CLO owner Eagle Point Credit Company has priced their new issues of baby bonds.

The baby bonds, which mature in 2030 are priced at 7.75%. This is a large 4 million share (bond) issue–actually made possible by the companys aggressive ‘at the money’ common share sales program.

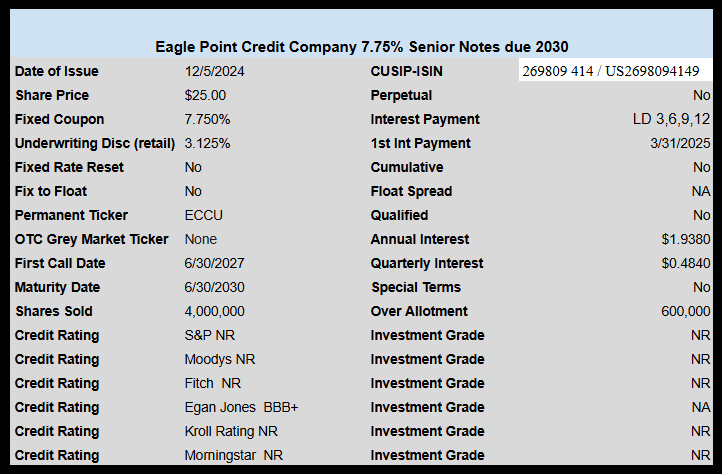

The pricing term sheet is here.

Prospectus: https://www.sec.gov/ix?doc=/Archives/edgar/data/0001604174/000110465924126297/tm2429841d6_424b2.htm

ECCF similar but 8%. Trading close to par today

It’s similar in the interest rate and timeframe, but worth noting that ECCF is a Term Preferred and the new ECCU is a BB. ECC seems like the sort of company where this distinction might be important in the future.

Here’s what I have for YTM of ECC’s Term and BB offerings:

ECCC, Term, 7.18%, 2031

ECCF, Term, 7.58%, 2029

ECCV, BB, 7.51%, 2029

ECCW, BB, 7.12%, 2029

ECCX, BB, 6.78%, 2028

It’s a little hard to see through all the noise, but in a logical world, this should mean that either this BB at 7.75% goes for above $25 or the rest of them are going to drop. But logic can take a while to work, and some of these differences have been going on for quite some time, so who knows. And maybe being a higher face, this new one is more likely to be called?

Nathan-

My spreadsheet calculator has YTM for ECCF at 7.8% based on today’s closing price of 25.15.

Thank you for noticing and commenting. I indeed had it messed up. After correcting (I hope), I also now get ECCF very close to 7.8% YTM.

Caveats: I’m still lying to the YIELD formula by telling it there are 4 payments per year rather than 12. And I’m not stripping accumulated dividend, although this is less of an error for a monthly.

I’m still learning about these new issues, and maybe someone could help me. When it says “None” for “OTC Grey Market Ticker”, does this mean that they will be going straight to the final symbol as soon as it trades? Or will it have a grey market ticker, but it’s just not known yet? More generally, is there always a period of OTC trading or is that just for some issues?

Notes don’t trade early on the Grey Market like preferreds. So yes, it will trade under it’s given symbol once it starts trading.

Interesting, thanks! Is there a technical reason for the difference, or just tradition? Open grey market trading for new issue preferred stock seems like a wonderful opportunity for those in the know, but it surprises me that the opportunity exists for private unconnected investors.