‘ money doesn’t grow on trees’ asks what are some securities–term preferreds or baby bonds on my list of favorites? I often refer to liking short duration (while I understand many like to go with perpetual preferreds–which is possibly infinite). Most short-maturity issues I buy I have little expectation of a capital gain (or loss), but pay a substantial dividend or interest payment/

Why do I like short maturity issues? When interest rates move higher they trade flat—when interest rates move lower they trade flat. Actually, that is a bit of an exaggeration – they do react to interest rates but mildly compared to perpetual preferreds. Why does this happen? They have a ‘date certain’ redemption date that is generally 2-7 years in the future and this date keeps the price pegged close to the redemption price and it generally moves closer to $25 the near the maturity date gets. Is this true of every short-dated security? It is true if the company performs well as most do–and it is true even for more marginal performers—BUT those destined for bankruptcy can go down in flames as investors detect a marginal ability to ‘refinance’ the preferreds or debt.

I maintain a spreadsheet of short maturity issues -term preferreds and baby bonds with maturities no later than 2031—it is here and can be found under the header of ‘baby bonds’ on the top of all pages.

Let’s look at an example--business development company (BDC) Saratoga Investment (SAR) has 4 baby bonds outstanding with coupons ranging from 6% to 8.5%. You might guess that the 6% bond would trade much lower than the 8.5% bond–you would be correct that it is lower–but incorrect that it is ‘much lower’ Yes it is lower, but only by $1.06/share.

Here is a WEEKLY CHART of the 8.50% issue (SAZ) which I own and was issued on 4/12/2023.

While interest rates have moved quite a bit–up and down in the last year the total range of the share price is just a little over $1/share. Some of the noise in this chart is caused by interest accrual and ex dividend dates.

Here is the WEEKLY chart of the 6% baby bonds (SAT) from Saratoga Investment which has a wider range of trading–around $2/share. This is caused by the very substandard 6% coupon–but notice how much it has moved higher in the last year or so as it is drawn higher by the maturity date, although it remains almost 3 years out. So an investor in this issue will receive their 6% annually and almost 4% in share price gain at maturity. A yield to maturity of something over 7.3%.

Interestingly of the 4 Saratoga issues outstanding with varying coupons and maturity dates they all trade in a range of $24.01 to $25.19.

Enough on that issue–what do I like (and these are not recommendations of course–just what I like).

Here is a relatively short list of issues I like–and most I own.

Carlyle Credit Income Fund 8.75% Term Preferred (CCIA) – mandatory redemption 10/31/2028. Trading at $25.75 now (a bit high). Current yield 8.56%. Monthly payer.

Eagle Point Income Fund (ECC) 7.75% Term Preferred (EICB)– mandatory redemption 7/31/2028. Trading at $24.86. Current yield 7.79%.

Priority Income Fund (common not listed) 7.00% Term Preferred (PRIF-D) – mandatory redemption 6/30/2029. Trading at $22.78. Current yield of 7.68% with a yield to maturity of up around 9%–or a little higher.

NOTE–the 3 issues mentioned above are all CLO (collateralized loan obligation) holders. If you are not comfortable with CLOs I suggest watching the detailed video here.

In the business development company sector I like the following baby bonds.

1st off I like the 8.50% baby bond (SAZ) from Saratoga Investment. Share price movement is almost all related to interest accruals and interest payments. Trading now at $25.18–so pretty much you can expect your 8.50% until 2028.

Next I like the New Mountain Finance 8.25% baby bonds with a maturity in November 2028. I do NOT own this one yet–it traded too strong upon issuance but now is moving toward a buy point with a current yield of 8.10%.

I also like and own the 7.75% baby bonds from Capital Southwest (CSWCZ). At this moment trading strongly at $25.85. A maturity date on 8/1/2028.

Others I like are–

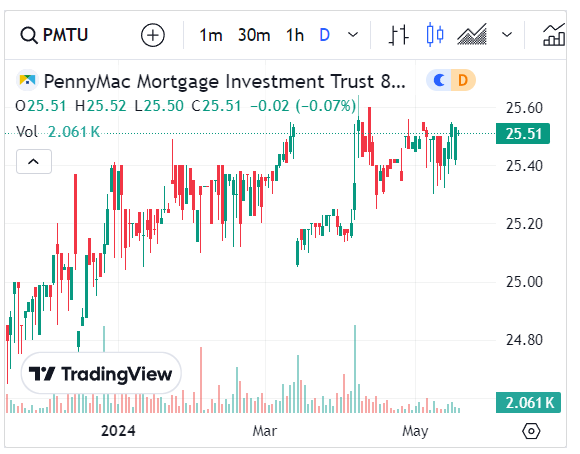

I like and own the Pennymac 8.50% baby bonds (PMTU). Trading with a bit more share price movement than some other baby bonds (since Pennymac is a mREIT) with short maturities it is now at $25.51. The maturity date is 12/30/2028.

I like, but do not own right now, the 8.00% baby bonds from NewTek One (NEWTI). NEWT was a BDC, but converted to a bank holding company a couple years. Once again this issue has a maturity date in 2028.

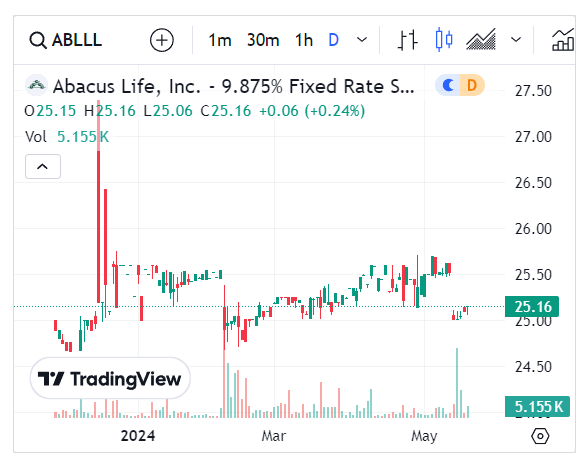

Lastly I am intrigued by the 9.875% baby bonds from Abacus Life ABLLL). Shares trade very steady, but they are new to the public share arena and I still have some discomfort with the company–we’ll see if that passes.

Now are these the only baby bond and term preferreds that I like? No. But they are some of the ‘high yield’ issues I like. I own some from very solid companies such as WR Berkley (WRB) for instance–investment grade and very strong financials, but low coupon.

As you can see in the weekly chart below shares have moved in a $5/share range over the last 5 years–and if you look at a longer chart the range is more like $8/share. This movement is caused by a maturity date in 2058–34 years from now.

The bottom line is that you should build a well diversified portfolio of various issues. No one should ‘hang their hat’ on a full portfolio of high yield issues (at least in my opinon). Additionally one needs to remember that these issues have maturity dates in the next few years–but they are optionally redeemable much earlier. When buying one shouldn’t be paying more more than $25 plus accrued dividends and interest (so in the $25.40-$25.50) range which is usually attainable within a short amount of time–patience may be required.

You can expect that if interest rates were to fall say 2% many of these issues will be called–but realistically the odds of that happening in the next year or two is very remote, but NO ONE knows what will happen with interest rates.

Every high yield bond I buy I fully expect that it will be paid at maturity, but who knows maybe someone will go bankrupt.

Issues I will likely not own are those from B Riley (RILY) and Sachem Capital (SACH). While all their issues have short maturities I have some level of distrust of the management teams-maybe warranted, maybe not, but it is how I feel at this time, which is subject to change at some point in the future.

Please understand that I do not recommend any particular security to anyone. There is ‘suitability’ that needs to be considered. While all the folks on Seeking Alpha ‘recommend’ buying certain issues – I don’t really believe in that since no on knows ages, incomes, money for investing and on and on when making these ‘recommendations’–not to mention that I am not licensed for such endeavors.

One of my safe issues is PRE-J, European Reassurance decades ago, partner with Bershire Hathaway. Apparently it is well respect in Europe. My earlier shares had mixed unrealized gain and losses. After adding some, the current yield is just 6%. Got 2 years and if called before that with 25.50 or so per QOL. I did pick up some Gridbird’s BANFP ((Thank you lGrid) after unloaded about 1/2 of CCNEP. It is possible that CCNEP could come back … perhaps not worth the drama. Jaime Dimon apparently not happy with the current market per FAST MONEY. JPM down some yesterday. I did lose actually quite a lot of First Republic, once upon a time a presumably (based on market action) a safe and “generous” $26 bank preferred. I still hold CUBI preferreds and ASB preferreds. BTW, I got saved by the fifth cardiologist who specializes in irregular heart beat. A pace maker plus time released calcium channel blocker which controls Atrial Fib. The other 4 well established cardiologists had no clue, including an Asian guy who got two fellowships from the Mayo Clinic. Did not go to Mayo, too cold (problem started last year) and their Arizona facility did not seem to have sharp cardiologists.

Tim, you might want to add TVC and TVE to your short-term list.

Added to TVC today at 22.09……

2WR – pardon my ignorance, but I am obviously missing something about TVE/TVC.

It looks like they are $25 issues that pay 2.x% (from Schwab and QOL).

They mature in a few years more or less so that final pay off adds to the total yield at maturity.

Private – Since these are TVA securities, interest payments on them are also exempt from state income tax.

Good article. Nice to know we play in the same sandbox. Of those you mentioned I have SAZ, NEWTI, PRIF-H (not D), CSWCZ, and EICB (also have EICC). Missed out on New Mountain BB but glad to hear its back to where it might be considered buy territory; I do have a modest stake in the New Mountain bond. Typically I play small ball with these so I have lots of positions but lesser in value.

Pig, I am trying to balance between risk and income I allocate no more than 3% to any one holding unless I am buying more to trade. Since I have not gone to 100% IG ( investment grade) Most of my holdings are averaging 1-1/2% of the total account. As has been mentioned here, you take a risk and have one loss it can wipe out any profits and then some.

Like you, sticking to smaller allocations helps lessen the risk.

Always interesting to hear what folks “full positions” are and the various rules they invest with. I have a subset of similar rules, only allowed to break them for certain market conditions and CDs.

You know Pig I am underwater on BMY and WHR and there is a risk they cut the dividend but I don’t worry as I only own 50 or so shares. I broke my own rule of not buying any stock over 50.00

When I finally got a decent job and had excess income I started buying stocks. That rule comes from when I was making $280.00 a week before taxes and the rule hasn’t changed.

I am also underwater on TY-P and UEPEP but I don’t care and plan to hold until they are called and we both know how long that will be.

Charles I have BMY on hotlist, I should put this note in common stock discussion here but since you mentioned it will note to you. Since it is an older trade idea I will mention the alert on it- came from my marketplace service. I only wonder why an activist like Peltz hasnt jumped all over this. One good point that was made by a pharma analyst is they are not in the GLP weight loss molecules..mostly a cancer drug franchise w all the acquisitions and a strong pipeline. With other co’s close to marketing those drugs, it may stay out of the fray. Not a reason to buy but I could also see another co buy it, 90bil is nothing to some of these pharma cos. Hope you are enjoying the retirement!! Bea

For me, when talking about preferreds, I usually start at 1,000 shares. A full position is 2,000 shares. I currently have a couple at double that, but who knows if my analysis on those companies is accurate or if I’m missing something.

This is a great question that you pose. I prefer to hold fewer positions but in larger quantity. I often feel a bit overwhelmed when I get too many holdings, whatever that means. But that’s just me. I can tell from the comments here that many have probably dozens of holdings, but I just can’t do that for some reason.

Rocky, this site has been great at helping me with keeping track and there has been a time I put in sell and buys because of the alerts here.

I do similar to what you do but I do smaller amounts for several reasons.

One, I have to be confident it’s a stock I want to own and a lot of times there’s changes in the price so I will add in tranches. Occasionally one will get away from me and I don’t get a full position. Another reason, I could be my own worst enemy. Some of these BB and preferred have small volumes and large purchases can upset the pricing. I prefer plucking the chickens one at a time instead of pouncing on the flock and sending them running.

Thanks for the response Charles. Yes, it’s definitely a balance. For my larger positions I’ve always bought on big downdrafts (think covid and bank failure panics). I guess by the time I start buying I’ve done enough research (or so I think) that I just do it. Again, maybe I don’t have the patience to scale in and out as other strategies would dictate.

I’ve found that most of my preferred positions have gone the way of the dodo bird in terms of liquidity, so you’re definitely on point about that. I don’t know what has happened (well, I do) other than interest rates have risen so the competition for yield (CDs, MMF, Treasuries, Bank Loans, etc) has drained the liquidity from the preferred market. Of course, this is just my take.

Yikes! I have 89 issues comprised of individual preferreds and corporate and agency bonds. No issue is more than 2.75% of port. A long time ago I got burned by way overloading one of my worst investments ever and learned a lesson ever since. Yep, I remember saying I’d mortgage my house if WorldCom got down to $25. Gives me the willies just thinking about it LOL.

jsh,

I bought 100 shares of Worldcom for I believe $1.10/share. I too went down with the ship.

I traded WCOM four times and all four were profitable. Yes, I’d rather be lucky than good!!

meme stock of its time

I remember I printed out the Marketwatch page with the huge banner “World-Con”.. ……

@Tim McPartland- many thanks for sharing your ideas and some on your list to consider. I will continue to check in and read the many comments and the great info here on your site…and continue to build my brain around Innovative Income ideas!

Thanks ‘money’

I would like to point out to people new to this site, that there is a lot of talk on here about various ways to look at yield for the same stock.

2WR is the undisputed expert on this.

Current yield, YTC ( yield to call) which is different from YTM (yield to maturity) and there are other ways to look at yield. There is a group on here who focus on YTM. I am more of a bird in the hand is worth more than two birds in the bush.

https://www.investopedia.com/terms/y/yield.asp

Tim, there is so much information on your website!

Tim,

Thanks for the list, and the reminder that many of these are subject to call much earlier than redemption dates, and I think that should have been mentioned in the discussion of individual issues. E.g., I’m not counting on getting my 8.5% from SAZ until 2028, as it could be called as early as 4/2025 (per QOL). I agree the NMFCZ has been too expensive (I sold half of my tiny initial holding in the high 25s), but even now, using an online calculator, YTC is only ~7% (obviously better the longer before they call), and I can get about the same on a $1k NMFC bond with maturity 2/2029 and not callable until 1/2029.

And, as mentioned above/below (e.g. EICA), some of the lower coupon notes with shorter maturities have pretty nice YTCs, and perhaps get overlooked due to lower coupon?

Fidelity usually lists a number of much shorter term 1k BDC bonds one can bid on (altho YTM is often lower than the BBs, given the shorter terms), including ARCC, BBDC, BCSF,FSK, GBDC, MAIN,OCSL, OBDC, TSLX, and likely several or many more. Some have pretty low coupons (I’d guess they were issued when interest rates were low and we were constantly being told that there was no inflation), and may not be as easy to buy or sell in small amounts, but I don’t need immediate high coupons, and I’m willing to take the interest/appreciation over 1-5 years, and not worry about major changes in short term rates or what I’ll do with the funds when they mature.

My 2cts

Agree, yield to call is driving pricing here, SAZ will likely be gone in about one year. The 6% coupon of SAT is a better investment in my view trading at around 24 as I know the bond will very likely be outstanding until maturity at a YTM of 7.5%.

CR – Are you saying there’s a way to search Fidelity for “shorter term BDC bonds” specifically? How? Can it be done inside Active Trader Pro?

2WR I read his comment differently. But if there is a BB screener I would be interested too.

I think he meant when you run Fido’s bond screener for corporate 1k bonds you can find a lot from BDC’s in their inventory. That has been my pet peeve lately with their offerings. 6 to 8 months ago they had more variety. Oil, banks, etc. I don’t know if you saw my list in the sandbox, but I own one of the NMFC 1k bonds it’s slightly below my buy in price, but I intend to hold to maturity.

Hi, 2WR. If there is, I’m not aware. I don’t use Active Trader Pro. I just go to the Fixed Income/Bond/CD page (drop down under News and Research), type in the corporate NAME (not symbol) in the search box, and see what’s offered, or use their Duration/Rating Matrix–most of the BDCs seem to be BBB.

Sometimes it’s tricky, e.g. if you want to buy the heavily discounted MPW bonds, you’d have to type in MPT. If you’re looking for NMFC, “new” doesn’t work, “new mountain” doesn’t work, but “new m” does. I’m not sure how I found some of them…My method is hit or miss, and I’d guess there are better ways.

I also keep an eye on new issues there, occasionally find something I like, esp. treasuries, as I can buy small amounts there vs. the huge amounts in secondary market, and I can keep things in one place rather than using Treasury Direct.

OK, CR….. Here’s a tip to perhaps broaden your search if you wish because the way you’re doing it you will only see, if you see, BDCs that have an IG rating from either Moody’s or S&P (maybe Fitch too, I’m not sure). If you go to the same start page of News&Research/Fixed Income, Bonds & Cds and then choose Bonds, and then All Offerings, a search shows up starting with Key Search Criteria. This will allow you to search “All Including High Yield.” That way you get to include bonds that are below Investment Grade. I don’t think it will show you any that don’t include a rating from at least 1 rating agency and unfortunately, the BDC universe includes a lot of decent companies that don’t sport a rating. However, using this search I suspect you’ll find more BDC bonds… And of course you can narrow the search down by maturities and acceptable rating ranges to you..

Also, as another helpful hint here’s a list of all BDCs as of January ’24 that carry an IG rating from at least one agency….. The list was compiled by a buzzing BDC expert on that other site…

List of BDCs with an Investment Grade rating from at least one of the major rating agencies, Moody’s, S&P, Fitch, or KRBA {Kroll] 1/11/24

ARCC Ares Capital Corp. NR/BBB-

TSLX Sixth Street Specialty Lending, Inc. Baa3/BBB-

FSK FS KKR Capital Corp Baa3/NR

OBDC Blue Owl Capital Corp Baa3/BBB-

BXSL Blackstone Secured Lending Fund Baa3/NR

PSEC Prospect Capital Corp. Baa3/BBB-

GBDC Golub Capital BDC, Inc. —

MAIN Main Street Capital Corp. NR/BBB-

GSBD Goldman Sachs BDC, Inc. Baa3/NR

HTGC Hercules Capital, Inc Baa3/NR

NMFC New Mountain Finance Corp. Baa3/NR

OCSL Oaktree Specialty Lending Corp. Baa3/NR

BBDC Barings BDC, Inc Baa3/NR

BCSF Bain Capital Specialty Finance, Inc. Baa3/NR

SLRC SLR Investment Corp [Solar Capital Ltd] —

MFIC MidCap Financial Investment Corp —

TCPC BlackRock TCP Capital Corp [formerly TCP Capital Corp.] Baa3/NR

CCAP Crescent Capital BDC, Inc —

PFLT PennantPark Floating Rate Capital Ltd —

PNNT PennantPark Investment Corp —

I do own a few NR BDCs including SAJ, GAINN and TRINL

Thanks much. When the other site was free or cheap, Buzz was one of the few whose opinions I respected. Now I prefer not to pay for any of it, and find a lot of good info on III.

I don’t get it…. A few other people here have said something similar about having dropped SA because of having to pay for what they used to get for free…. Why am I so special? I’ve never paid for anything and don’t find whatever implemented changes to limit anything I want to do over there. I don’t seem to have any trouble reading any new articles or for that matter, old articles that supposedly go behind the paywall… I don’t know why…. Maybe it’s because I’m such a good bud of the Moron, PennYLess, Brad Thomas and oh I don’t know, may be somebody else as well.. Now who could that be???? https://www.youtube.com/watch?v=MQpV3ST6Kso&ab_channel=WilliamDeHuff

2WR maybe we ghosts?

2WR re SA and not being forced into Premium…some of us are considered ‘legacy’ participants and are not s/t the maximum views and then forced into premium to continue. I see from your profile you are 2008 same as me (I migrated from yahoo conversations which got ridiculous w spam)…now whether they continue or not is another question! things change there w/o notice who knows. It is al based on algorithms as well, activity etc. Not the same place since Eli Hoffman died a founder. B

Bea I may be right on the edge being there since 2012. I was over there today looking for nuggets. I took your Duquesne reference and have been looking at utes. Amazing how many have been taken over in the last 10 yrs.

Researching their old bonds has been an eye opener. Prices have recovered to the extent long dated bonds are yielding about the same as a 6 month CD and close to or even over par.

The market is very forward looking as I suspect the consensus is the feds will be dropping rates.

On SA since “only” 2014 and no problem. Also, I initiated a new SA account just this year using a pseudonym and have access to the entire site without having to pay a dime, so ???

2WR – I searched your list of Investment Grade BDCs on this site to see if they have any active Baby Bonds or preferred stock issues. Most don’t, but there are four:

PSEC-A (perpetual)

HCXY (matures 2033)

NMFCZ (matures 2028 and mentioned in the main post above)

MFICL (matures 2028).

Read in eight columns

Issue Last price Current Yield RD Pays First call Matures Rate

PSEC-A 17.93 7.46% As declared 1st 2,5,8,11 7/19/2026 N/A 5.35%

HCXY 25.10 6.23% 15th 1,4,7,10 30th 1,4,7,10 past 10/30/2033 6.25%

NMFCZ 25.46 8.10% 1st 2,5,8,11 15th 2,5,8,11 11/15/2025 11/15/2028 8.25%

MFICL 25.47 7.85% 1st 3,6,9,12 15th 3,6,9,12 12/15/2025 12/15/2028 8.00%

I doubt Buzz created the list with only baby bonds or preferred stocks in mind…. There’s the 1k market of course as well as baby bonds and even other reasons why a company might want to pay to keep a rating… To be honest, I didn’t cross-check the list for accuracy but I did check a few names back then in the 1k mkt and did find an issue or two for most….

CR—I did mention in the article that the issues all had call dates much earlier than maturities–but we will need interest rates lower for this to happen.

so I copied this from the series K prospectus.

these are the mandatory redeemables. B, J and K are not redeemable.

A, C and E are trading right at or over par.

D, F, G, H and I are trading below

Series A Term Preferred Stock Due 2025 over par

Series D Term Preferred Stock Due 2029 22.75

Series E Term Preferred Stock Due 2024 at par

Series F Term Preferred Stock Due 2027 23.75

Series G Term Preferred Stock Due 2026 23.89

Series H Term Preferred Stock Due 2026 23.93

Series I Term Preferred Stock Due 2028 22.28

I wouldn’t invest in Priority just because of this…/s

page 9…

“We may choose not to invest in Senior Secured Loans directly because our principle investment strategy is to invest in the equity and junior debt tranches of CLOs”

Nice proofreading job there, PRIF…

https://www.sec.gov/Archives/edgar/data/1554625/000155462521000206/a20211005-prifk424b1.htm

Justin, I am not interested in Priority per se but I like researching on Quantum

Can you give me an example of the format to use over there to look up some of these?

search by company name.

priority

My bad, I forgot about the drop down.

Charles- you do know that all the information is on this website? Just type PRIF in the ‘parent ticker” box on the home page.

https://innovativeincomeinvestor.com/

Per this website, PRIF-A, B, C, and PRIF-E have all been redeemed. They don’t show up on MarketWatch, either.

PRIF-J has a first call date of 8/10/2024 and must be redeemed by 12/31/2028.

Here are the current internal rates of return for the PRIF issues that have fixed end dates and are still active (so excluding PRIF-K which is perpetual):

Read in three columns

Issue Maturity Date IRR

PRIF-G 6/30/2026 8.97%

PRIF-H 12/31/2026 8.15%

PRIF-F 6/30/2027 8.78%

PRIF-I 6/30/2028 9.58%

PRIF-J 12/31/2028 9.17%

PRIF-L 3/31/2029 8.62%

PRIF-D 6/30/2029 9.45%

The IRRs bounce around a little, making these good issues for swapping. To my eye, PRIF-I is currently the best deal.

Full disclosure: I have held G, J, H, and I at various times in the past, but I don’t currently have positions in any of them.

LOL Sailor, you make my case there is an opportunity to flip in these preferred. I have no interest because of the low volume and I have others I watch.

PRIF-F omitted curr yld ~ 6.97% at current price.

Justin, good example for what can happen to a buy and hold investor.

On page 6 of the prospectus it lists the different holdings and their market

value

Senior Securities as of June 30, 2021(a)(c)

If you had been holding D at the time it was 25.05 and continued to now it is 22.76 and it had a dump or flash crash to 20.30 at one point in the last yr. If held this entire time you would be sitting on a unrealized loss of $2.29 not counting dividends received. This has been due in part to interest rates going up. This is not counting other variables like investor sentiment or the overall market which is partying heartily right now. A lot can happen in the next 5yrs to a buy and hold investor.

What I find interesting is that the two shorter term preferred G & H due in 2026 have also dropped in value and current yield is about 1% less than D

They are performing to the theory that their price rises as they get closer to maturity. Additionally I find it interesting there is a lot more volatility in share price of these 2 preferred to D

Enough price movement to give an investor a queasy stomach or someone the opportunity to flip but the volume makes that very risky.

I have the opposite opinion. Perpetuals pay a higher dividend they often have more price upside and volatility is good if you are a trader. Term preferreds may be safer if I expect rates to go up from here. I don’t. Better deal for the originator than the investor. Except the underwriting fee for just a few years eats into their bottom line.

Absolutely Martin G – we are all different. You are ‘special’–you watch closely and take advantage of opportunities—I have so little time I can’t do that type of thing right now, but can appreciate your methods.

Tim, Abacus caught my eye too, it has certainly garnered some interest as several PE funds have invested in them. But like you I am on the sidelines for now with a show me attitude. I thought their model is similar to what was being pitched about 15 or 20 years ago where an insurance or a finance company was doing reverse mortgages, or buying life insurance policies at a discount from people who were ill and needed the cash and these companies bought them out at a discount and continued to make payments. Problem was most people lived longer than the buyer had cash to continue paying and these companies ran into problems

I have been hearing Bea and Dick and a few others talk about booking profits and I have done a few if I was able to find a similar quality and return. Of course I have been forced by a few calls to also look for new investments. I have stated before I prefer not flipping, but I also learned this is part of actively managing my own money. My goal is to keep the same level of income or more coming in for the next 10 yrs. After that, I would consider vested funds like annuities where I no longer manage the investments in return for a steady payout.

As a side note, I was not happy to read ALL again has lost money. This has made me put it on my watch list as a possible sell.

You mention annuities, Charles… As you know, I’m a serial prospectus reader when it comes to trying to understand what I’m investing in….. Have you ever tried to read a “prospectus” that goes with an annuity? I have never come across one written simply enough for me to feel like I can understand what’s going to happen when or what the true consequences of choices I have to make prior to buying will be. In fact, having bot a few, I don’t think any one of them ended up acting the way I thought they were supposed to act based on what I had read….. I bet maybe Bea can understand these things, but I sure can’t…..lol.. To me annuities are not bought – they’re sold by salesmen to those who trust what the salesmen have told them.

EICA close at $23.10. My calc has 8.46% YTM 10/31/26. Does anyone know if these have OID if held in a taxable account

If I might add a few for consideration…..

GAINL, GAINZ, & RWAYL

Tim the majority of the ” bloggers” on the other site are not licensed and at least one who has added CFA after the name I suspect is living in a different country I wouldn’t trust for real estate advice.

Charles–I know they are not licensed. I was at one time–30 years ago.

Ha, he is the worst, Charles…A total numbnut… It isnt his reit expertise that earns him money. It’s the monthly subscriber fees he collects from fools that puts bread on his table.

A nice list Tim. I remember those high ute yields in the 1970’s and early 80’s too Charles.. I had United Illuminating at the time which was crushed by using oil fired electric plants and eventually recovered. It is now part of Avangrid..I did not ‘hang’ on either. I am not convinced this current ute rally has legs guess we’ll see. Stay frosty I guess.

I think owning UIL taught me a lesson not to chase high yield and turnaround stories can take a long time pretty early in my investing life..but sad to say I have made this mistake since. I try to book to capital often and some of the gains I have in pfds now are making me antsy too. Bowman at the FED mentioned today if inflation persists, rates could rise, something Dimon has cautioned. We sure help each other navigate these volatile times-and safer yields like short maturity w strong underlying assets and income can really help juice cash returns.

Despite all the attention pfd/bb bonds have garnered in the last few years by so many including over at the dark side..I mean site.. we still can fish out a few w all the knowledge brought here to III. Bea

Thanks Bea–I do watch SA for an occasional idea, but don’t hang my hat on their ‘recommendations.