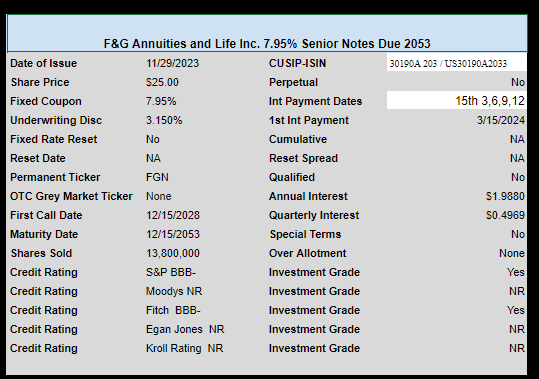

Insurance company F&G Annuities & Life (FG) has priced a new issue of baby bonds.

The issue prices at 7.95% and is investment grade per S&P and Fitch–both at BBB-

The issue has a long maturity date out in 2053. The ticker will be FGN when it finally begins to trade.

The pricing term sheet is here.

Thanks to numerous folks who pointed out this issue in comments.

I’m seeing $25.09

Compare to the LNC bond I posted on $1,000 Inst. Bonds category last night.

Not even close.

Joel, you are correct. But because they are different bonds. The one you posted has a present higher yield but is a 2026 floater off a lower 2.36% adjustment, while the other is a fixed issuance. If Fed lowers rates the yield could drop substantially. Plus they arent even the same cap stack. The $1000 one is a deferrable subordinate note while the $25 issuance is a senior unsecured. They really arent comparable and depending on ones assumptions, goals and eventual outcomes will determine which one performs better long term.

I get that. That’s why I said DYODD…which you did!

What you poking around on these days, MAYBE just a few symbols to work on?

Just a thought, I think it may be helpful for others if you know its a floater and cap stack to mention it. Otherwise it may have some incorrectly assume its a fixed. I knew the minute I read your post I intuitively understood it to be a low adjustable floater. But others maybe not be so versed and not as able to quickly figure it out may not have.

Keep in mind this doesn’t mean I think its a bad issue in any way whatsoever.

I do check through my brokerage bond screener frequently, but big board bonds credit spreads have really fallen off. I actually sold some off on the rise. Now I did buy some 2035 Empire District Electric fixed at about 6.5% YTM this week. But that was just adding to the collection I already have as it doesnt pop up to buy much. Nothing to do cartwheels over.

I just watch through my bond brokerage screener, but nothing I am finding of real interest now until pricing changes. But I watch.

FYI, for comparison there is a 2028 7.4% bond trading at about 7.25% (cusip 30190AAC8). I assume that F&G is matching asset maturities with these securities.

The rate I find confusing. 795…not 8 not 7.875 not 7.85. I can’t remember any deal pricing at blank95!! It’s like when people say the point spread is telling them something. I’m just not sure what its saying!!!

Anyway supposedly a 12/6 settlement,….FNG symbol??

If you Prefer–the notes will be issued in minimum denominations of $25 and integral multiples of $25 in excess thereof. We intend to apply to list the notes on The New York Stock Exchange (the “NYSE”) under the symbol “FGN,”

From the S-1 registration statement

I saw pricing, in secondary, Friday….another strange take on weird offering!! Thought 12/6 was day 1.