At the request of a read I am posting this tale from a week or so ago.

Our site runs on donations to keep it running for free. Please consider donating if you enjoy your experience here!

At the request of a read I am posting this tale from a week or so ago.

BIP preferreds have traded poorly, at best. All I can figure is that CRE exposure has everybody worried. Instead the Mcreits have done much better!! Crazy world…

FWIW…

The history of the world is that interest rates move in generational cycles with length on the order of 30-40 years. We have just ended a 40 year down cycle and if the 4,000 year global history of interest rates is any guide we are now in a 30-40 year cycle of increasing interest rates. Not in a straight line… there will be ups and downs within a long term upcycle.

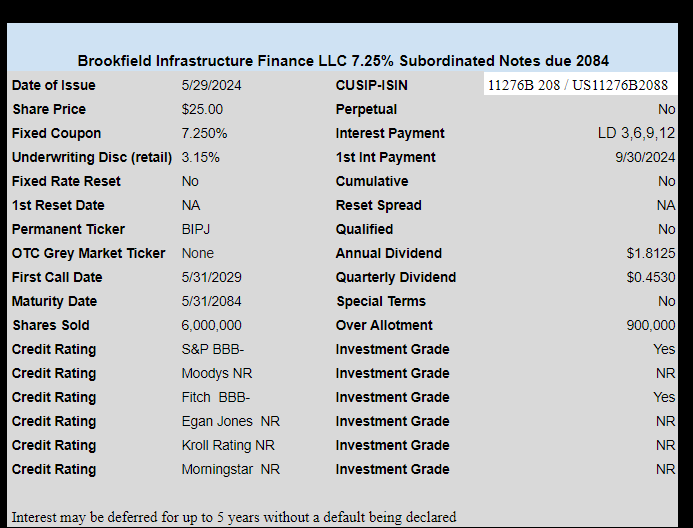

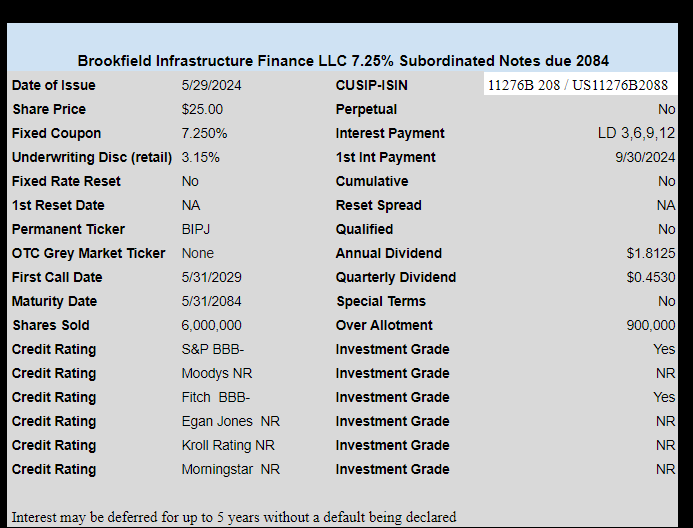

If this plays out – then a 7.25% fixed coupon subordinated BBB- 60 year bond is going to be a trainwreck.

Also looking at the website – this infrastructure play is all over the map geograpically and also in terms of the type of infrastructure it invests in. Who knows what geopolitical events are going to occur in 60 years? I would rather not have a bond clearly exposed to geopolitical risk with a 60 year maturity.

Compare with long duration infrastructure plays like MLPs such as ET and EPD which own energy transportation infrastructure in the US and transport oil, gas, chemicals and NGLs out of places like the Permian basin to end markets. The benefit here over a fixed coupon bond is that the distribution at least has a chance of keeping up with inflation. Another benefit is that these are US based assets located in traditionally sane parts of the country.

A 60 year+ bond is essentially a perpetual. It does not have a 5 year reset feature. 5 year resets offer some protection against interest rate increases. Also, and to Newbie’s point, a cumulative feature on a that can be found in some reset prefs is far preferable (IMO) to the 5 year “we don’t have to pay you any interest at all” feature of this issue.

I would rather eat broken glass than buy this.

Im not a player/trader here either, August, at least at this price point. But just a bit of clarification. Technically this issue has a “better” cumulative feature than a cumulative perpetual preferred.

“ Deferred interest will accrue until paid. A Deferral Period terminates on any Interest Payment Date on which the Issuer pays all accrued and unpaid interest on such date. No Deferral Period may extend beyond the Maturity Date.”

See it at least caps the pain at 5 years, while a cumulative preferred can defer to infinity. That is the theory. In reality if either type isnt paying by 5 years, likely one isnt going to ever get paid. Or accept some painful cram down offer to settle up. It is what it is. An asymmetric risk perpetual “preferred” with the company getting the tax break and leaving you paying full rack rate interest costs. Also if memory serves one has to pay income tax on any deferred payments. If it later goes belly up, you have to amend to reclaim the cash is my understanding anyways.

Hey Grid – yes you are correct on the 5 year period. Yes this is technically superior to a cum pref issue in that regard.

I would still rather eat broken glass than buy this issue & will add that I think bitcoin is safer.

August, if company is fine and market pukes it to $15, you and I can eat some glass and then plunk down some cash for some quick gains!

Grid you love being a swing trader. I guess the million dollar question that no one has an answer to is what are rates going to do short term and for the longer term. A lot of us here have been through several rate cycles.

I think going forward higher rates are here to stay, but what they will be who knows.

My feeling is that businesses taking short term higher rate loans and people piling up credit card debt at 28% that are hoping rates will come back to 1/2 to 3% are going to be disappointed and we will see a lot of them filing for bankruptcy.

Charles, personally I am fine with 3% inflation and 5% funds rate, but I really have no opinion of where rates are going. Though I still wonder where the hell my 6% CDs are, last broached by my local bank from 2006. Im not too worried about the extremes presently, that being the ZIRP of a few years ago, or the 15% plus from 4 plus decades ago. Have a little of everything with a stronger tilt on safety/short duration. Not from any sense of any no knowledge emotional sense of doom, just simply its at a yield I can accept. But, Im mindful of reinvestment risk, and will monitor that.

Thanks for the reply Grid. I have been beginning to doubt myself. I have been playing in the sandbox of 2027 to 2031 or so. Been checking longer term bonds thinking I might want some but the market is acting like rates are going to return to normal, whatever that is. Returns were higher 9 months ago and prices have been bid up so high that 20yr to call bonds are only paying 1/2 to 1% over a CD. Personally I don’t see any benefit to being a long term bag holder for the risk.

Charles – when you say “long term bag holder”, what do you think will happen to long term rates if we enter a prolonged recession? I would expect rates to fall and I think that’s a pretty reasonable expectation. So, if rates were to fall and let’s say the prevailing rate on a high quality, low coupon QDI preferred was 5%, how much capital gain would someone expect if they bought now? Run that math sometime.

“My feeling is that businesses taking short term higher rate loans and people piling up credit card debt at 28% that are hoping rates will come back to 1/2 to 3% are going to be disappointed and we will see a lot of them filing for bankruptcy.”

Charles – Help me understand…What direction will long term rates go when these bankruptcies happen? Wouldn’t I want to hold high quality, low coupon, longer duration under that scenario?

Dick, Run me a chart over a 20 yr. period and show me the ups and downs on a bond. I was referring that I am not paying over par to get 5% on a bond. Bonds and preferred are 2 different investments.

Charles,

Just my observation, but I think there is probably a lot less strategic planning going into much of that credit card buying / short term borrowing than we would like to think.

From conversations I have had with parents of kids at my wife’s school who are struggling with increased costs (inflation) and the loss of a lot of government programs from COVID era, I think a lot of that credit buying is happening because folks don’t see an alternative. If they want gas/groceries/etc., they have to pay for them – and if they don’t have the cash, they pay with credit hoping that they will find a way to pay for it in the future. Most I have talked to are not stupid, they just don’t see immediate, viable alternatives (whether there are any or not).

However, I am an old guy and maybe I am missing the point. More than one parent has told me that I am thinking about the problem in an old fashioned way. They think they can borrow to live beyond their means (my words) and that if things get bad, the government will bail them out.

Certainly gave me pause.

Last 25 years of loan modifications, student loan forgiveness, Covid-era extra unemployment payments and eviction moratoria, free phones/free internet, etc. etc. – maybe they aren’t wrong (or at least I can see how they might think the way they do)?

I think a some companies borrowing at high rates are in a similar pickle. It is not necessarily what they want to do, but they have to do something to keep the lights on and people paid as they try to find a way forward. The alternative is to close the doors, which in some cases, would be better for the owners in the long term, but “hope springs eternal”.

Next week or two I will get to meet one of the owners. I suspect they are combining business with pleasure. Coming out to wine country and with plans to stop on by. See what vibes I get.

I may be out to lunch on this one, BUT, If you read the prospectus on at least of the preferred stocks, Brookfield cant pay dividends if the interest payment on this note is in a deferred status. So, if you own a preferred, and interest gets deferred on this note, you are as they say, up the creek until it’s paid on this one first

Read Bear’s post over on the sandbox page. I apologize ahead of time for this vague post, but in general, several of these PE companies have been limiting withdrawals this past year and selling several of their more marketable properties like a casino in Vegas to raise cash. I would assume they can’t or will not sell properties at a loss. Are they raising cash to weather the storm or pay out existing investors or raising a a cash hoard for future purchases?

With all the talk about trouble in reitdom I am not sure I want invest as a buy and hold investor.

The things that worry me most about this offering:

* Maturity ~ 5/31/84…60 years from now

* Subordinated Debt

* Interest Deferral ~ up to 5 years without being default on a BBB-/NR note

Newbie, I will take trust debt SCE PN even if it’s not term before I would buy this. Los Angeles is still going to be here in 60 years unless someone nukes the US.