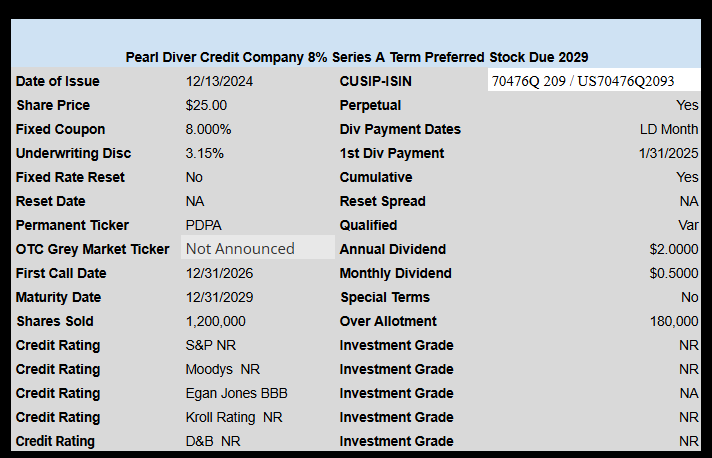

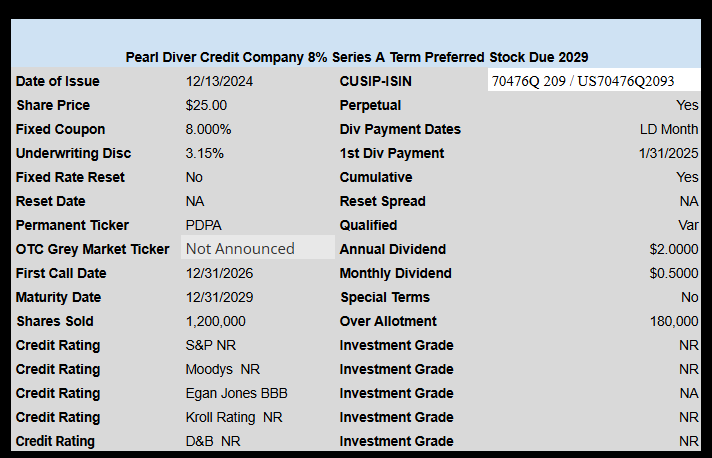

Newer closed end fund Pearl Diver Credit has priced their new issuance of term preferred stock with a coupon of 8%.

The issue will have a mandatory redemption on 12/31/2029. This is a monthly payer.

The pricing term sheet can be found here.

Our site runs on donations to keep it running for free. Please consider donating if you enjoy your experience here!

Newer closed end fund Pearl Diver Credit has priced their new issuance of term preferred stock with a coupon of 8%.

The issue will have a mandatory redemption on 12/31/2029. This is a monthly payer.

The pricing term sheet can be found here.

Everything a yield hungry investor could want. 8% Yield, monthly payer, 5 yr term with mandatory redemption, BBB rating from Egan Jones, One of the lead book runners desperate for cash flow and risk on is B Riley, external management paying themselves.

The new butcher shop in town with the dead duck they have hanging in the shop window just isn’t appealing.

Here is the grey market ticker because you are so anxious to buy.

https://www.otcmarkets.com/stock/PDCPV/quote

Just missing one thing. A buy recommendation from HDO and then you know it’s everything a high yield seeker needs.

HDO example recommendation. “Pearl Diver Credit is an ultra safe high yield because it’s a fairly new company without much history in the CLO space and what you don’t know can’t hurt you.”

Love it

That’s not a real quote, is it? That’s such a dumb statement it sounds even too dumb for HDO.to have said.

You must not be a long time reader or recall the type of quality content that Pendragon posts.

You’re right in a sense, legend – I’ve been banned from commenting on HDO articles for so long that I had forgotten just how deep the depths of the dumbness can be when it comes to the Dragon… However, I actually saved a dialogue of denial, obfuscation and inability to grasp the facts that I had with him 5 years ago on a F/F issue with a 7% floor AND an attached put, symbol LMRKN. A quick review of that dialogue and I accept your criticism. That was back in the days when Preferred Stock Trader just joined the HDO team. First thing PST did was write an article on LMRKN, confirming everything I argued… At that point, the Dragon completely reversed himself, without apologies of course, and went on to babble about LMRKN in support of PST as if it was the greatest security ever created and he knew it all along… I absolutely do not miss reading HDO articles.

As an aside, the LMRKN comments were in Jan 2019. It didn’t take PST long to realize the error in his ways for having joined HDO. He went independent in Sept 2020 by starting the Conservative Income Portfolio Investing Group.

Correction: PST did not start the CIP group. He was “fired” from HDO, then joined CIP which was started by Trapping Value.

You’re partially right I believe…. I was inadvertently reading the wrong bio, i.e. TV’s bio, on the Conservative Income site… TV started it, and PST joined in 2022, not 2020. However, having had PM’d with PST, I seriously doubt he was fired from HDO

“I have been writing on Seeking Alpha since 2016. I partnered with the Conservative Income Portfolio starting September 19, 2022, prior to which I worked for several years at another Investing Group service on this platform….”

2WR I want to make something clear about HDO, I agree with what people are saying.

I was once a follower of Rida almost 10yrs ago when he was promoting a buy and sell on ex-divy dates. Worked great until it doesn’t and you get caught holding a stock and losing what you made. There was no taking into account anything else going on in the market and if the stock was a loser or a keeper.

Also at the time I had no idea he was a veteran of boiler room tactics of driving up a stock price then getting out and leaving others holding the bag.

Nothing has changed on his tactics except now he preys on people getting ready to retire and those already retired by telling them how great his ideas are as a long term investment and return of income. He is still leading people down the primrose path to the dragon’s lair. There are a few followers who know what is going on and play along to their advantage lending a choir to the posted comments. I admit he does post on some good stocks but the pump and dump is still going on.

I posted this long serious note because there are some readers on here who do follow the HDO crowd. Hopefully with eyes wide open.

I love the sarcasm here. It also gives me another opportunity to point out that Egan Jones is NOT A NATIONALLY RECOGNIZED STATISTICAL RATING ORGANIZATION for CLO’s.

SEC revoked that a long time ago and forced them to put a notice on their website to such effect.

Consequently, I’m extremely suspicious of any company that would pay them to rate a CLO

losingtrader–thanks for adding to what we mostly believed to be true. I add it to stuff I post simply because it is usually part of the prospectus an pricing term sheet. Maybe I need to go back to adding my warning to their ratings.