This is just a bit of a catch up from being out of the office.

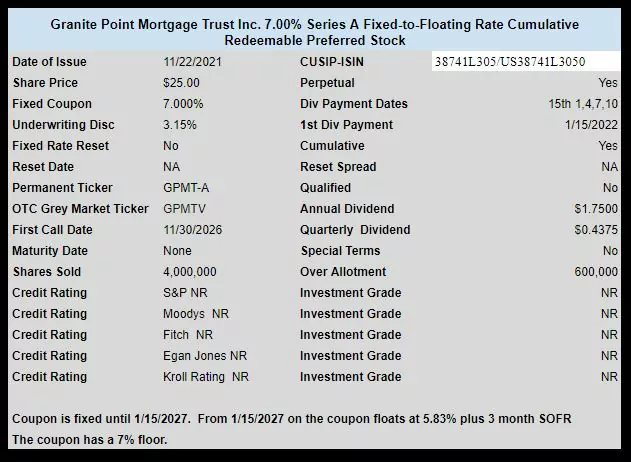

Below are the details of the new fixed-to-floating rate preferred from mREIT Granite Point Mortgage (GPMT).

The 7.00% issue is now trading OTC under ticker GPMTV. The issue closed right at $25.00 yesterday.

Note that while this is a fixed to float issue the coupon has a 7.00% floor (the lowest it will go).

The pricing term sheet is here.

I was unsuccessful in purchasing this with TD Ameritrade today.

Think Or Swim would not allow online orders and directed me to the trade desk. I called and was told it’s not on a major exchange and we will not take orders.

The SEC OTC trading rule and the CYA approach of the trading firms is hurting us little guys.

On Wed, Schwab was taking orders, but I couldn’t fill, Now they refuse it- ‘not a valid symbol’ . TD was showing vol. activity on it, without quotes- now no Vol

Oh well, market will prob be down until this new variant is old news.

The symbol appears to have changed to GPMTP. You can trade it on schwab.com

Yeah- it finally was allowed after not taking it. BUT- there are only two big trades of 42500 ea @24.80 from the look of it. So, not likely to fill.

Now able to buy at 25 ( tried 24.82, 24.90) – Schwab

Will take a small slice of this, an ok article on the pfd on SA by the Investment Doctor I think.. where as usual the comments go into the credit worthiness a little better than he did .. 7% is fine w me w the good terms outlined at reset. All this assuming the FIDO limit order executes! They kill me, pumping crypto (( “LINK YOUR COINBASE A/C” !!) while ‘restricting’ these trades. Bea

I would have never guessed this preferred would be so popular around here or maybe get this many comments. They were one of the mreits that suspended their div and if they had a preferred at the time might have suspended that as well. I always thought of them at not the lowest tier mreit but definitely not above middle of the pack. Heavier weight loans in hotel, office, and retail. I mean they are not in MITT territory but it was brutal for them.

I guess, just thinking out loud here, I would give up some yield and instead buying a preferred from ABR. I would feel more comfortable with them. Perhaps I am missing something or showing my ignorance of mreits.

If I bought one REIT for the rest of my life this wouldnt be it. But that’s not my game. I play the field play the IPOs and play the flips. So count me in.

Buying near par, for this puppy, might turn into a small loss. I don’t see this shooting up past 25.50. In a few biz days. This might be 24.75. So I don’t get the flip part unless I saw it lower. Not par. The name brand recognition just ain’t there for me. It was just a couple of years ago if my memory is correct that this type of mreit would be an 8% type yield.

New OTC rules wreaking havoc again. I have a buy order at 25 partially filled and I don’t know hat the hell is going on.

I wonder how long it takes Fidelity to figure out this is a fixed to float issue and adds it to their restricted list?

Happy Thanksgiving to all!

Sometimes it takes a couple months until the first dividend is declared.

Vanguard did not allow the transaction. Saying it is in a category of restricted transaction?

Yes. Vanguard has new policy which puts all the new preferreds, etds with temporary symbols from trading. I will need to ask Schwab to transfer my IRA account from Vanguard to Schwab. Not s long ago, Vanguard fixed income was able to place the order … it sure gets worse. LOL

Schwab would incentivize the transfer with $cash

Welcome, Tim. Hope all’s well and you got a good break.

Thanks for the pricing details.

An additional detail – this one will float with a floor of 7%:

“… plus a spread of 5.83% per annum of the $25.00 per share liquidation preference (the “Floating Rate”); provided, however, that in no event shall the Floating Rate be lower than 7.00% per annum.”

Happy Thanksgiving holiday to you and yours, and to all of us III’ers and their families and friends.

Thanks mbg–yes time off was good – maybe the best ever since I didn’t work the time I was away–now to get back into the swing of things.

Bought 4000 shares at 25 thru Fido this AM. Attractive pricing for place in the cap structure

Order filled at FIDO @ 24.99…ymmv

FWIW – FIDO and Schwab took my limit orders today. I even put in a market order at Schwabby for giggles n’ snorts….no fill…no fill…no fill…nada

I think Tim McP bought em’ all ha ha…..just kidding Tim

Happy Turkey Day to all III’ers

gobble gobble

For those who bought at Fido, did you have to call it in or did you place the orders online? I have a couple of limit orders just sitting there. Thank you and Happy Thanksgiving, everybody!

OD,

Online….Active Trader Pro user

You could always call the dreaded “bond desk” and wait and wait and wait

I can’t remember if they do preferreds…brain freeze

Etrade gives me this message and won’t let me buy :Opening transactions in Pink No Information, Grey Market and Expert Market securities are not permitted due to the inherent risk associated with these products.

I was able to purchase online w/ standard Fido platform. Put in small limit orders at 25.01 and 25.00. Only the first has been filled–at 25.00.

And, FWIW, able to buy NYMGV 2 days ago (altho now just showing as CUSIP but meanwhile can put in order for the current NYMTZ).

But.., they still don’t show ATLCL, which I bought yesterday at Vanguard.

Go figure….I can’t figure out Fidelity.

Thank you NWGG and CR, funny hiccup on this, put in two limit orders at 25, one at 25.02. Quite a while later the 25.02 filled at 25 so I changed the other two to 25.02 and they sat there. Came back an hour or so later, still sitting there. Went back in just now to do something else and they both filled at 25. Some kind of lag I suppose but happy ending all around. Thanks again and Happy Thanksgiving!