Last week was kind of a wild week day to day, but the end result was the S&P500 ended up by about 1/2% compared to the previous Fridays close. The range was 5011 to 5139–more than 2% as economic news and earnings pushed the index around.

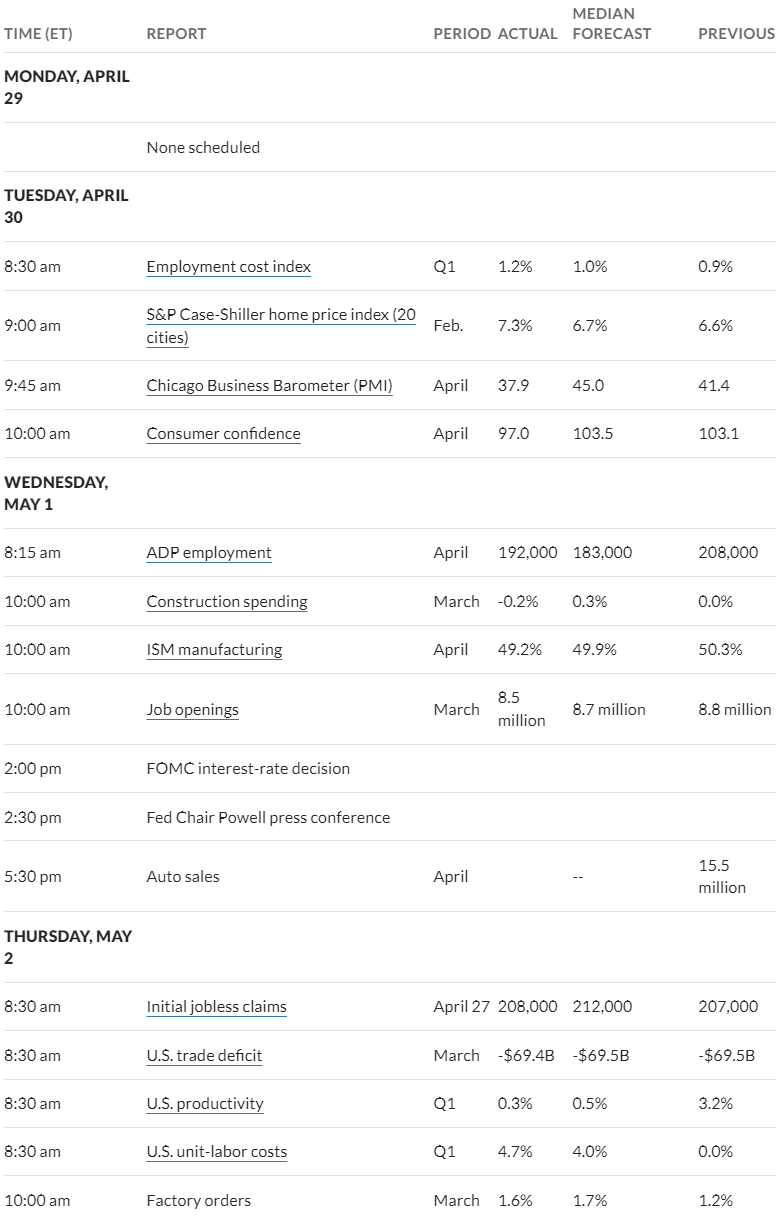

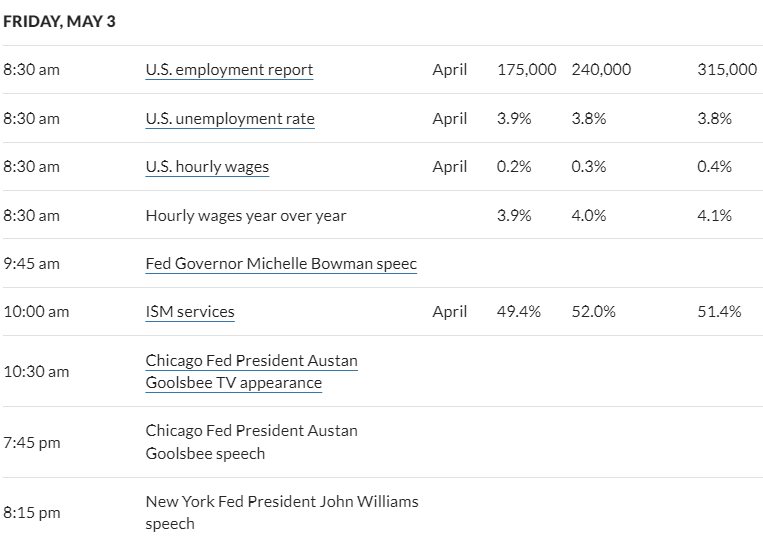

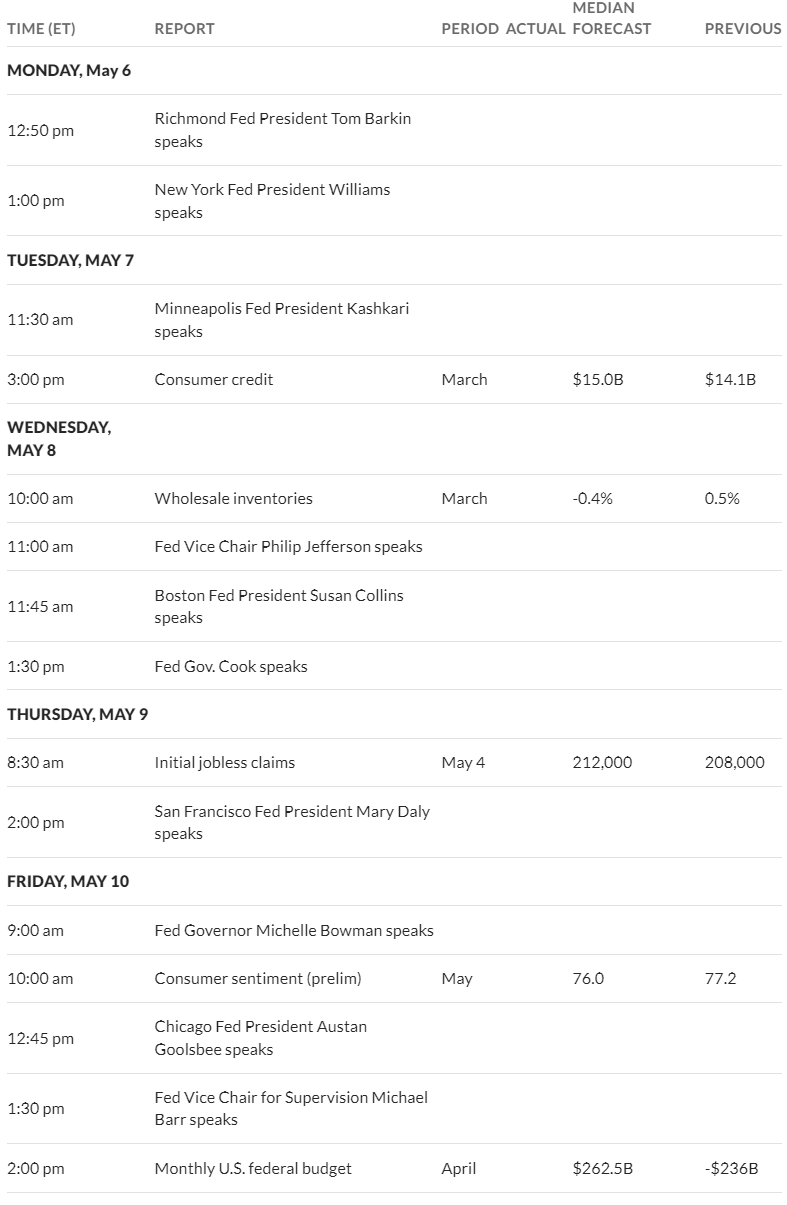

Interest rates (the 10 year treasury) moved nicely lower–closing last week at 4.50% which was a full 20 basis points lower than the close the previous Friday when the close was 4.706%. Last week was ‘jobs’ week in economic news and they provided the impetus for rate movements. ADP jobs came in just above forecast and the ‘official’ government jobs report showed fewer new jobs– below forecast. The unemployment rate ticked higher to 3.9%. Labor costs came in higher than expected. Of course mid week we had the FOMC meeeting and presser–and as expected no change in the Fed Funds rate.

This week with the FOMC meeting behind us we have bunches of Fed yakkers–.should have less impact on markets than previous impacts and the tone has been set for rate cuts (or lack thereof). All in all it is lite economic calendar.

Last week the Fed balance sheet fell by $40 billion last week. This may be the larger reduction we will see for the rest of the year as the Fed has announced a slowing in the runoff starting in June. The $90 billion monthly runoff will be reduced to $55 billion/month with a large reduction in treasury runoff while mortgage securities runoff remains unchanged at $30 billion/month.

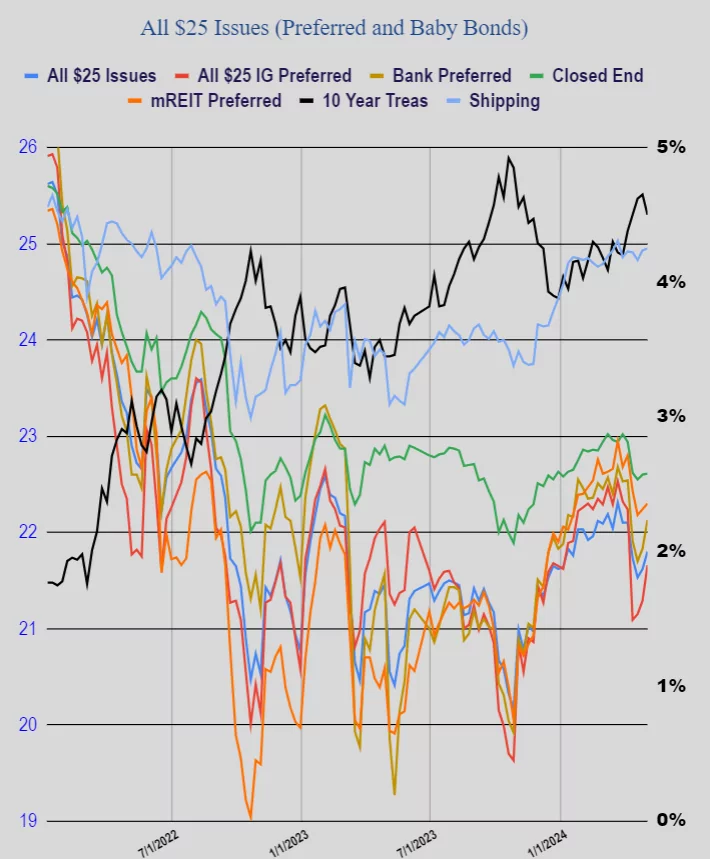

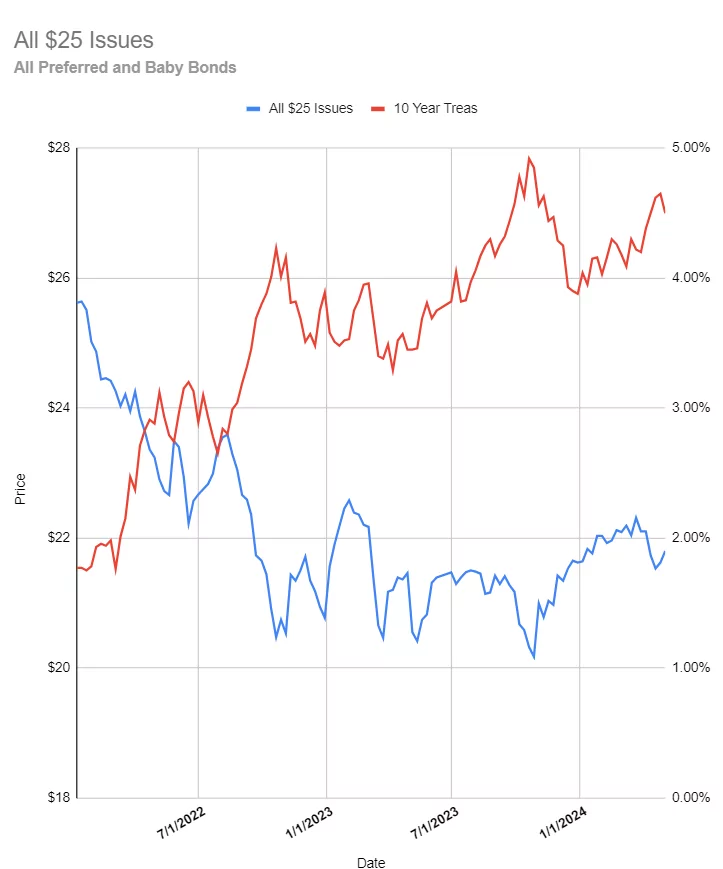

As you might expect it was a decent week for income investors as the average $25/share preferred and baby bond rose by 19 cents. Investment grade issues popped hard as they rose 37 cents, banks rose 30 cents, mREITs rose 6 cents and shippers moved 2 cents higher.

Last week we had no new income issues priced.