Last week was a loser week for stocks with the S&P500 off just over 2%. Obviously Friday was the big down day, but when one looks at this move lower on a historical basis it was not really a big deal – we’ve had much worse.

The 10 year treasury yield moved lower to 1.48% on Friday from a high earlier in the week of about 1.67%. The close last week was 5 basis points below the close the previous Friday. Certainly it is likely we will see the yield move a bit higher this week as calmer heads prevail relative to the new covid variant.

The Federal Reserve balance sheet data was not released last week with the holiday – but will resume next week.

The average $25/share preferred stock and baby bond moved lower last week by just less than 1% – off 21 cents. The average investment grade issue fell by just over 1% – off 28 cents. CEF preferreds fell by only 8 cents with mREIT preferreds off just 6 cents.

Last week being a holiday week we had only 1 new income issue price.

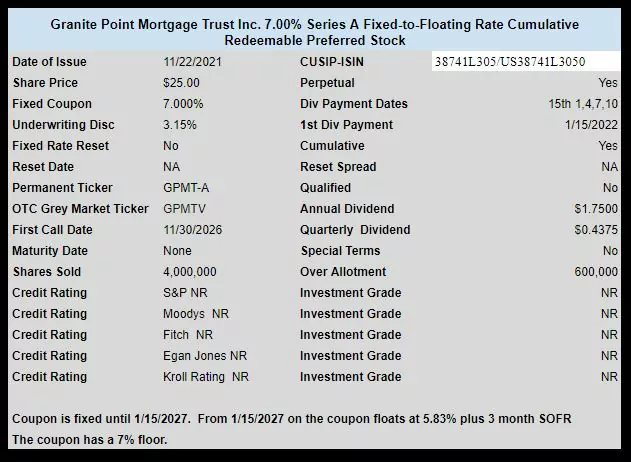

Granite Point Mortgage (GPMT) priced a new issue of fixed-to-floating rate preferred with an initial coupon of 7.00%. The issue is trading on the OTC exchange under ticker GPMTP (a change from the original OTC ticker of GPMTV) right at $25 on Friday.

Now trading as GPMTP. Yes, Len, you are correct re terms.

Aren’t these fixed to floating with a minimum reset rate of 7%?

Len–yes they are as noted on the grid.