Banker Wintrust Financial (WTFC) has priced their recently announced fixed rate reset preferred offering.

The issue will trade with a coupon of 7.875% for just over 5 years–until July 2030 and then will ‘reset’ at the 5 year treasury rate plus a fixed spread of 3.878%. Resets will be every 5 years thereafter.

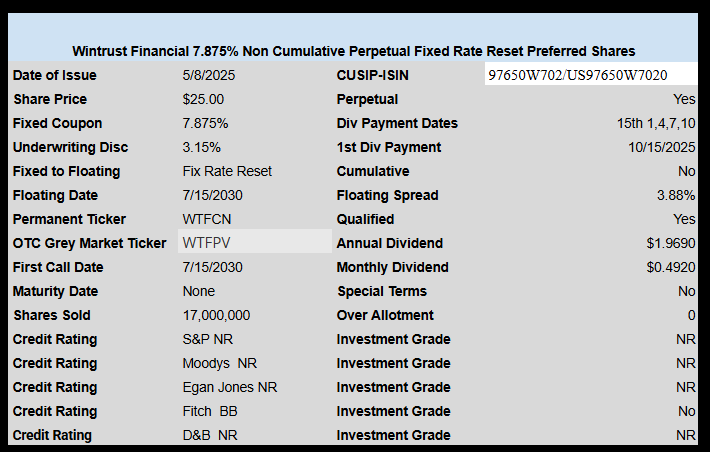

The pricing term sheet can be seen here.

Today 5/13 I purchased on two seperate orders @ $25.28 and $25.30….any comments on it trading at these levels while the two outstanding issues trade at 6.48% and 6.84%…..Just looking at those two the new one is pretty cheap?

Not as comparable as you might think because both outstanding issues are “pinned to par” due to near by call dates with high probabilities of being called….

Wintrust ….. WTFPV …… Monday Pre Open ( 7:50am NY ), entered a limit order on Schwab SSE that Schwab took, yet showed a Tack-On $6.95 commission.

Any Schwab fills without the commission item…..

JIM; Please let us know if your order actually gets “filled”. There have been several here that have entered orders only to find out they are not getting filled. Iam very interested in buying a fairly large amount of this issue but spent tons of time last friday with zero luck. And I have my account at Schwab as well.

Will do, No pre-mkt fill ( usual for the Prfrd Mkt ) I will try again at open.

SSE shows a Friday close at $25.17 …..” Last Trd ” $25.08

Volume today over 1,500,000 as of now

https://www.otcmarkets.com/stock/WTFPV/quote

I have found today to be somewhat of a frustrating day as I’ve spent close to 3 hours on the phone getting Schwab to chase this thing down. STILL CAN’T BUY IT ON SCHWAB as they are trying to tell me even though the volume is over 1.5 million its just dealer to dealer right now. Sounds like one of those Bullshit stories to me. I gave them every piece of info off of Tims post above. But they still don’t have it set up in their system.

Chuck, to funny, schwab just accepted my order for it.

RA; BUT, did your order actually get FILLED???????

No, my offer is very low, I’m really not interested at the current price level.

Chuck, just tried at Schwab. Closing transactions only. Not able to buy. I miss Scottrade…

https://quotes.freerealtime.com/quotes/WTFPV/Time%26Sales#google_vignette

The transactions without the “R” in the second column seem to match the transaction data in the otcmarkets website. R may be broker to broker – low was 25.08

bought some at fidelity $25.15

To “Bull2000”; Did you just use the temporary symbol of “WTFPV”??? I’ve spent over 2 hours on the phone with my Schwab Rep this morning and they still do not have it available as of yet. They told me they have to set up a profile and put it in their system. I planned on buying some this morning but can’t do it on Schwab.

Same with me at Schwab ….. Tried online with SSE …. and then at the Main Schwab Trd page….. ticker not recognized.

I put in a limit order with Fidelity for 400 @ 25.12, all-or-none. This didn’t fill despite quotes showing buys at 25.12 after that. Later I canceled it and made a new order, 400@25.15 without all-or-none. That didn’t fill either before the close.

Etrade: Opening transactions in Pink No Information, Grey Market and Expert Market securities are not permitted due to the inherent risk associated with these products.

Even if they would sell now, there is 6.95 fee while OTC

Ticker is loaded at Wells Fargo Advisors, shows last price $25.14

Not sure about others but it is pointless for me to try to buy at Ally until it hits the pink. It shows it is on the grey at the OTC. Been through this before with them. I can place an order all day long by calling in but it will never function properly upstream from them.

Were they using the WTFPV ticker , or something else.

Appreciate post of trades being done today.

Looking at these dates when would one expect this to trade on the grey market and regular market? I see a settlement date of 5/22

Craig; Thats a very good question. I wonder why there are no ratings to speak of?? Obviously with that “coupon rate” the big boys don’t have alot of respect for this bank.

Chuck—I am also surprised by the coupon rate. I was going to load up, but now feel somewhat cautious.

There were advertised as expected ratings BB (stable) (Fitch) / BBBL (stable) (DBRS).

Source: FWP

https://www.sec.gov/Archives/edgar/data/1015328/000110465925046219/tm2513736d4_fwp.htm

I compare this to ATH-E. Athene is an insurance company, not a bank. But it was investment grade when ATH-E was offered, and the ratings have only gone up since then: https://ir.athene.com/financial-information/ratings

ATH-E pays a 7.75% coupon till 12/31/27, and the reset rate is 5yT + 3.96%. It’s trading a tad over $25 now, but often dips below $25. What are the arguments for picking the new Wintrust over ATH-E?

Roger-

I’m starting to wonder if there’s an element of trophy hunting among preferred buyers.

Sorry Rocks, what do you mean by trophy hunting?

O. Chongusu he means there is a lot of excitement on the board to buy this. Makes you wonder if anyone is doing their due diligence or following the trend of the moment.

It seems that every new issue generates buying interest without regard to other stocks on the market. I feel it too. I want to buy it and hang it up above the fireplace to admire and remind me of my hunting skill. My trophy!

I tend to think of some of the ills as the trophy mantle acquisitions. When only 5k to 25k shares outstanding they are special. New stuff? Not so much.. we are starved for new issues.

rocks

A lot of new issues that generate interest will shoot up initially, then settle back down. I often try to buy those and flip them as they shoot up. Often make 15-20% and only hold for a few days.

Don’t do huge volumes and try not to play in things that are junk, but a little flipping profit makes me feel good (and I don’t talk about the few times I have gotten my fingers singed…)

Flipping new issues used to work for me but not so much in the last year or so. Mostly holding steady.

On Thursday – Late post by… af …. showed an attachmnt of Pink Symbol of WTFPV ….. don’t know when that is in play.