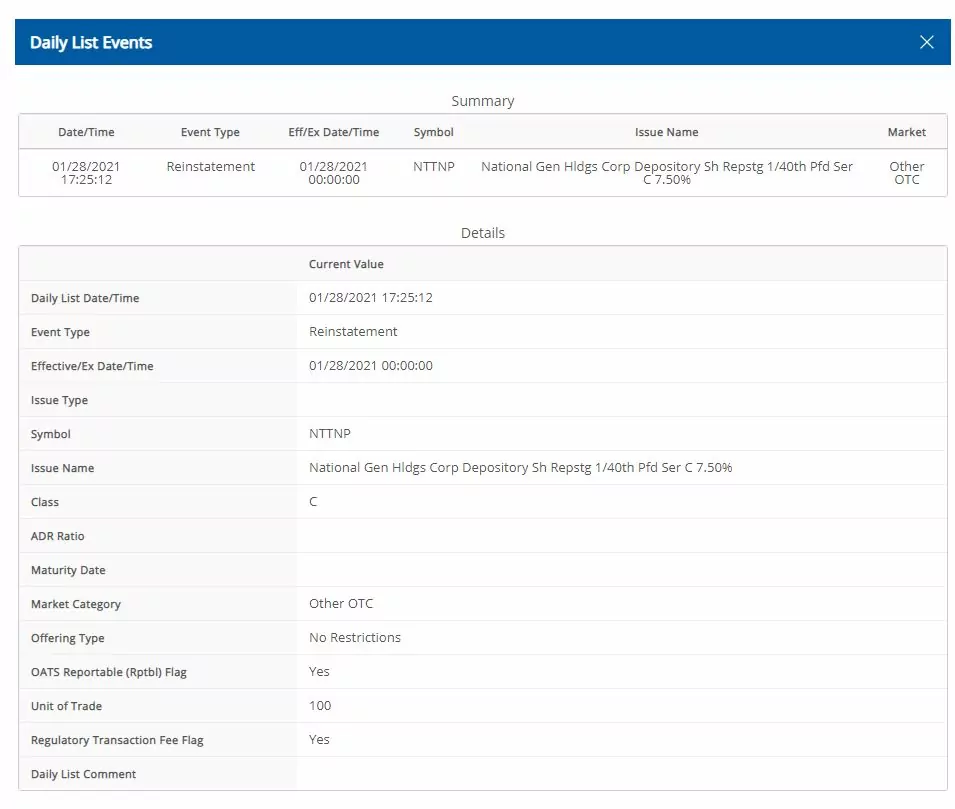

National General Holdings which was acquired by Allstate recently had a 7.50% perpetual preferred which was delisted at the time of acquisition (previous ticker was NGHGN). The company had 2 other preferred issues outstanding with coupons of 7.50% both which already been announced for redemption on 2/3/2021.

The intention of Allstate (ALL) is to call the last outstanding issue on 7/15/2021 which is the first date the issue is optionally redeemable.

This preferred which has 2 dividends payments of about 46.8 cents each (93.6 cents in total) remaining before being called is now trading on the OTC market under ticker NTTNP. Shares closed at $25.61 today.

I managed to snag NTTNP at 25 in a bizarre drop yesterday (ask was 25 but bid was 25.69. Go figure.). I would expect today to be the ex date since 4/1 is a record date, but it doesn’t seem to be registered anywhere, and it’s still trading as if it has 2 dividends to come. Does anyone know for sure?

I sold mine for $25.73 3/31 and thought I would still get the dividend which was supposed to be paid yesterday, but it’s not in my account. Can’t find any other info than what was in the statement. I think it would be weird if the div dates had changed.

“Prior to the redemption of the Class C Depositary Shares and Class C Preferred Stock, National General will continue to pay quarterly dividends on the Class C Preferred Stock.”

Ok, yesterday I got the div dated 4/15 though. I guess I have to be glad some people don’t know the div dates.

I own NGHCO and it still shows up in my Schwab account and it still trades every day. If it is to be called on 2/03, when will it actually be withdrawn from my account? I very infrequently have stocks that are called and don’t remember the actual logistics. Thanks in advance for any info.

Randy – It’s spelled out here https://www.sec.gov/Archives/edgar/data/1578735/000119312521001004/d71355dex991.htm

NEW YORK, January 4, 2021 (GLOBE NEWSWIRE) — National General Holdings Corp. (Nasdaq: NGHC) (“National General” or the “Company”), a wholly owned subsidiary of The Allstate Corporation, today delivered notices of redemption to, on February 3, 2021 (the “Redemption Date”), redeem in full:

•

all of the issued and outstanding shares of its 7.50% Non-Cumulative Preferred Stock, Series A (par value $0.01 per share) (CUSIP No.: 636220709) (collectively, the “Class A Preferred Stock”), at a redemption price equal to $25.00 per share plus declared and unpaid dividends on the shares of Class A Preferred Stock called for redemption for prior dividend periods, if any, plus accrued but unpaid dividends (whether or not declared) thereon for the then-current dividend period, to, but excluding, the Redemption Date, without accumulation of any other undeclared dividends;

•

all of the issued and outstanding Depositary Shares, Representing 1/40th of a Share of its 7.50% Non-Cumulative Preferred Stock, Series B (CUSIP No.: 636220808) (collectively, the “Class B Depositary Shares”) and the underlying 7.50% Non-Cumulative Preferred Stock, Series B (par value $0.01 per share) (CUSIP No.: 636220881) (collectively, the “Class B Preferred Stock”), at a redemption price equal to $25.00 per Class B Depositary Share (or, as applicable $1,000 per share of Class B Preferred Stock) plus declared and unpaid dividends on the Class B Depositary Shares (or shares of Class B Preferred Stock, as applicable) called for redemption for prior dividend periods, if any, plus accrued but unpaid dividends (whether or not declared) thereon for the then-current dividend period, to, but excluding, the Redemption Date, without accumulation of any other undeclared dividends; and

•

the aggregate outstanding principal amount of its 7.625% Subordinated Notes Due 2055 (the “2055 Notes”), in increments of $25 aggregate principal amount of the 2055 Notes, at a redemption price equal to 100% of the principal amount of the 2055 Notes being redeemed plus accrued but unpaid interest to, but not including, the Redemption Date (collectively, the “Redeemed Securities”).

Any dividends or interest payable on any Redeemed Securities on a date prior to the Redemption Date will be paid by National General on such date.

National General also intends to redeem the Depositary Shares, Representing 1/40th of a Share of its 7.50% Non-Cumulative Preferred Stock, Series C (CUSIP No.: 636220857) (collectively, the “Class C Depositary Shares”) and the underlying 7.50% Non-Cumulative Preferred Stock, Series C (par value $0.01 per share) (CUSIP No.: 636220865) (collectively, the “Class C Preferred Stock”) when they become redeemable in July 2021. Prior to the redemption of the Class C Depositary Shares and Class C Preferred Stock, National General will continue to pay quarterly dividends on the Class C Preferred Stock.

National General has notified the NASDAQ Global Select Market (“Nasdaq”) of its intention to, voluntarily delist from Nasdaq the Class C Depositary Shares, and, if permitted under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), terminate or suspend, as applicable, the registration of the same securities under the Exchange Act.

The Class A Preferred Stock, Class B Depositary Shares, 2055 Notes and Class C Depositary Shares are currently traded on Nasdaq under the symbols NGHCP, NGHCO, NGHCZ and NGHCN, respectively. National General does not plan to (i) list the Class C Depositary Shares on another national securities exchange or request quotation of such securities on any other medium, or (ii) register the Class C Depositary Shares under the Exchange Act.

Randy

On 2/3 your account should show the shares being withdrawn and a cash credit of $25 per share plus about 9-10 cents for dividends from 1/15.

Will trade in a narrow range unti call. By trading that range I could possibly boost the return a couple percent with low risk. Probably not worth the trouble except for money just sitting around. A safe way to practice the technique.

Thanks so much, Tim. As usual your sharp eyes and mind is the BEST for sure.

I tried to find something to sell. Realizing that BEPC (the spin off of Brookfield Renewable) has just reset the yield below 3%. Sold them all and bought just 300 shares of NTTNP within 30 minutes of market opening or so. It gapped up momentarily above $26 and then back to just below $26.