The S&P 500 barely moved last week as the index rose by about 2/10% over the close the previous Friday—the range was 3440 to 3550–closing at 3482.

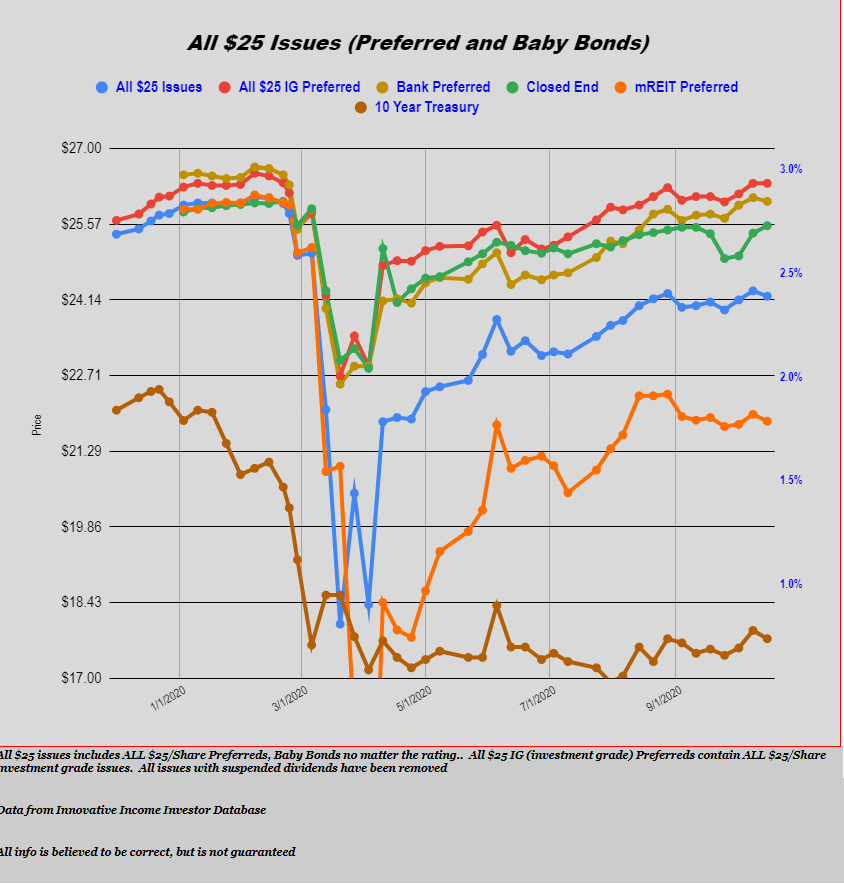

The 10 year treasury traded in a range of .64% to .78% before closing at .74%. With employment now faltering and no stimulus package being agreed to this is locked in a pretty tight range. When we see a stimulus I think we will see a pop higher in all rates.

The Fed balance sheet grew by a relatively giant $77 billion after growing $18 billion the week before–the balance sheet is just $18 billion below the highest level ever which was hit in early June.

The average $25 baby bond and preferred stock fell by 10 cents last week. Utility shares fell by 10 cents, bank related issues fell by 7 cents, investment grade issues fell by 10 cents—the only segment (I track) rising were the CEF preferreds which rose by 15 cents.

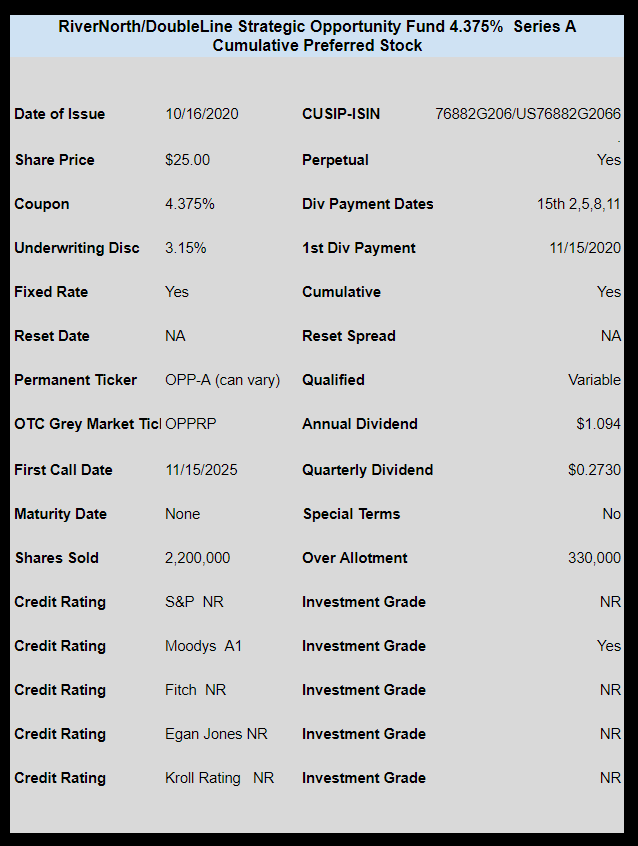

Once again the new issue market was very quiet with only the 1 new issue from RiverNorth/DoubleLine Strategic Opportunity Fund (OPP) being announced and priced. The issue will trade right away this morning on the OTC grey market under ticker OPPRP