Markets continue to move in a manner indicating no one knows for sure what is going to happen in the weeks ahead. As if we didn’t have our hands full with tariffs as well as many geopolitical events we now have the potential for a government shutdown next week.

In more normal times one could simply yawn about the government shutdown I think it is wiser at this time to pay attention. It would seem to me that with all the vitriol in the capital this shutdown could go longer and have more noticeable consequences.

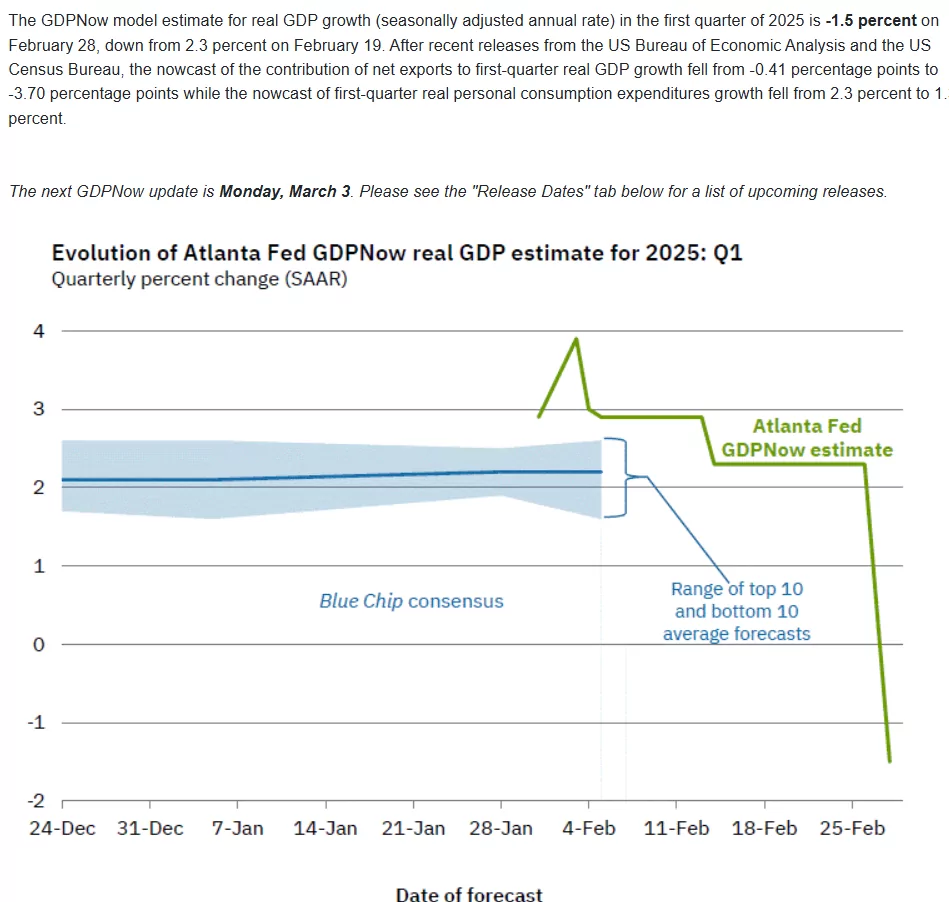

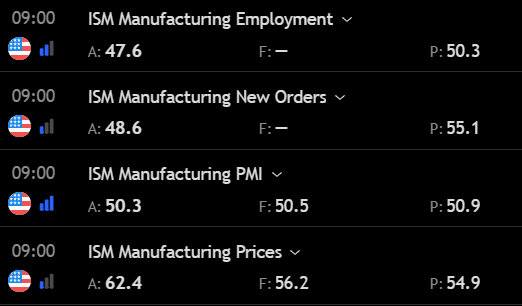

The 10 year treasury yield is trading lower once again today in the 4.18% area–helping to give just a tinge of green to income securities. Economic data–the institute of supply managers data–weak–except for the price reading which as hot.

I hate the uncertainty–absolutely hate it, BUT I have to deal with it just the same. Since our portfolios are giving us a respectable return (certainly not a super duper return) I guess I will mostly watch the drama unfold.