The 10 year treasury is tumbling some today-now off 5 basis point to trade at 1.72%. Apparently the bloom is off the rose in regards to the China trade deal and we have moved into fear of a global slowdown based on a virus. One can never, ever know where these things will take us, but more often than not it is likely we won’t see longer term damage to growth–but the knee jerk reaction is negative. We will just have to wait and see.

Stocks have tumbled as many as 200 Dow points–a non event really–less than 1%. As I have mentioned before I don’t give serious attention to equity moves until we see at least daily moves of say 1.5% or more and then my attention is too watch for more panic moves by nervous nellies bailing out of their income securities.

As mentioned by many in comments today all of the shipping companies are giving up ground–both preferreds and common shares. By far and away they are the biggest and most wide spread losers in the preferred arena.

I do see 1 ‘silliness’ move in the CEF preferreds as someone paid $27.85 for Gabelli Utility Trust 5.625% (GUT-A). This issue is up $1.30 from earlier in the month. The issue has been redeemable since 2008–folks are looking for a bruising as they could call this any minute–no doubt they could garner a 5% coupon (or better). I owned this issue last year and while it was a base holding I exited because of valuation (coupled with call risk).

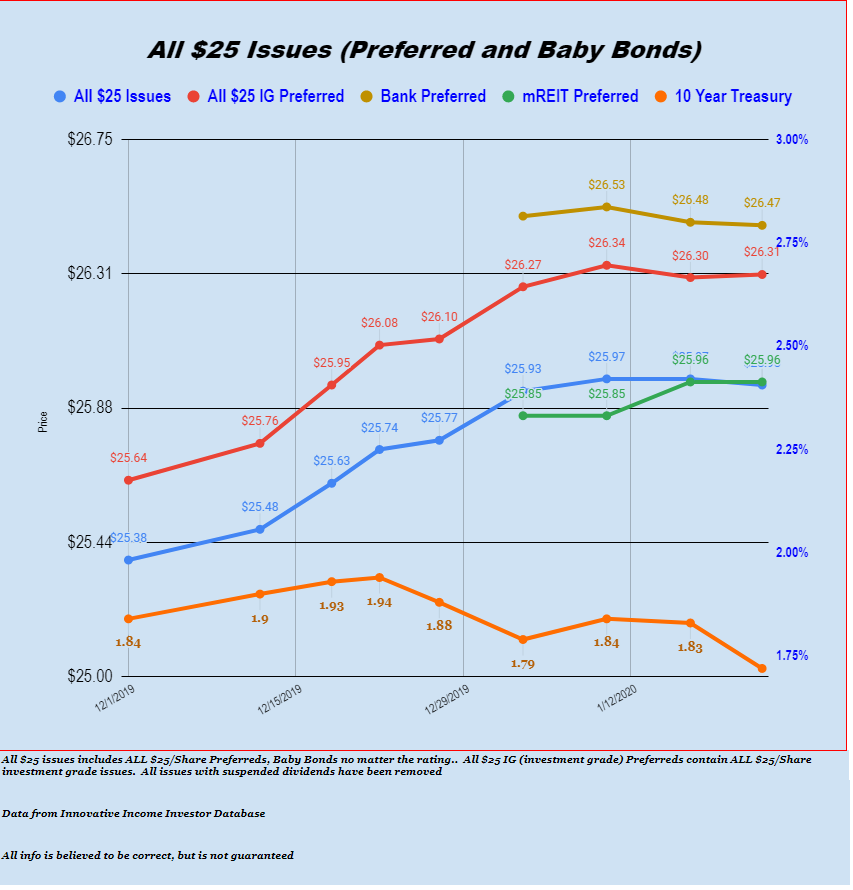

The average $25 preferred and baby bond is off 3 cents today–no doubt being driven by some of the shippers as most sectors are plus and minus a penny. The only line on our chart moving lower is the 10 year treasury–and I expect that move will continue–slowly.