Tele medicine company LifeMD Inc. has priced the previously announced perpetual preferred.

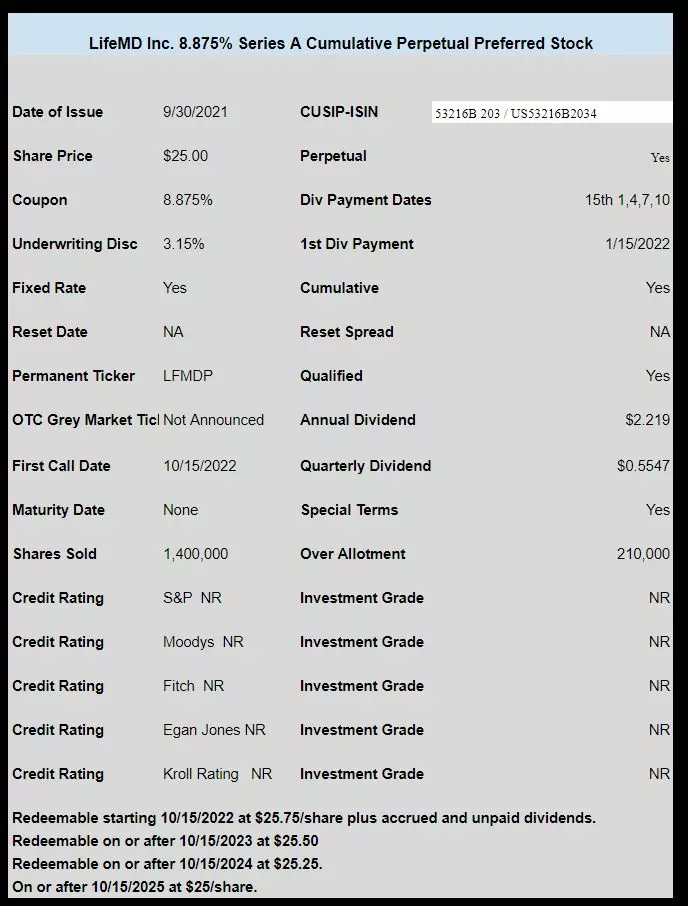

They have priced 1.4 million shares with a coupon of 8.875%. There are another 210,000 shares available for over allotment.

The issue becomes redeemable 1st starting on 10/15/2022 at $25.75 plus accrued and unpaid dividends. The redemption ‘bonus’ then reduces 25 cents/year until 10/15/2025 at which time redemption is at $25/share.

The company is escrowing the 1st 8 quarters of dividends for this issue.

The pricing term sheet can be read here.

Not only did these folks announce this pfd offering, but they also just recently diluted the common side as well. Revenue and earnings for the last ~4 years are heading in opposing directions, for the most part…

Sep 29, 2021 07:20am

LifeMD Announces Pricing of Public Offering of Common Stock

NEW YORK, Sept. 29, 2021 (GLOBE NEWSWIRE) — LifeMD, Inc. (the “Company”) (NASDAQ: LFMD), a leading direct-to-patient telehealth company, today announced the pricing of its previously announced underwritten registered public offering of 3,333,334 shares of its common stock, par value $0.01 per share, for gross proceeds of approximately $20 million at a public offering price of $6.00 per share of common stock, prior to deducting underwriting discounts and commissions and estimated offering expenses. In connection with this offering, the Company has granted the underwriters a 30-day option to purchase 500,000 additional shares of common stock at the public offering price, less underwriting discounts and commissions. The offering is expected to close on October 4, 2021, subject to customary closing conditions.

I will be watching the stock price closely to see if it can hold $6 in light of the offering. At this point I’m on the fence with the preferred.

I found this post on a message board that I thought I would paste in here which provides a different point of view (meaning bullish) on this:

“….The preferred requires no equity give up. The first few years of preferred dividend are to be escrowed, so it will not be a cash flow issue. With the $35 mm in preferred and the $20 mm in common they have actually raised substantially more than they need to reach profitability in 2022. True they gave up 3.3 mm common shares but they are paying off debt which has 1 mm warrants attached which will be extinguished so the net dilution is 2.3 mm shares. This equates to a 6% dilution for a net of fees total proceeds of $52 mm. IMO this is a very benign and strategic financing. Justin had to do the common as a consequence of the preferred, which he wanted to get done now because the institutions always want at least a little common in combination. The common was oversubscribed by 8 mm shares (330%). This means that the institutions love the company and will probably be purchasing in the market in the coming days. Bear in mind also that the institutions involved are significant Wall St firms who are likely L-T players and who will attract more eyeballs to the company. This is a very good deal for us that gives the company more than they need and accelerates the march to profitability through more marketing, call center and perhaps new product licensing, without having to do another capital raise probably ever….”

Here is more info to compliment what I posted, earlier regarding the common offering:

https://www.sec.gov/Archives/edgar/data/948320/000149315221024237/form424b5.htm

Tim,

Something wrong with the date part of this, “The redemption ‘bonus’ then reduces 25 cents/year until 10/15/2021”?

Thanks A4I–fixed