The S&P500 moved higher once again last week–although it took a big day of gains on Friday to move us solidly into the green.

The index rose 1.4% after the jobs report on Friday surprised by a huge amount to the upside – forget that the jobs gain number of 353,000 might see giant revisions next month – we play the ‘hand’ we are dealt.

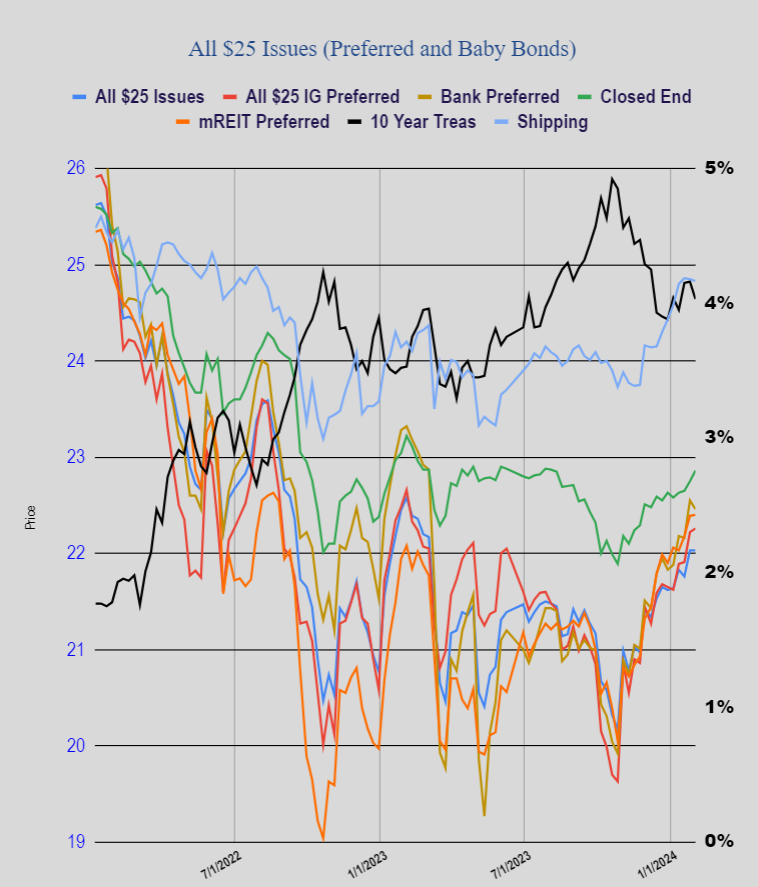

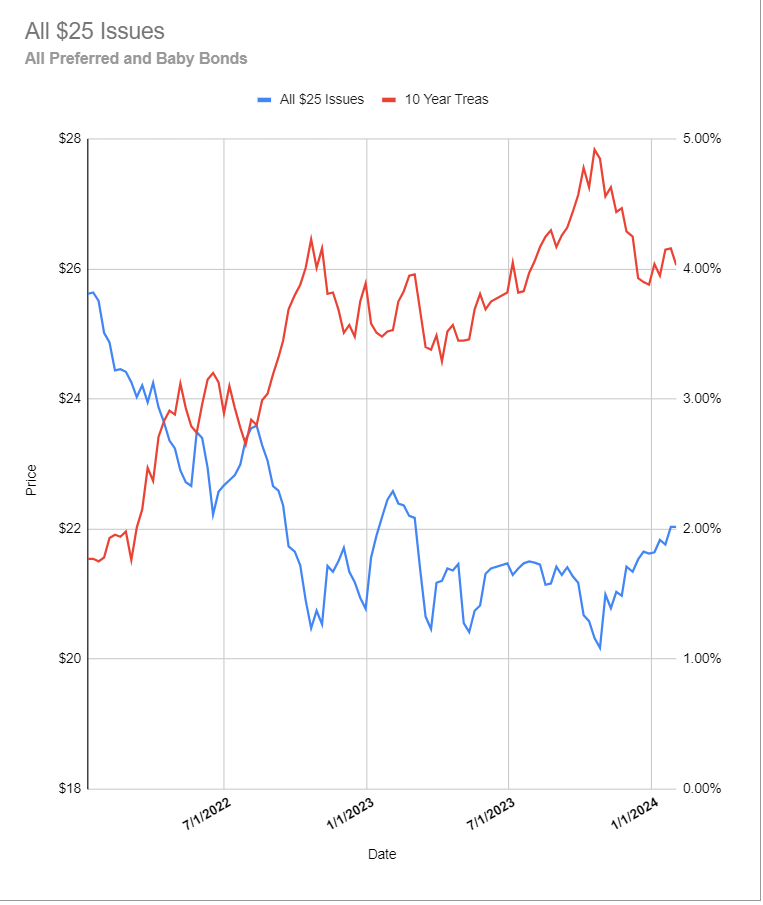

Interest rates moved in a fairly wide range with the 10 year treasury yield trading as low as 3.82% with a high of 4.12%–a 30 basis point range. The yield closed at 4.03% on Friday which was a 13 basis point move lower from the previous Friday.

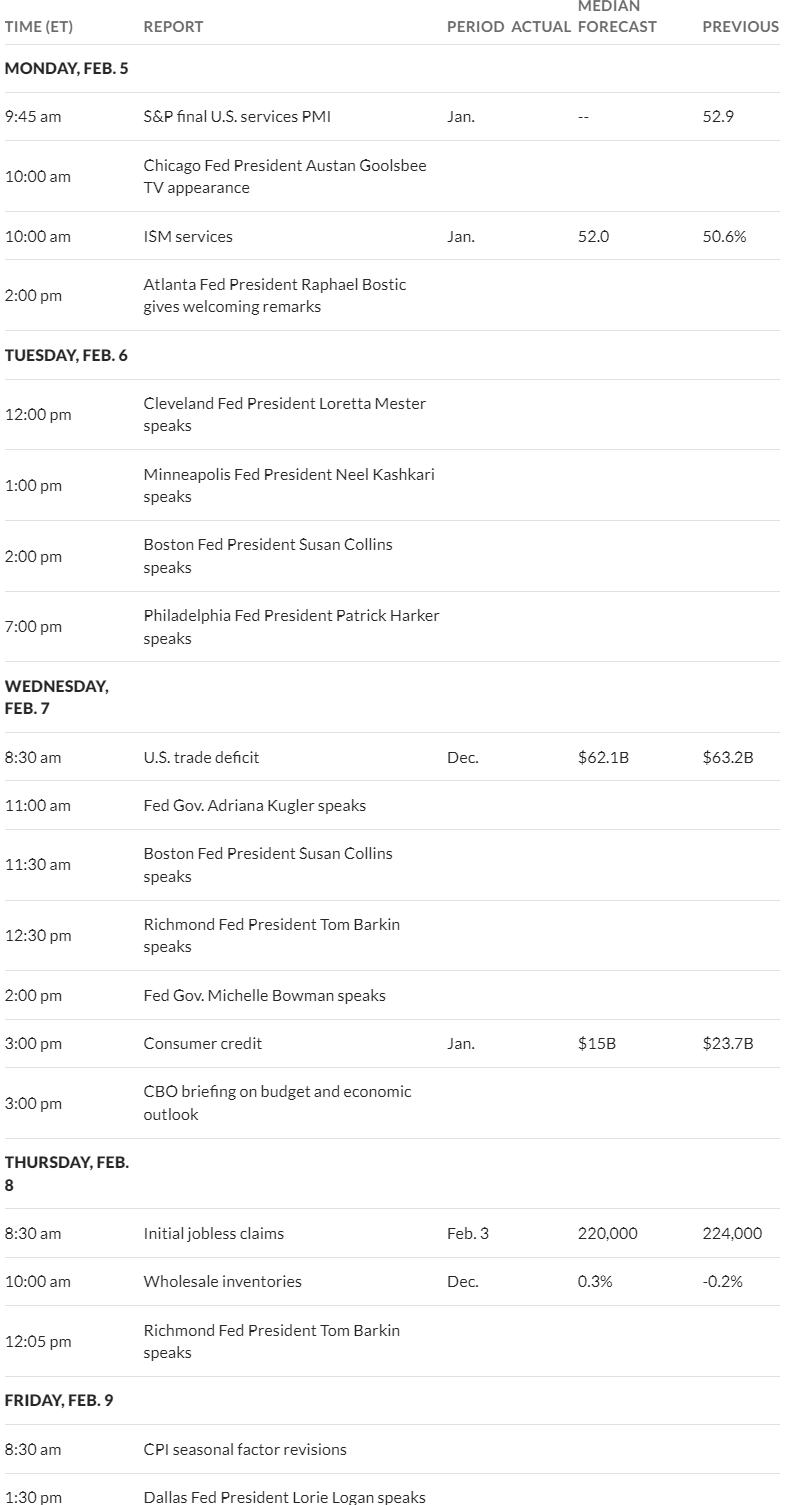

This week we have only minor economic reports–no major inflation reports–no major employment reports etc. But now that the FOMC meeting is over the Fed yakkers will be out in force as shown below–these folks will move markets as we now go back to the ‘guessing game’ of when do interest rates get cut.

The Federal Reserve balance sheet assets finally took a tumble last week–it had to come as the run off was running way behind $95 billion/month. The fall of $47 billion brings the run off back on schedule.

The average $25/share preferred stock was unchanged last week at $22.03. Investment grade issues rose 4 cents, banks fell 9 cents/share, mREIT preferreds move 1 cent higher—all in all an incredibly quiet week in which we saw the 10 year treasury move in a 30 basis point range.

Last week we had no new income issues priced.

“Business activity in the US service sector expanded at a stronger pace than anticipated in January, with the ISM Services PMI rising to 53.4 from 50.5 (revised from 50.6) in December to beat the market expectation of 52.0.

The Employment Index advanced to 50.5 from 43.8, while the Prices Paid Index – the inflation component – climbed to 64.0 from 57.4.”

Inflation comes in waves.

Watched a video on investing over the weekend in which they discussed the simple concept of ‘buy when its cheap and sell when its expensive’ and how hard it was to execute. Right now nothing looks cheap and everything looks expensive so I will continue reducing my exposure even if the market continues higher.

I keep emergency money in the bank. Otherwise, my investing accounts are fully invested all the time. My main interest is yield and I don’t fret over bottom line. Actually, in my traditional IRA, which is heavily invested in preferreds, I’d rather see the bottom line go down as it doesn’t affect the yield but lowers the required minimum distribution.

Citadel, I am not fully invested but I do have bids out at prices I would like to own. Like you nothing seems cheap right now. I did sell a couple recently like the ADM where I made a couple bucks in just a few days. Overall, if the market was to drop the income should stay the same even if the account value goes down.

With Q4 earnings season halfway over and the expectation of a Fed rate cut in March fading rapidly, its hard to see what propels the market higher going forward. Absent a compelling buy opportunity and with money market rates hovering above 5%, I’d rather take some profits and move to the sidelines than grinding for an extra percentage point or two.

Today reading some of the articles on Yahoo and MSN I see I missed 60 minutes last night where they had Powell on there saying they already know which of the smaller regional banks that are in trouble and likely to close or merge but that it isn’t 2008 and it’s a manageable problem.