Ripping higher. Regardless of what Peter Schiff (or other negative nellies) spout off about week in and week out common shares moved higher again. Honestly we can all see 100 reasons why the ‘sky might fall’, but it never falls. No reason this is going to change until the money spigot gets turned down a notch or two. The S&P500 rose about 1% last week–another record closing high.

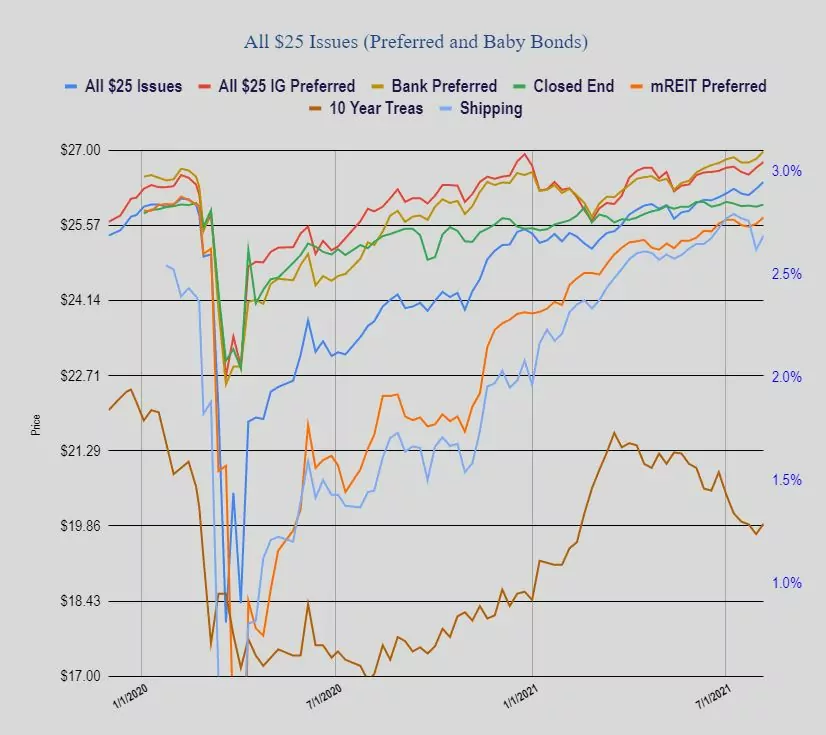

The 10 year treasury yield jumped by 6 basis points on the week to close at 1.29%–although during the week the yield bounced around in the 1.12% area.

The Federal Reserve balance sheet grew by $14 billion last week.

The average $25 preferred stock and baby bond rose by 13 cents last week. This is a record high average price – $26.40. Investment grade rose by 11 cents, banks by 14 cents and CEF preferred by 4 cents.

Last week we had 4 income issues priced.

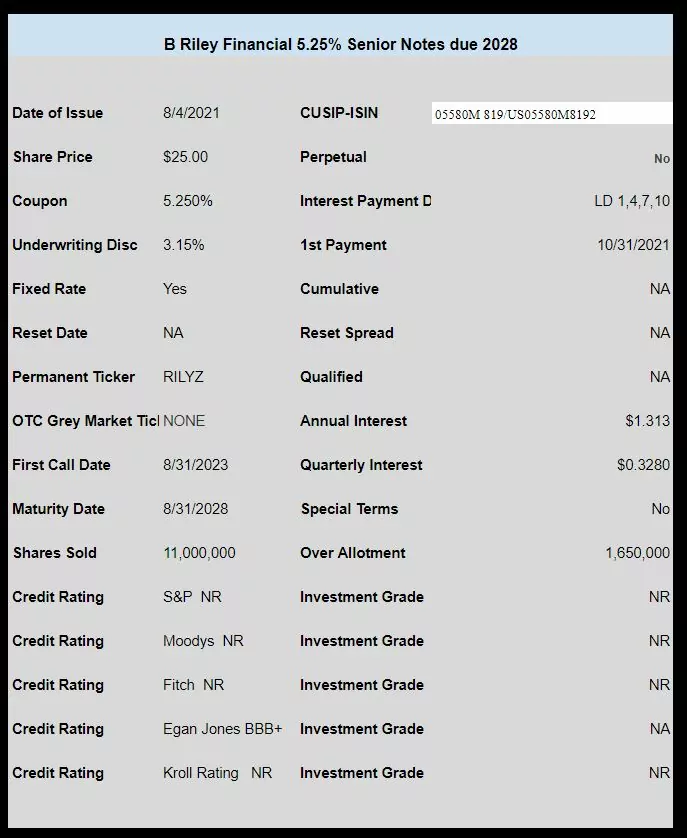

B Riley Financial (RILY) priced a new issue of baby bonds with a coupon of 5.25%. The issue is not yet trading.

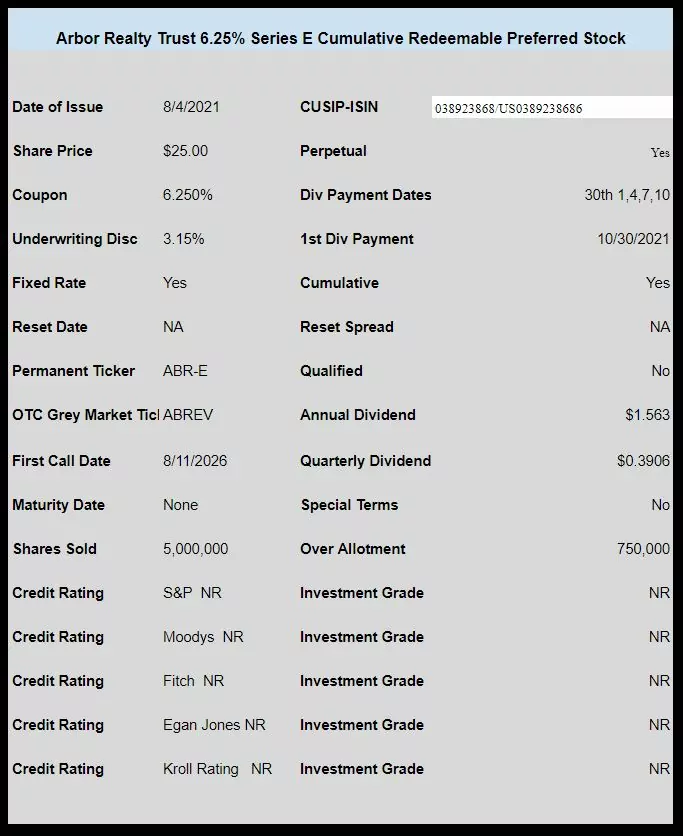

Arbor Realty Trust (ABR) sold a new issue of unrated, cumulative perpetual preferred with a coupon of 6.25%.

The issue is trading on the OTC grey market under ticker ABREV and last traded at $25.13.

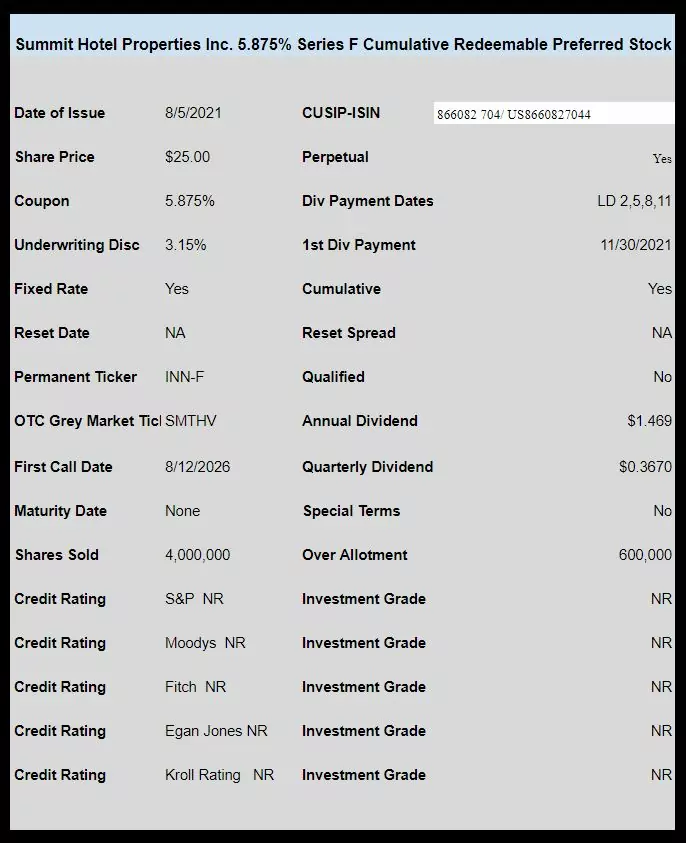

Lodging REIT Summit Hotels (INN) sold a new issue of perpetual preferred stock with a coupon of 5.875%. The issue is now trading on the OTC grey market and last traded at $24.86

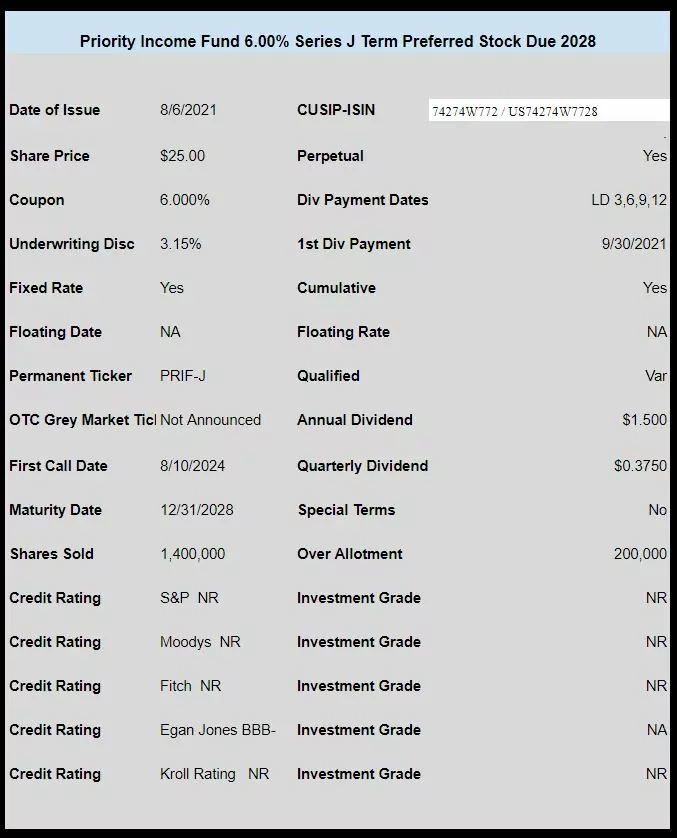

Lastly Priority Income Fund (not publicly traded) sold a new issue of term preferred with a coupon of 6.00%. The issue is trading on the OTC grey market under ticker PRIJP and last crossed at $25.00.

ABR in now trading under the symbol of ABREP at TDAmeritrade.

25.05. No commission at Fidelity.