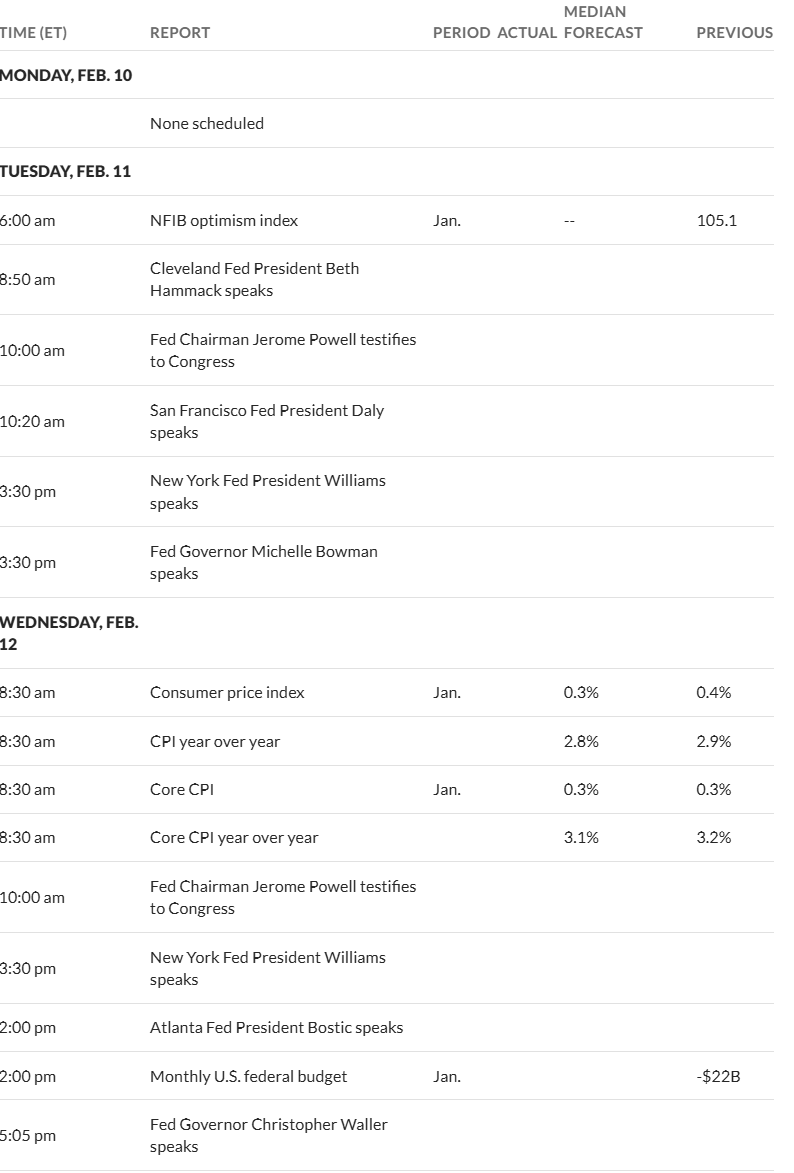

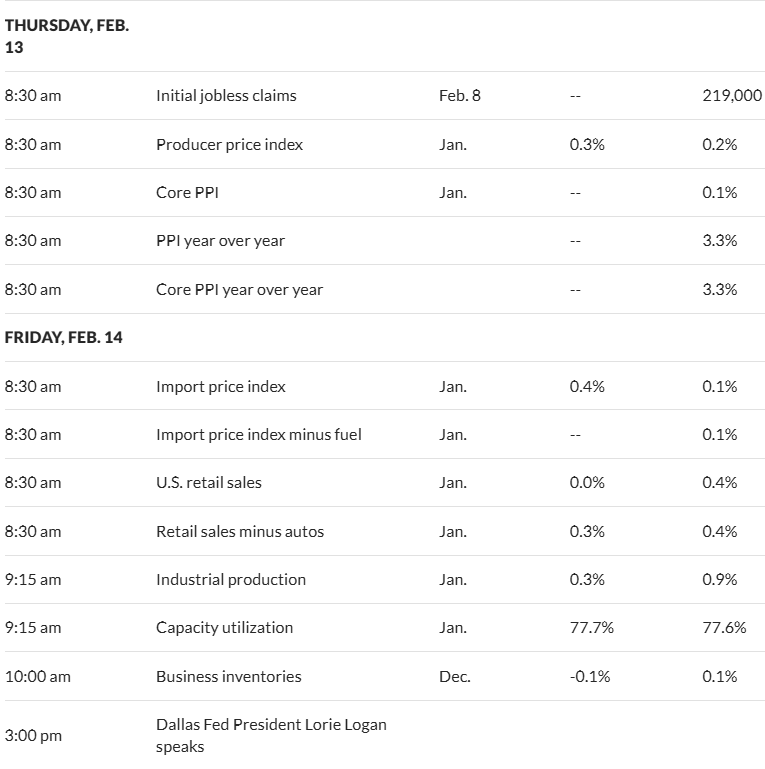

Well we almost certainly have another exciting week to look forward to –up or down who knows, but likely in both directions. Last week the S&P500 moved up just 1/2%, but moved in about a 2% range. This week we have the consumer price index (CPI) and the producer price index (PPI) being released on Wednesday and Thursday respectively and additionally we have Powell testifying before the senate and house on Tuesday and Wednesday. Lots of excitement will be created.

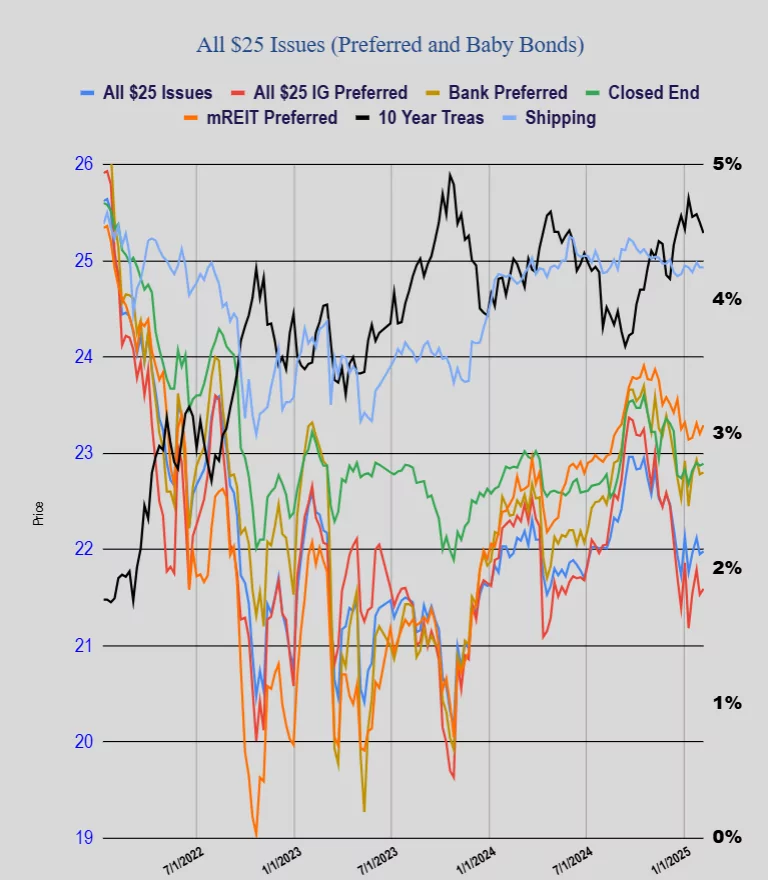

The 10 year Treasury yield closed the week 4.49% which was down 8 basis points on the week. The yield moved in a range of 4.41% to 4.60% for the week. Economic data continues to push rates around–most data has been a bit mixed–some better than expected with some worse than expected.

The Fed balance sheet fell by$8 billion last week as the balance sheet runoff continues.

Last week in spite of interest rates falling 8 basis points for preferreds and baby bonds didn’t respond as the average share price fell by 2 cents. Investment grade issues rose 3 cents, banks rose 1 cents, CEF issues rose 2 cents, mREIT issues rose 3 cents.

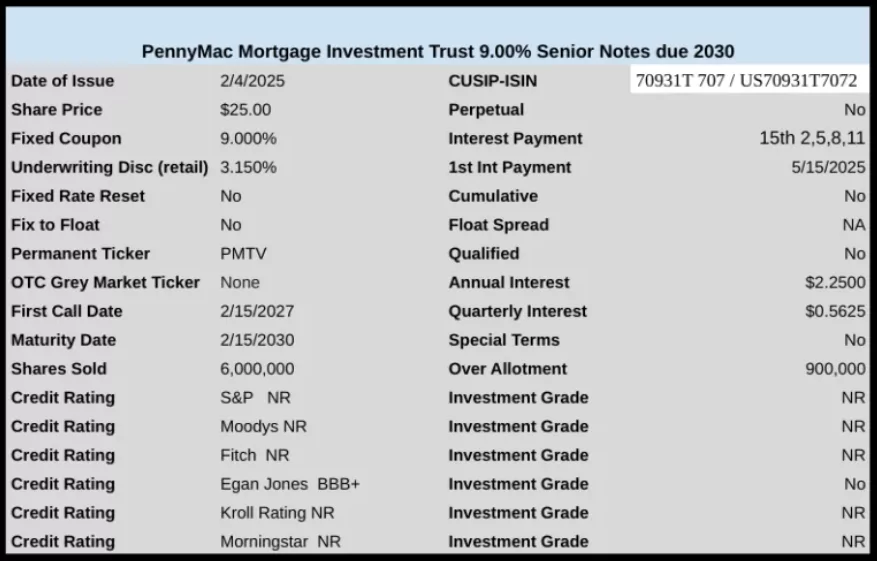

We had one new income issue launched last week as mREIT PennyMac Mortgage Investment sold a baby bond with a coupon of a tasty 9%.