Once again equity markets moved higher for the week. The S&P500 closed the week at 5865 which was up .85%–around 50 S&P500 points.

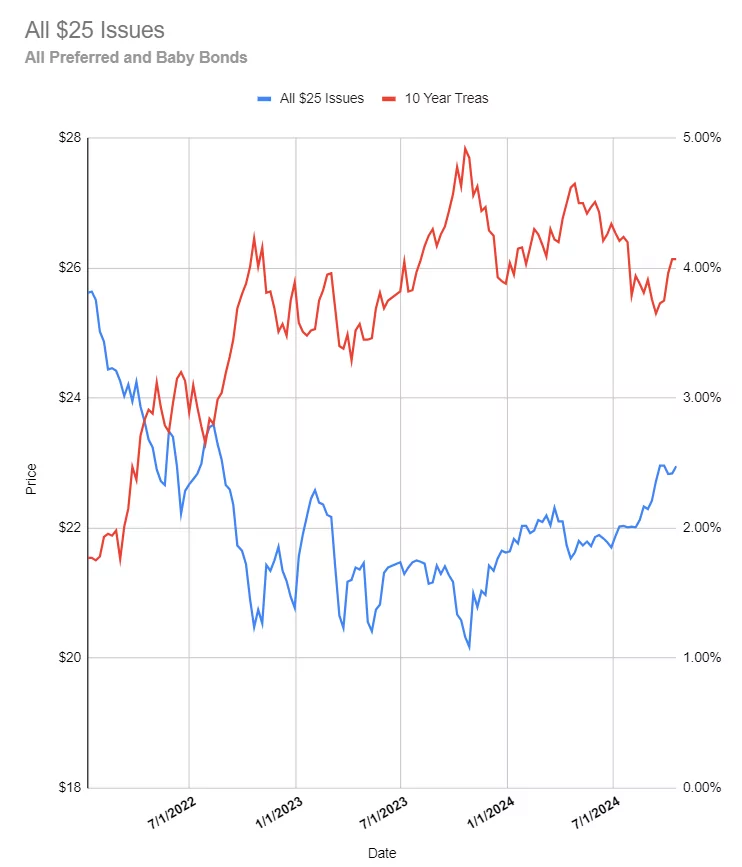

The 10 year treasury closed at 4.07% which was unchanged from the previous Fridays close. Without employment numbers or news directly related to inflation markets remain fairly quiet. The total range of interest rates was around 10 basis points which historically is fairly tight.

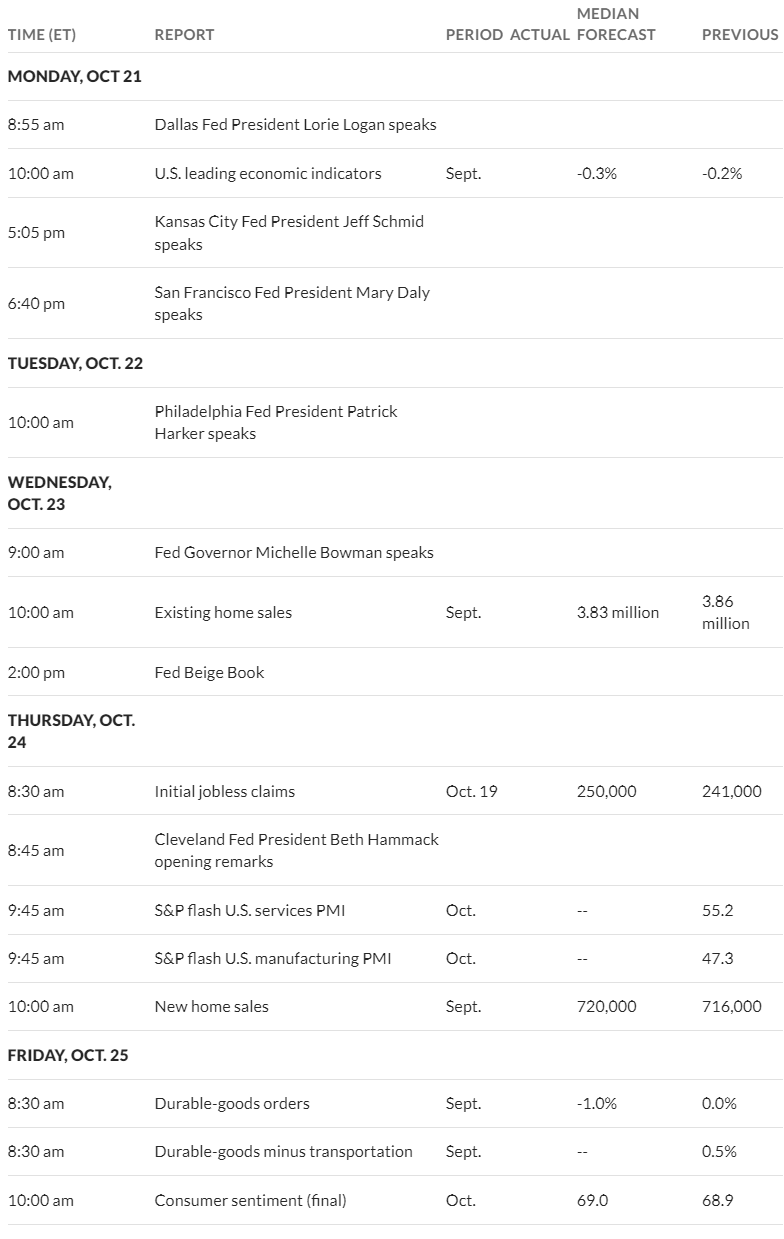

This week may well be kind of quiet again as the economic news being released is more of a minor type, although we do have the ‘beige book’ being released on Wednesday which can move markets.

The Federal Reserve balance sheet fell by $7 billion–we should finally crack the $7 trillion level in November for the 1st time in about 4 years we will be at $6.xx trillion.

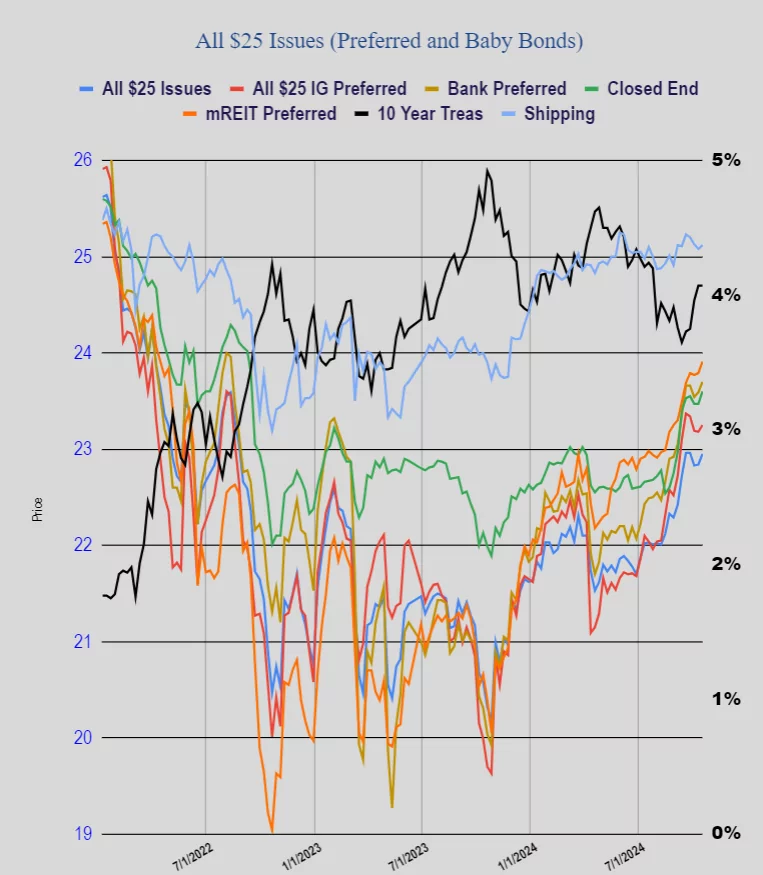

Preferred stocks and baby bonds took their que from common shares and moved higher on the week by 11 cents. Investment grade issues rose 7 cents, banking issues were 11 cents higher and CEF issues moved 13 cents higher.