will not last either.

I agree DJ. My sister went on a rant and I should have kept quiet. It’s sad everything has become so polarized. As I said, the news these days is all about opinion and stirring controversy to capture clicks.

All my life DJ, I have been the one sitting in the back of the room or just doing my job at work. I need to try harder not to be going down the same path I see others doing.

Back to crystal balls and investing. I have been working on moving into fixed rate reset. That can be good or bad as you pointed out things always change. I could end up buying a reset that locks me into a lower rate, similar to a Metlife insurance policy I inherited that had a low rate. I could have cashed it out and put it in a 6 month CD earning 2 or 3 times more and FDIC insured but both my wife and I had worked full time that year.

Interesting the perception of interest rates. During January to November 2024 inflation was as follows (BLS) 3.1 3.2 3.5 3.4 3.3 3.0 2.9 2.5 2.4 2.6 2.7.

We currently stand at 2.7….I can remember the inflation years in the mid 70’s due to the Vietnam War and the Oil Embargo….That led Fed Chairman Volker hiking interest rates to 16%…!!! Ouch!!! I was just out of collage , unemployed and hurting big time. I remember one of my friends who was a saver buy 10 year T-Bill at 16%!

It has been a crazy year, and the next one will probably be crazier still. Turmoil and uncertainty create volatility, which creates opportunity. hope we can identify those opportunities.

Personally, I look forward to Trump part II, electric boogaloo. The volatility he will drive should create opportunities – and the entertainment value will be high. I tell myself it’s government by magic 8 ball.

And, as an added bonus, we get to watch Elon joust with a bureaucracy where he can’t just fire people. That will create some hilarity.

The CFO of one of our companies worked at Tesla for a few years, and her stories of Elon firing people when he wasn’t happy are priceless. They used to send key people on “visits” outside the plant when Elon was coming just so they weren’t around to be fired. He won’t be able to do that in the gov. bureaucracy.

FWIW – I just looked at my YTD return and it sits at almost 17% net (I don’t try to track donations, etc. – too complicated for my spreadsheet). Way above my target, but so much of it is just inflation. Doesn’t feel like I am actually making progress.

A lot of my return this year was from some lucky flips – proving once again that is is better to be lucky than good.

Merry Christmas to all.

Good to hear from you sir. I hope you have a good Christmas and new year and are just as successful in 2025.

You mentioned flipping and being lucky. I decided to see how our accounts are doing. I am trying not to flip and a portion is just cash in a MM fund. We are down about 2.2% off the high for the year.

I moved my wife’s account on April 25th so I can’t claim this is for the full year. But up 30+ with a few flips and trades (mainly on one stock) including income and even with deducting my wife’s monthly withdrawals. So I do take a little risk. Oh, I don ‘t know how to do options so I just buy and sell.

I am at 24% for the year across all accounts. My active trading account is up 45% without owning any stocks that weren’t option plays (and the returns from those were modest). That was good enough for my wife to retire earlier than planned.

I hope everyone else had a good year as well.

And Merry Christmas!

Congrats Scott!