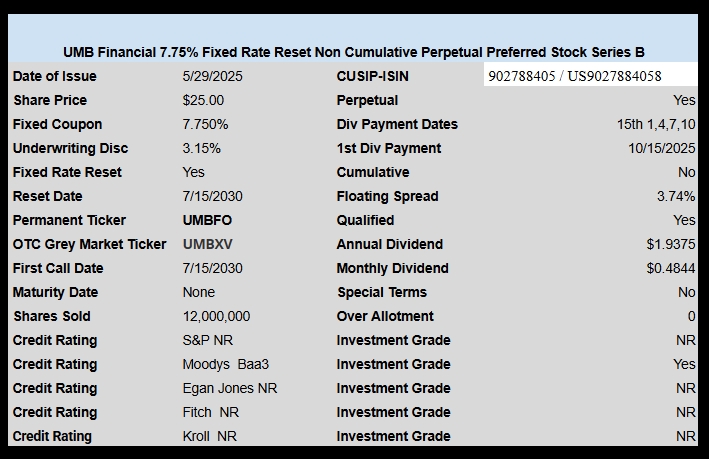

Banker UMB Financial (UMBF) has announced pricing of their new fixed rate reset preferred issue.

The issue prices with an initial coupon of 7.75% which will be reset on 7/1/2030 at the 5 year treasury rate plus a fixed spread of 3.743%.

It is highly likely that a portion of the proceeds will be used to redeem the UMBFP 7% fixed to floating issue which goes floating starting 7/15/2025–this issue was originally issued by Heartland Financial which merged with UMB Financial.

The pricing term sheet is here.

Decided to buy a 100 shares at 25.25. I will probably double it when UMBFP is called as I only have a 100 of that. I doubt I will ever go above 300 shares since it is a financial and I do not want to be too heavy in that one sector. Just keeping with my plan of buying a couple hundred shares of each somewhat interesting new issue. These higher yields are nice and these fixed rate resets are good to mix in with the rest.

1.331 million shs traded today- many in the 10-40k shs range- – must be ETFs / big boys.

Strange- got this msg at Etrade when I entered buy at $25 to ck :

“Important: You are about to place a marketable limit order that is at least 20% greater than the current ask price for the security and could be executed if placed. To proceed as planned, please click Place Order.”

At 20% or more too much, that would make the ask 20.83 or less It is trading with an OTC fee of 6.95 Not sure why the odd msg. last price 25.25, but not showing B/A

There was no published bid or ask, because the symbol is on the grey market.

Where are trades available? This has a higher rating than most TBTF bank preferreds

mine filled at 25.25 and the bid was 22 and ask was 37. I bought half and might buy the other half.

Gary, as John pointed out, there was no bid/ask. I think Fido saw “no ask” as being the same as an ask price of $0.00. Your bid of $25 is at least 20% greater than $0.00

I’m actually surprised you could even place an order. I’ve been unable to place orders at Fido when there’s been no bid and ask.

As I wrote- it was Etrade. I don’t care for 6.95 fees either. Haven’t bought so far.

Try to avoid any market orders on pfds in the gray market. Look to see where they are trading on finra and then place a limit order. Expect it to take an hour or two before you’re filled, if you’re filled. NEE and KKR just came out and if you look at a graph of spot trades you’ll see 20-40 cent moves trade to trade

Gray market trades are weird. Limit orders only…ONLY !! You have to ‘look’ where other trades appear to be going off at. You’ll never know the exact timing of the reported trade vs when you see it. So if you have courage and conviction you set an order and see if they take it. Dont be surprised if it takes much longer than normal. And dont try to yank the order. Set it and forget it. If you get it good if not dont sweat it you’ll never really know why you missed it for sure.

I think I’m gonna buy some. The Kempers are reasonably good corporate citizens. Made nice lick on the heartland preferred and got to say sayonara. the reset is 100 bps above the tbtf banks from last year, and any comments about reset spreads would be useful to me. cheers

Not available on Fidelity as of yet.

Reset is exactly how it should be – 5 Yr UST at the time of pricing + 3.74 = 7.75

I guess my question is whether SS/Goldman get a better market/rating that gives them the 260 bps spread or is all I’m looking at the current spread…I know the ratings tick it up and down …. 375bps seems pretty okay to me.