General Observations

Well we finally had a bit of a down week in equities with the S&P500 down for the week by right around 1%–down 56 points. This is the 1st time in weeks that we have seen equities fall. Of course this was extremely minor and there is no reason to believe that we will see a continuation of falling prices–it seems like each little setback brings out new buyers. We’ll see–certainly there is plenty of money available for buying if investors so choose.

In addition to the normal economic data which can move markets we have bunches of earnings reports this week– most critical is the earnings of big tech which has driven the equity indexes all year long.

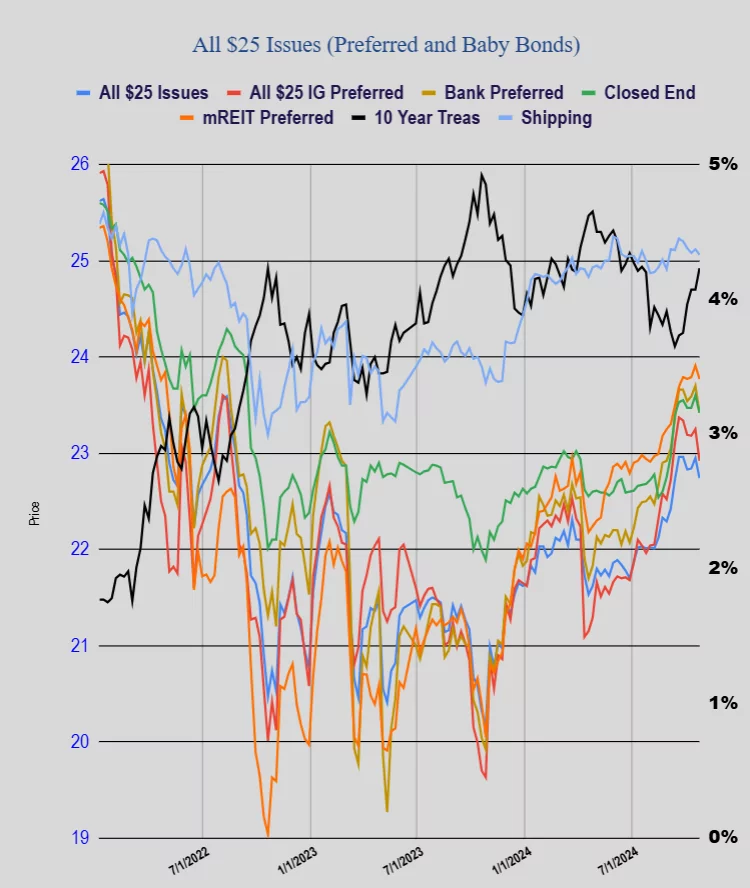

The 10 year treasury yield took a ride higher last week moving up to close at 4.23% Friday. Yields had traded as high as 4.26%. This is a critical week for economic data with the personal consumption expenditures (PCE) being released on Thursday and then quickly following up this important number with the official government employment number coming Friday morning. Markets are looking for softening numbers in employment with the forecast only looking for 110,000 new jobs in October. Interestingly the JOLTs (job openings and labor turnover) report which comes on Tuesday is forecast to show a relatively strong 7.9 million job openings. Last month we had 8.0 million job openings and the data showed 254,000 new jobs created in September (we’ll see if we get revisions).

While one might be looking for interest rates to ease this week that may not be the case. At 4 a.m. (central) this morning the 10 year Treasury is trading at 4.28%–we will have to see if this backs off a bit or if it remains elevated. Once again the velocity of a move higher is as critical as the direction of the move. Ticking higher by 1 or 2 basis points each week will not be as damaging as large jumps of 10-15 basis points weekly.

Importantly we will have the monthly treasury statement coming out on the 8th business day of November–deficits have been massive–$1.8 trillion for 2024. Here is a look at the 2024 revenue and spending.

One thing we won’t have to deal with this week is Fed yakkers as they will not be doing public appearances in the run up to the FOMC meeting next week (November 6-7). Seems like every week is extremely important when it comes to economic data. With the Atlanta Fed now showing a 3.3% growth rate estimate for the 3rd quarter the rate decision at this FOMC meeting has to be in question. Markets are overwhelmingly still looking for a rate cut of 1/4% at this meeting and that same amount in December, but one has to really question whether theses rate cuts will occur.

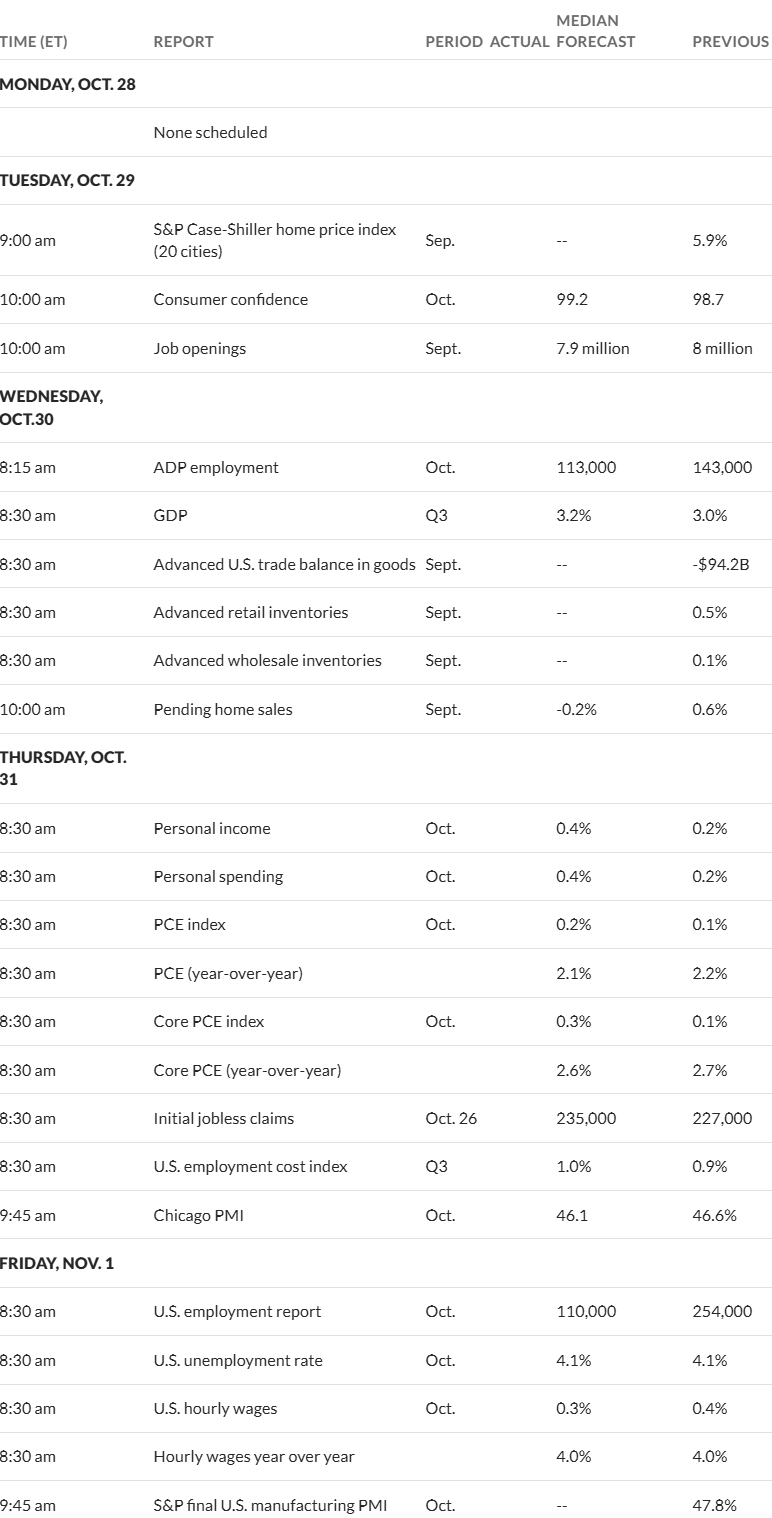

Economic Data for the Coming Week

The Fed balance sheet fell by $10 billion last week–now set to fall under $7 trillion in November–finally.

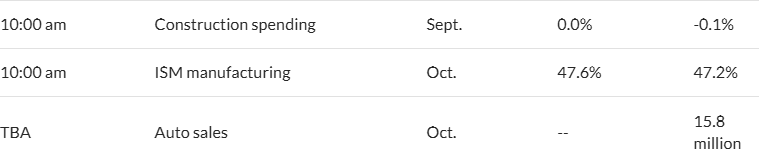

The Week in Preferreds and Baby Bonds

With the 10 year treasury yield rising sharply last week we would expect prices of preferreds and baby bonds to fall. The average price of a $25/share issue had held up nicely for the last couple of months as interest rates rose–BUT this past week prices reacted to the rate jump with the average price falling by just shy of 1%. As one would expect investment grade issues (high quality-low coupon) fell the most – down by 30 cents! Bankers fell by 28 cents, with CEF issues off 18 cents, mREIT issues were off just 14 cents and shippers fell just 4 cents. This goes to show when rates rise sharply high quality issues take the largest hit while folks are more content to hold the 8-9% issues.

Financial markets are 100% corelated to liquidity. Minus short term moves from this or that QT is ongoing, albeit at a slower rate. I do believe we should keep that in mind.

Tim, Did you see this article Sat?

https://fortune.com/2024/10/26/us-debt-crisis-bond-vigilantes-election-trump-harris-deficit-jerome-powell-fed-rate-cut/

Some bond heavyweights are saying they may push long term rates higher as they demand higher yields to balance the risk of the federal deficit.

This will have the opposite effect on stock prices.

Thanks Charles–no but will check it out.

The Fed can keep the long term rates low if they want – just like the Japanese have done. All it requires is political will.

Personally I think we should not have very low rates as it messes up things in the economy.

David,

OTOH, higher long rates is a form of tightening that the Fed might like.

As to long-end yield-curve control, what policy would the Fed have to adopt to cap rates, and what would be the consequences? For Japan, a consequence is that the BoJ owns most of the (very low coupon) debt. It’s often asked if Japanification is the destiny of the U.S.