The S&P500 traded in a range of 2966 to 3155 last week before closing on Friday at 3098–a gain of around 2% on the week.

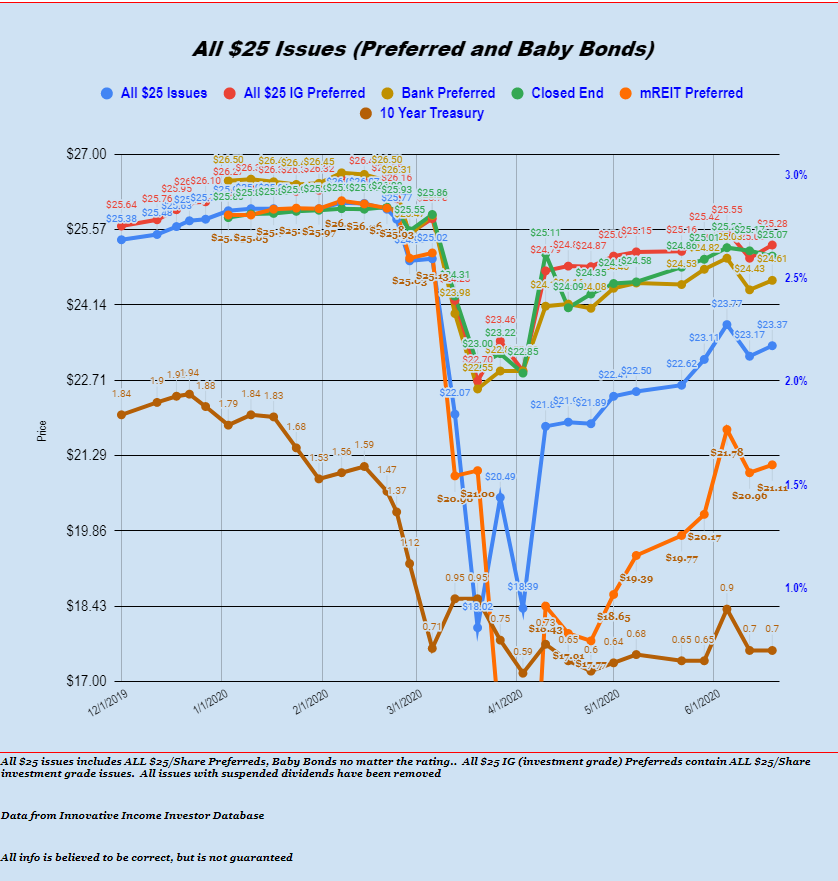

The 10 year treasury traded in the range of .66% to .76% last week and closed at .70%.

The Fed balance sheet FELL by $74 billion last week. This tumble came after rising just $4 billion last week. You can be certain that this will NOT continue longer term–with the Federal government spending like crazy and tax revenue drying up the Fed will be forced to continue to buy debt to fund the crazy spending.

The average $25 baby bond and preferred stock moved higher last week by almost 1%–up 20 cents/share. Investment grade issues moved up 1%, CEF preferreds moved lower by 10 cents. Lodging REIT preferreds moved lower by 2.5% as Ashford Hospitality suspended their preferred dividend which sent their preferred way down.

Last week we had 5 new income issue come to market.

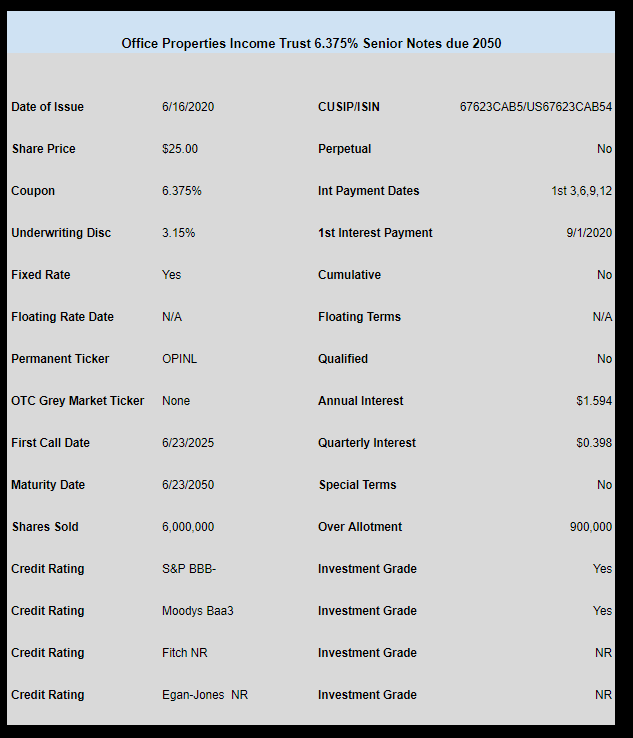

It started off with Office Properties Income Trust (OPI) selling an investment grade debt issue with a coupon of 6.375%.

This issue is not yet being traded as near as we can tell. Begin debt there is no OTC grey market trading.

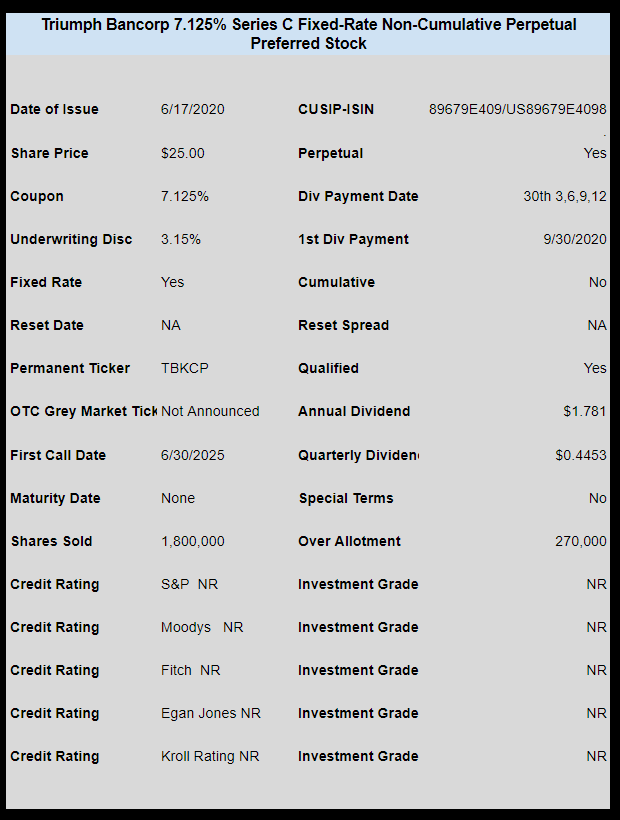

Small Texas Banker, Triump Bancorp (TBK) sold a new issue of non cumulative preferred with a fixed rate coupon of 7.125%.

The issue is now trading on the OTC grey market under ticker TMPHL. The shares last traded at $24.45.

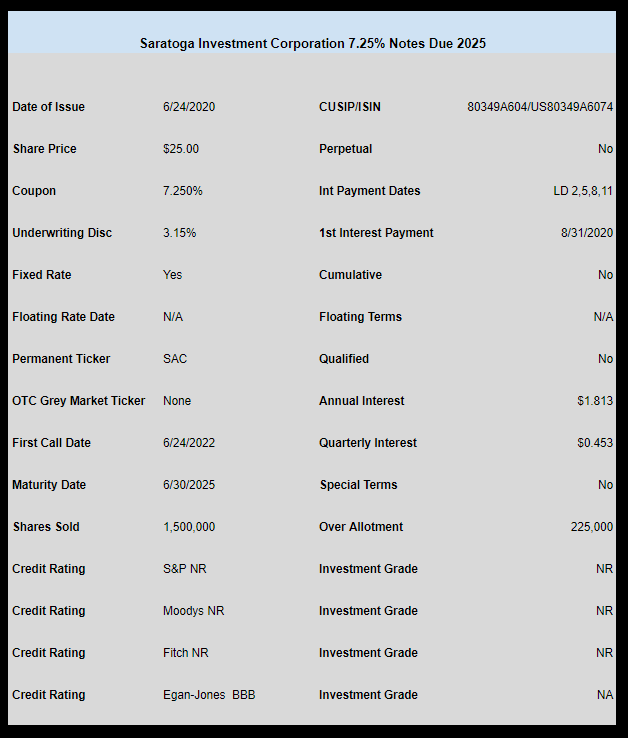

BDC Saratoga Investment (SAR) issued a new baby bond with a fixed rate coupon of 7.25%. There is no OTC grey market trading in this issue.

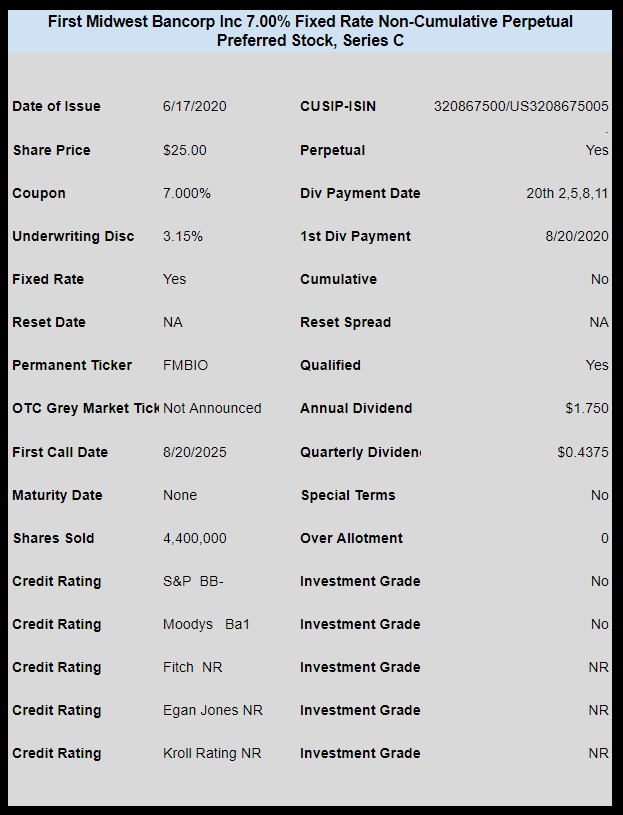

For the second time in about a month First Midwest Bancorp (FMBI) has come to market with a non cumulative preferred with a fixed rate coupon of 7%. The issue is trading under OTC ticker of FMDWl and last traded at $24.75.

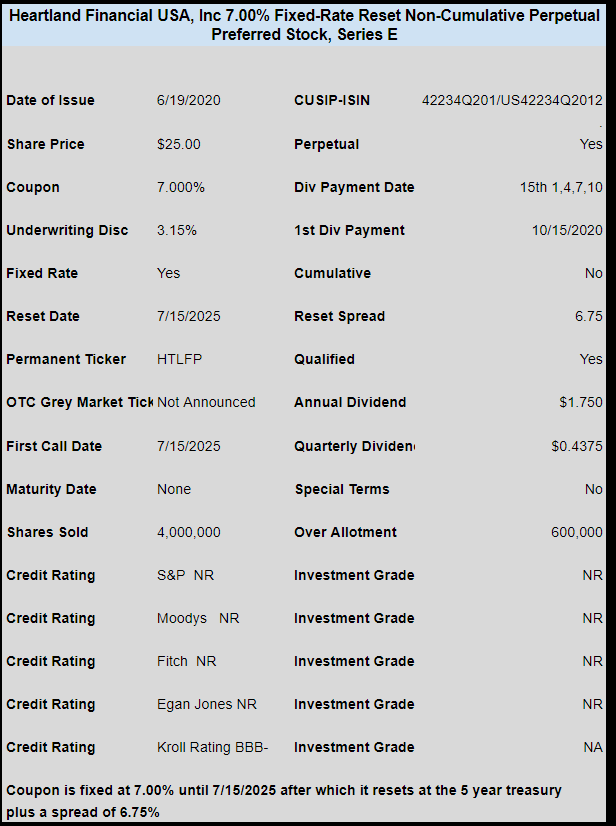

Lastly Iowa banker Heartland Financial (HTLF) has sold a new issue of fixed rate reset preferred. The issue priced at a fixed rate of 7% for about 5 years after which it will reset to the 5 year treasury plus a spread of 6.75%.

The OTC grey market ticker has not yet been announced.