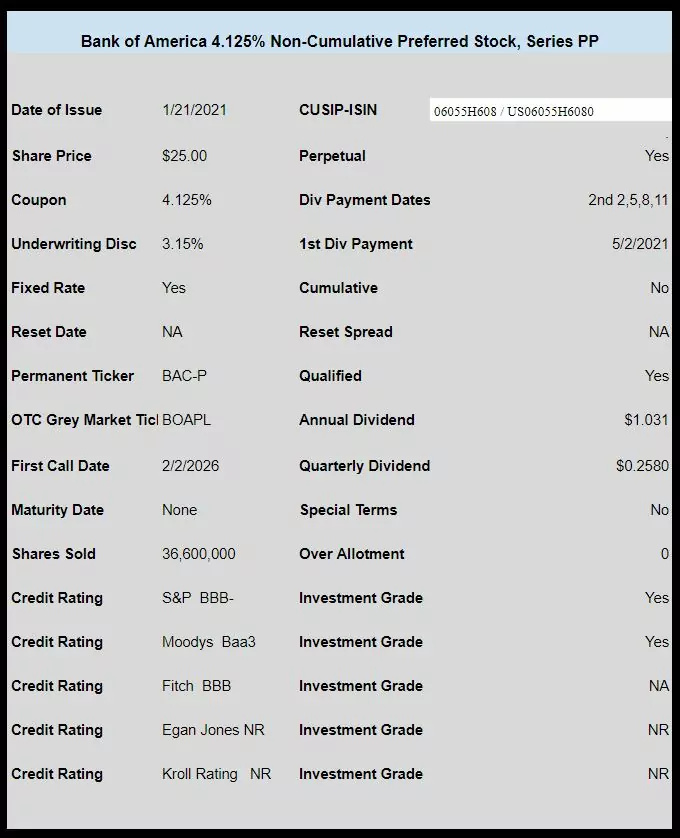

Giant banker Bank of America (BAC) has priced their previously announced $25 preferred stock issue.

The issue prices with a low coupon of 4.125%. The issue is non-cumulative, qualified and investment grade.

They have sold 36,600,000 shares with no over allotment.

The issue trades immediately on the OTC grey market under temporary ticker BOAPL.

Prior to making any buying decisions investors should review all of the preferred issues outstanding from BAC which can be seen here.

The pricing term sheet can be found here.

razorbackea had the pricing prior to any SEC filings.

For an issue that engenders such a low level of interest here it was nearly impossible to buy any shares below $24.97 up to $25.02

4.125% = Pass. If this is what you want buy BAC-L for 5%, as others have pointed out. or BML-L with the same rate and some rising rate protection.

Yes, BAC-L does yield 5% but may fall more than the 1% difference in yield on the next scare of interest rates going up. This newer BOAPL likely to maintain the $25-ish price and likely a flip if it goes to mid-$25s.

I did buy some $24.96 and may buy some more if gets a bit lower

picked up 32 shares at $25/share (buy and hold)

Not an issue to own when interest rates rise. Will a 25% increase in money supply in 2020 alone kindle inflation and rising rates?

That’s the big question in my mind – Modern Monetary theory seems a little TGTBT.

I find it amusing that so many on WS are now confident predictors of interest rates!!!! You know the same voices / the same people from 2015 on who shouted ULTRA SHORT is the only place to be.

09:46 1/22 vanguard 150 shares bought @ 24.95