There is no doubt that this week will be ‘interesting’–everyone has to define interesting for themselves. Does it mean nothing at all happens all week as we head into the long weekend? Does it mean that interest rates plunge even further. Do investor decide we are going to have a ‘hard landing’ instead of soft? I have no real clue, although it could be quiet all week–even with the personal consumption expenditures (PCE) numbers being released on Friday–who knows?

Last week the S&P500 moved up again–up by 2.5%–powerful. The range was 4593 to 4738—finally closing at 4719. These are powerful gains–the type that make me want to be a common stock investor–I always want to be a common buyer at the highs–no thank you I’ll stick to my knitting.

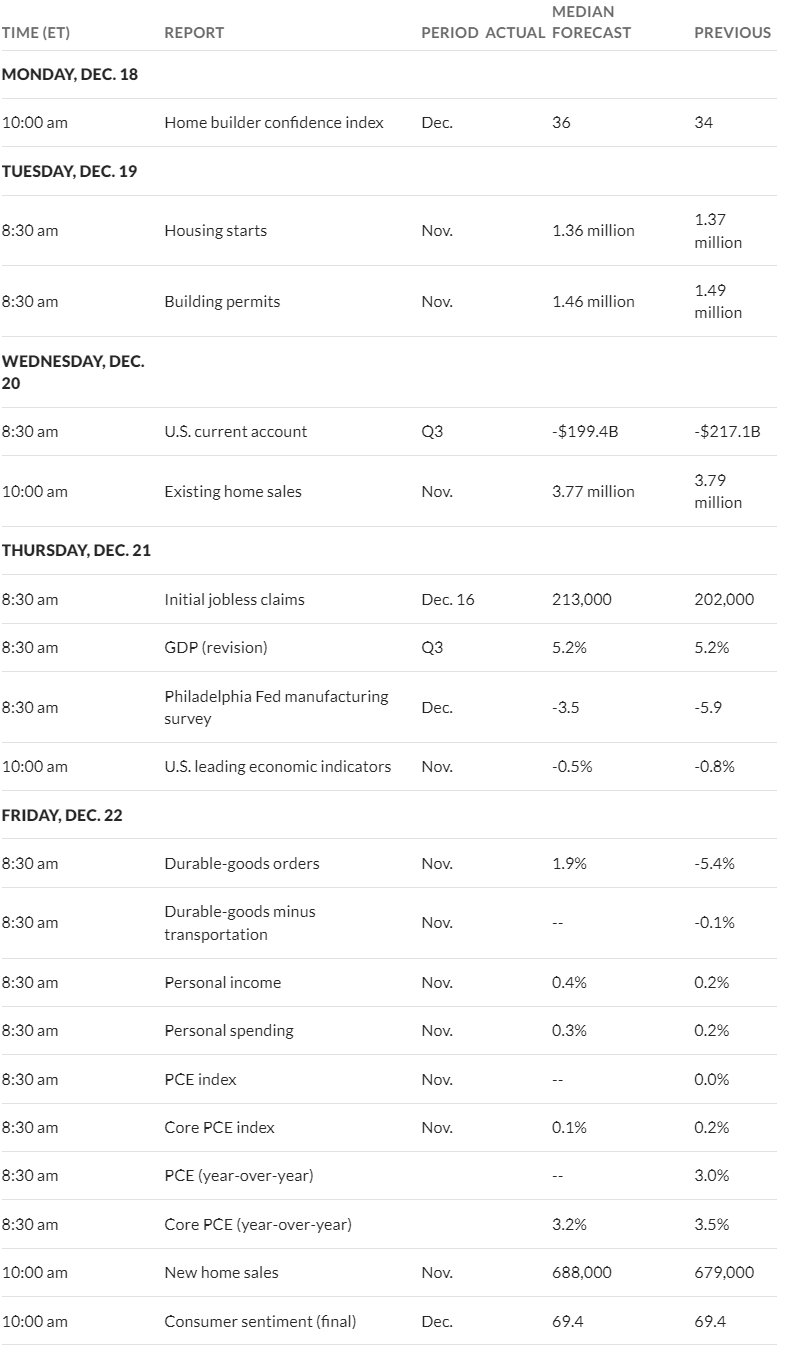

Interest rates, as measured by the 10 year treasury, moved sharply lower. The 10 year closed the week at 3.93%–the range on the week 3.88% to 4.29%. This was an epic move lower. This morning the note is trading at 3.91%–fairly steady. News this week for the most part is normally not market moving (except PCE on Friday)–but one can’t predict what part of ‘news’ creates as outsized move. A lot of housing news is on tap this week so I guess we ccould call this ‘housing week’.

The Federal Reserve balance sheet grew by $2 billion last week–a departure from the normal drop–after the $59 billion drop the previous week a small drop (or in the case gain) is pretty normal. Regardless the balance sheet is down $1.3 trillion from the peak–still massive at $7.7 trillion, but a good start preparing for the time the Fed is forced to go to quantitative easing (QE)–hoping that is a long time in the future.

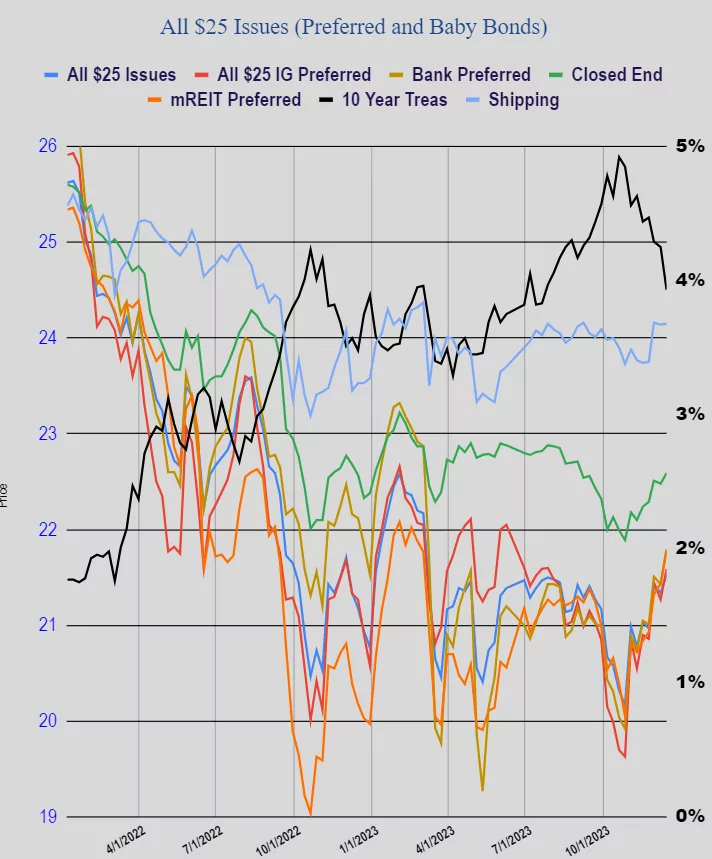

The average $25/share preferred stock and baby bond moved higher–but gains couldn’t match common shares. The average share moved higher by 23 cents–nothing to sneeze at for sure. Investment grade moved 23 cents higher, banking preferred were higher by 36 cents. mREIT preferreds moved up by 35 cents, CEF preferred were 10 cents higher and ocean shippers up by 1 measly penny. Obvious interest rate sensitive issues were the biggest winners on week.

Last week we had no new issues priced. Some (including me) are awaiting trading on the Midcap Financial 8% baby bond (MFICL). I see they registered the shares last Wednesday so hopefully we will see trading in the next couple of days.

Thanks TP – I definitely have been feeling the FOMO of wanting to be a common stock ‘investor’! But, so far I have stuck with the treasuries and preferreds and BBs. My current “effective” yields have steadily dropped as the prices have risen and, this morning’s calculation has me at 6.22% even though my YOC is very close to 7%

I do have a small “trading” account that allows me to trade the commons via them proper or options but that is more a ‘hobby’ of mine versus investing.

I noticed I have a LOT of treasuries laddered with yields 5.4-5.6% – not sure if I can get that now as I have some maturing at the EOM/EOY. I have some GS and JPM bonds at 6.85% (6.75% coupon) and looks like you can’t touch those now for more than mid-to-upper 5% range. Maybe I will also check out the MFICL bond when those $$$ free-up.

It has been a pretty wild year in the fixed income markets, for sure.

yazzer–just had a large chunk of CDs mature Friday and today in the 5.15% area–I could replace those at 5.35% for a 3 or 6 month issue, but looking for those 6% and up super safe and 8% and up high yield issues. Even the money markets are still in the 5.3% area so can sit in cash a little while and realize a respectable return.

It’s a stock market, or is it a market of stocks? Like we have seen with banks an MREIT’s there is a time to buy common stocks. Not so sure about the indices. A large part of the movement could be generated by just a small group of stocks, FANG, the fabulous 50’s whatever you want to call them. That is the point. Depending on the sector and the economy there is a time to buy into “certain” common stocks. You have to pick a sector and become familiar with the ups and downs.

Stocks will be my focus this week. Time to buy stocks or time to sell? I sure don’t know. I did sell one risky stock I had when it was up 30% this month. A few are up 20%+ for the month and those I need to decide on. Energy stocks are down a few percent but mine are holds for now.

The rollout of MFICL has been taking longer than usual. I imagine it will do a fast pop.