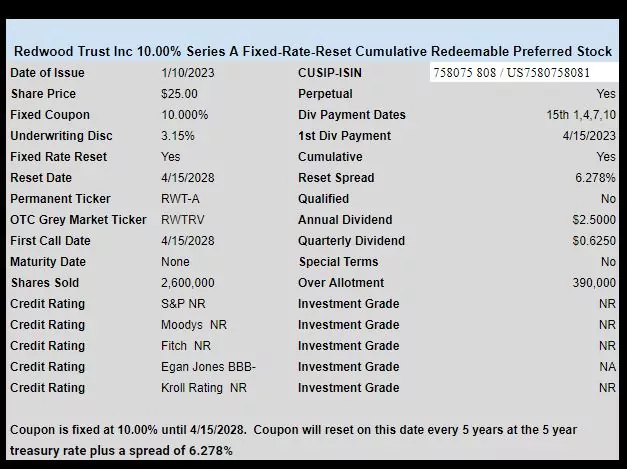

mREIT Redwood Trust (RWT) has finally priced their new issue of fixed-rate-reset preferred.

They have priced 2.6 million shares with a fixed rate of 10% with a spread of 6.278% (to be added to the 5 year treasury). in April, 2028.

The issue is rated BBB- by Egan Jones and is obviously a high risk issue.

The pricing term sheet is here.

Make sure to read the comments that were left by folks

10% !!!!

Well …………

LNC -D is 9 % (BBB-) S&P

MS-P is 6.5 % (BBB-) S&P

Nature is out of balance ……..

PN, thanks. Several floating rate IG options now at 7+%.

Looking at LNC, Their profits were down 900% and operating income -615% earlier this year Y/Y. .

TailWalk–but on special 1 time items (at least they damned well better be).

LNC-D current yld = 7.84%, but, still good – if no problems.

Not over subscribed, booked 55 mm….. I think

Three thoughts:

1) This will be oversubscribed as yield chasers feast on the juicy 10% coupon.

2) No way on god’s green earth it should be rated this high, BBB-. Out to be a B or B- at best. Insane rating. Probability of non-payment HAS to be significant, guessing 10% to 20%.

3) Somebody please explain to me how Redwood is going to issue say 7% mortgages, and fund it with 10% paper? Seems like a desperation, loan shark kind of funding to me.

I was going to ask the same thing, along with why they would use 10% paper to pay for 5% paper which isn’t due yet.

And thanks to Tim for posting this information on how big the offering was — now where did I put my pencil and sharpener…?

That’s not a difficult one, Scott – CFO thinking I’m an on the cusp company right now…. I’m facing a recession. I have short term debt that’s coming due pretty soon, perhaps right in the middle of the recession and I have no cash t pay it off…. Mr Investment Banker has my ear and he’s telling me the market RIGHT NOW is willing to still lend you some money and why not take it while the market for you is still open and stretch out the day of reckoning…. You’re not going to be able to get a rate cheaper than what you’re going have to redeem anyway, so getting the money now at any rate is better than risking not being able to get it at all closer to the maturity.

2WR, you think your buddy Milken would have floated this back in the day? I should note that they have every major IB house as bookrunner’s on this, so I would be surprised if it does not end up oversubscribed. Last thing the IB’s want to is to get stuck holding a big chunk of this on their own books. Kind of like the Twitter buyout bond mess they currently hold. .

Ha…. If he would have, there’d be no question whether or not it was going to get underwritten successfully… His letters of confidence and his cross network of buddies would have locked it up in advance…. I think Sade must have been singing about Milken – https://www.youtube.com/watch?v=4TYv2PhG89A&ab_channel=SadeVEVO

As an aside in the “I wonder how it would have turned out” category, though I never met the man, his Los Angeles operation tried to recruit me to move from Wall St to LA back in the day… It was exciting to consider, but I had just bought a new house on LI and still had not unloaded the old one, so I stayed put…. I still wonder what it would have been like…. this was well before knowing much about how thin the line was he was walking between legal and not… It sure would have been eye opening…

2WR: You avoided a moment of the collapse of Babylon. I worked in the workout section in the Beverly Hills office in the last 18 months before the Valentines Day “Massacre.” One, there was no notice of even distress one month prior to closing Drexel down. Two, Milken was gone and there was no quality control, none, for the last year. If the Fed’s hadn’t put Drexel under, the market would have. Three, Drexel had its best bonus pool bonanza the prior year.

Good story, Potter……. One way or another, unless I wanted to be a Left Coaster anyway, it was most likely a good decision to have passed….

Potter, younger III’ers might not appreciate how Milken/Drexel changed the landscape for lower quality borrowers, aka junk bonds. Would you hazard a guess at to what the overall default rates was for the Milken bonds? And did the underwriting standards get worse over time, leading to higher default rates?

Seems like we will never go back to pre-Milken times, so everybody can float a new bond regardless of credit qaulity. Also seems that way in preferreds where very high risk issues find a way to come to market. .

Tex, I hadn’t thought to do a bond search until EarlyBird’s post. I was surprised at the debt listed. Including that 7 per-cent’er just issued 6 months ago. To list the bonds and say your going to ues the proceeds from a 10% issue of preferred to pay it off doesn’t ring true.

I and a lot of people were fooled when AGNC said in its offering of the AGNCL they might use the proceeds to call the AGNCO then didn’t.

This sounds like handing off a bag of doo doo trying to get cash. As Bea might say, I’ll trade you my trash for cash”

Don’t get me wrong. I originally looked at RWT to track and wait for when the housing market recovers. I liked the thought of investing in a local publicly traded MREIT instead of the big national companies. Really glad a lot of people here posted their thoughts.

Piling on here: Tex, from what I’ve observed, an Egan Jones BBB- is nowhere near an S&P BBB-. Seems like EJ will give anyone an IG rating…

Bur, Egan Jones has a rich history of SEC violations, this is just one article in The National Law Review https://www.natlawreview.com/article/rate-conflicts-sec-sanctions-rating-agency-and-its-principal Just do a web search for Egan Jones fraud and many other stories about EJ magically appear. How a Board of Directors, CFO, financial institution(s) or anyone remotely credible could use their ratings as an authoritative and honest viable source is beyond my understanding.

Man looks in the abyss, there’s nothing staring back at him. At that moment, man finds his character. And that is what keeps him out of the abyss.

I am Azure

Azureblue—correct–a bit scary they are left to potentially mislead investors–buyer beware.

“Somebody please explain to me how Redwood is going to issue say 7% mortgages, and fund it with 10% paper? ”

In a word: leverage. Nonetheless, very suspect to be issuing 10% preferreds. Other mREITs are looking at buying back preferreds in the open market with those sorts of yields.