Will this be a quiet week–probably not, but one can always hope. I love collecting dividends and interest without movement of capital values. Almost without doubt one can’t earn 7-8% without seeing prices bounce around – if you could earn this high yield everyone would own shares in those investments.

Last week WAS quiet in preferreds and baby bonds, but less so in the S&P500 which had a good week moving up about 2% from the close the previous Friday–which was a close under 5,000. Thus far equity prices have held up well given that the year started with expectations of 6 interest rate cuts and we are now down to 1 or none. There continues to be boatloads of money out there–the ‘haves’ continue to have plenty and the ‘have nots’ remain where they are normally are at–struggling–and the gap gets wider and wider.

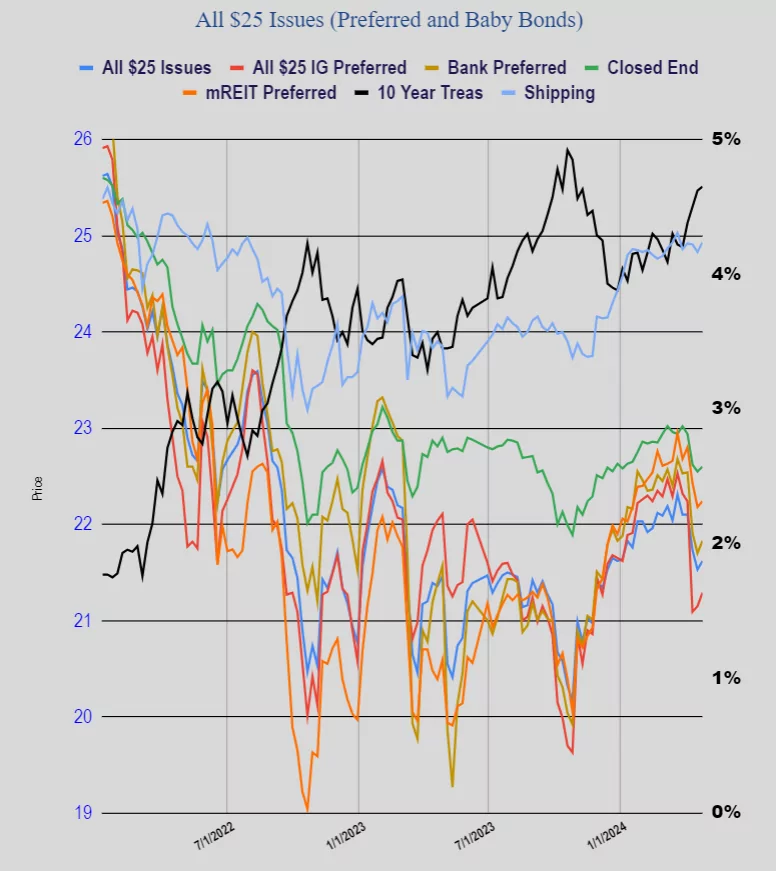

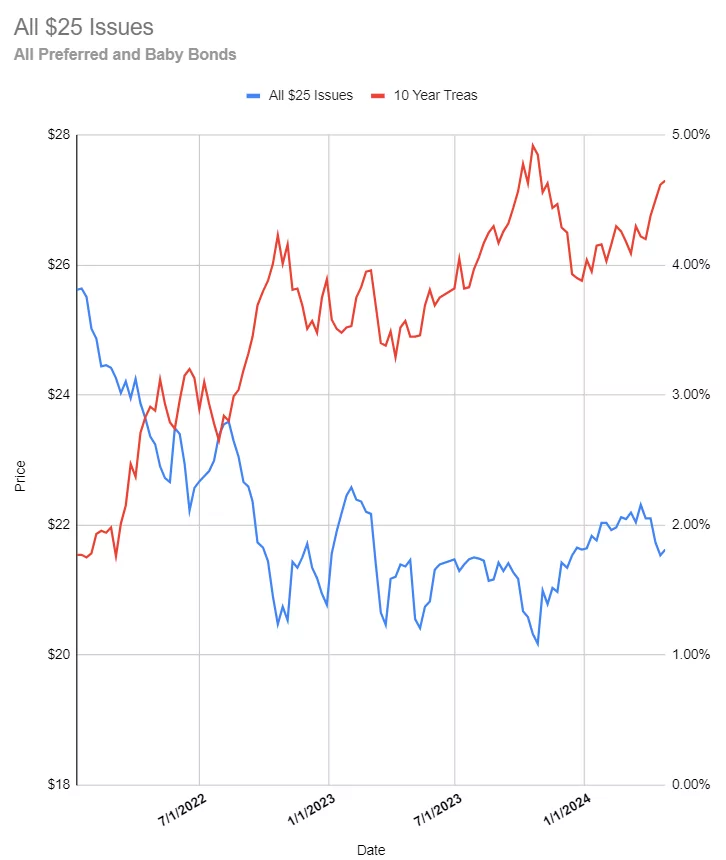

Interest rates (the 10 year treasury) moved in a relatively tight range of 4.57% – 4.74%. For a day or two I thought that rates were going to breakout above 4.75%, but it was not to be in spite of economic news that showed inflation remains a concern. It was helpful that last week was somewhat lite in Fed ‘yakkers’–they have pounded their point of higher for longer enough. Personally I need more data–always more data. If one is ‘data dependent’ one needs data–every day, every week.

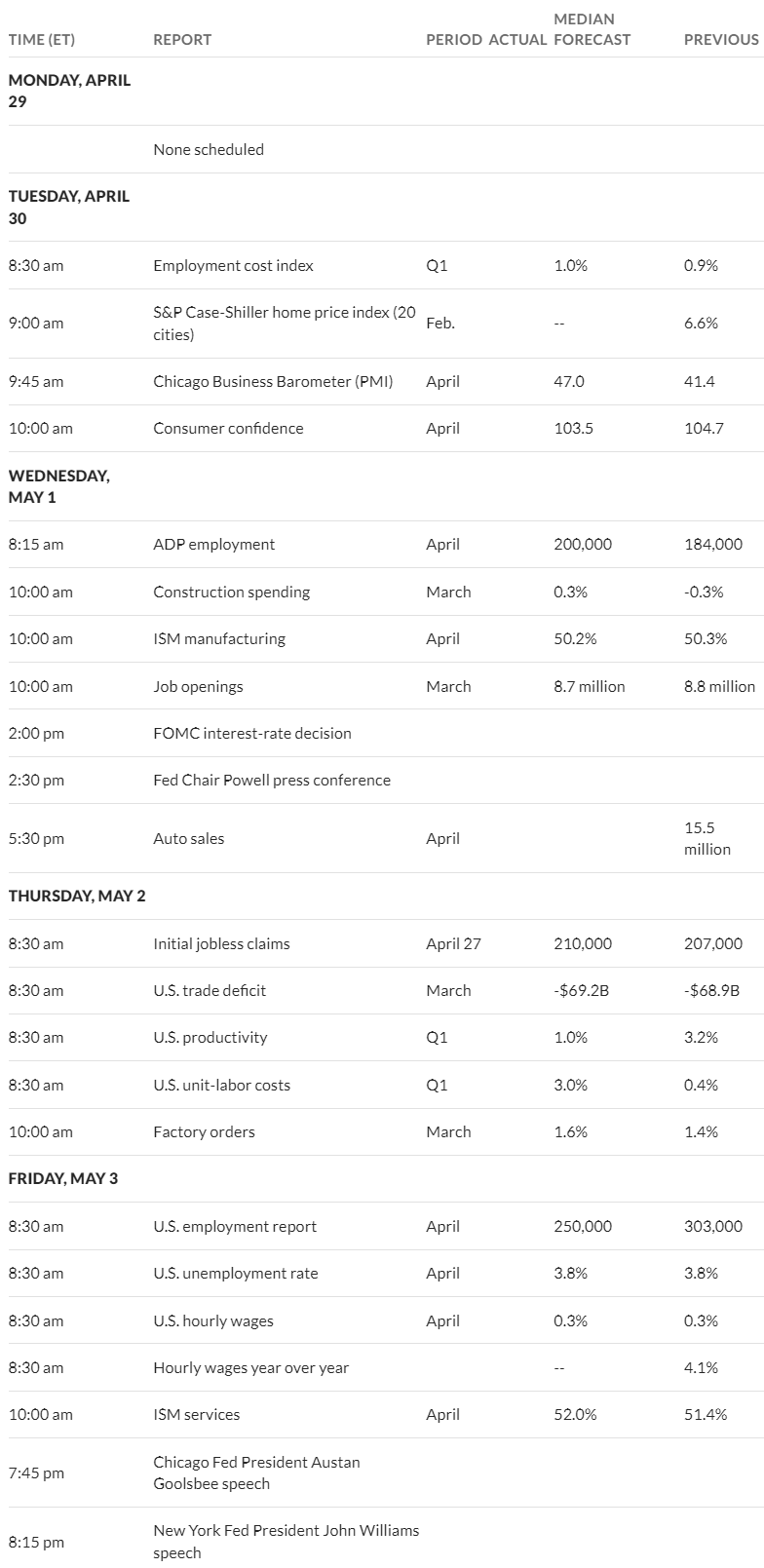

This week is ’employment week’ with numerous pieces of data related to jobs. We have the employment cost index, ADP employment, initial jobless claims and then on Friday the April employment numbers. Toss in that we have a FOMC meeting this week and a Fed presser by Jay Powell after the meeting on Wednesday and we could see movements in markets. One would have to be living under a rock to believe in a rate cut in Fed Funds this week–not going to happen.

The Fed balance sheet assets fell by just $3 billion last week after a number of larger drops the previous weeks.

Last week the average $25/share preferred and baby bond was up a very modest amount. The average share rose 9 cents, investment grade issues rose 14 cents, banks rose 13 cents, mREIT preferreds were up 6 cents and shippers were up a dime.

Last week we didn’t have any income issues price.

I have an out-sized amount of funds maturing this week – mainly treasuries and one agency bond. Will probably roll them back into treasuries for the ones in my taxable accounts and maybe CDs for the tax-deferred/Roth.

Couple of thoughts:

1. If you know how to use an RSS reader, you can get all the posts from all the different topics (a reader like FeedBro is free, but there are lots of readers out there).

Good news/bad news – There is a LOT of content, so it can keep your reader pretty full. personally, I try to read a lot of what gets posted, but the volume of great info is hard to keep up. I don’t know how Tim keeps up with it all himself, especially with his “day job” – he must really eat his Wheaties….

2. Unfortunately, the “search” function is almost useless (sorry Tim). If you don’t catch a conversation in “real time”, you probably won’t be able to find it later by searching.

RSS – thanks, I’ve already added the feed that gets Tim’s posts. Is there another feed to get the reader generated posts like those from the Sandbox etc?

I think this feed will get you everything posted by Tim and the rest of the peanut gallery (including old nuts like me)

https://innovativeincomeinvestor.com/comments/feed/

Thanks!

I see what you mean about the search – tried searching a recent comment about AGNCM and it only returned old stuff. A search in the RSS feed app did find it tho.

Tim I just recently discovered this site. Lots of information! Can you tell me the best way to navigate around to get the most value from the site or perhaps point me to a FAQ? There’s so much here I’m having a hard time developing a routine. Any assistance would be greatly appreciated! Thanks!

Hi Eben—I would make sure to read the ‘Sandbox Page’, where the smartest people post lots of good information about a plethora of subjects. The Sandbox page is for information about anything income related and is the 2nd most active page on the website.

https://innovativeincomeinvestor.com/sandbox-page/

There is a link to this page in the right hand margin.

The newest comments show up on the right hand side of the page. I would follow those. Then I would look at the list of different sub pages, like common stock chat and illiquid preferred.

The top has drop down lists of groups of stocks.. Be careful using these lists. These are not meant to be recommendations, rather these are lists of stocks in certain groups of the market that allow you to somewhat follow what is happening in those groups. Do your research.

The people here are a great group to listen to.

Eben, my ‘go to’ daily ea morning and thru the day is the pfd stock sorted by gains/losses, I sort by ‘losers’ and see if any outsized bargains show up and follow w due diligence, see if there is anything new causing it or just someone selling like an ETF etc for ‘no reason’ just to exit. And of course any ‘color’ provided from commenters. 2nd page I read is the Sandbox for last posts. Bea https://innovativeincomeinvestor.com/25-preferred-stock-sorted-by-share-price-loss-gain/

Thanks MS BEA- I am not seeing that link titled $25 pref stock etc down the right hand side of the page?

money doesn’t grow on trees – you can also find this page link under the dropdown list of pages under the Preferreds header at the top of the page.

Eben

I’m w/Bea

I also sort Day Gain/Losers first by Losers/%, seeing if there is a buying opportunity

Then Day Gain by Gain/%, and then comparing to 52 week range. I then look at RSI – if in >80%, I’ll consider a Sell order.

Last, I’ll sort by Yield to see if I’m happy still with the lower yielding holdings.

If I have $ to spend and feel the market is in a stable mood, I’ll look through the Sandbox to see if any interesting opportunities are there.

One of the best things about the site is that early warnings about individual issues, calls, and ominous articles often show up here first. The race often does go to the smart and the swift.